- Wealth Stack Weekly

- Posts

- 7 Real Lessons From Monopoly (That We’re Using Right Now)

7 Real Lessons From Monopoly (That We’re Using Right Now)

This is the Legacy playbook.

Hi ,

This issue is about a strategy most investors never learn.

This week is a special edition where we’re taking you inside Deal Drop: Legacy, the live event where I introduced one of the boldest real estate plays I’ve ever made.

Acquiring 11 off-market properties in the most desirable neighborhood in the Midwest, and using them to launch a $200M urban portfolio.

Yes, it’s a real-world Monopoly board.

Yes, we’re buying all four corners of the highest-foot-traffic intersection in the Central West End.

Yes, the seller rolled $8.3M into the deal to carry his legacy forward.

But what matters most?

The way we’re executing—because that’s where the edge is.

Maybe that's why data shows private investors account for 60% of U.S. CRE transactions as recently as 2023. Outpacing institutions who made up just 18%.

This week Wealth Stack Weekly is bringing an exclusive look at this deal and more. We are breaking it all down:

The middle-market opportunity gap that most investors never see

A RARE supply-constrained window in multifamily that’s opening right now

The 7 Monopoly moves that win games—and real, real estate deals

Plus, an insiders view of how AHM Group built $250M+ AUM by buying neighborhoods, not buildings

If you’ve ever wanted to build a legacy portfolio, if you’ve ever wondered what it looks like to go from LP investor to fractional owner of a strategic real estate rollup, this is your playbook.

Let’s build a legacy,

P.S. If you’re interested in joining us, there is an increased preferred return available for early investors. You can watch the full Deal Drop, review the offering documents, and make a soft commitment HERE: buildwealth.investnext.com

Prefer to talk with Mike, our Director of Investor Relations? Find a place on his calendar HERE: Schedule time at Calendly

SHIFT YOUR STACK

Before You Start to Play the Game - Let’s Look at the Board

There’s a massive disconnect in commercial real estate—one of the last places where risk and reward are still mispriced in your favor.

Here’s the problem: Institutional capital is too big to go small and individual capital is too small to go big.

So what happens in between?

Nothing.

That’s the opportunity.

Most individuals top out around $2–3 million per deal while Institutional capital can’t consider any investment under $10 million. It’s just too small for them to deploy. The middle market, made up of this $5M to $50M acquisition range, is an underserved market—a capital desert.

Fewer bidding wars. No “smart money” interruptions. Just overlooked assets with real cash flow and little competition.

The middle market isn’t broken. It’s just ignored.

And a huge opportunity to capitalize on multiple expansions if you can bridge the gap.

These assets are often great investments, they just don’t fit the machine.

Institutions don’t have better deals. They have fewer options because they’re locked into blue-chip targets with conservative returns.

Ultimately, they don’t build value, they capture value that’s already been created by someone else.

But for a nimble sponsor or an LP who knows how to source, operate, and build in that void, it’s pure pricing power. Clean fundamentals, the ability to move, and substantial asymmetric upside.

This is the focus of this week’s report, The Sub-Institutional Opportunity.

In it, we show how this forgotten tranche of real estate trades with better cap rates, less buyer pressure, and more upside than almost anything you’ll find at scale.

In other words, the market’s most inefficient pocket is also its most lucrative.

Get a look at how this breaks down. Read the full report.

THE PLAYBOOK

A Winning Strategy for the Game of Monopoly

When was the last time you took a tour around the Monopoly board? It’s amazing what we can learn from the game. But there’s a difference between playing Monopoly and winning Monopoly.

There’s actually 7 specific steps you should take if you’re playing to win.

It’s the exact strategy behind our Legacy Fund, which is targeting over a 5x return over 10–12 years.

Winning at Monopoly starts with a bias for action and understanding the properties on the board. But it goes much deeper if you are willing to play the long game.

If you want to learn how these steps play into St. Louis’s Central West End deal, and how we’re playing Monopoly in real life, check out The Monopoly Formula video here.

BEHIND THE NUMBERS

Multifamily Supply Cliff: The Next Macro Tailwind?

If you’re paying attention, you can almost hear it—the quiet pause of new multifamily projects not getting started.

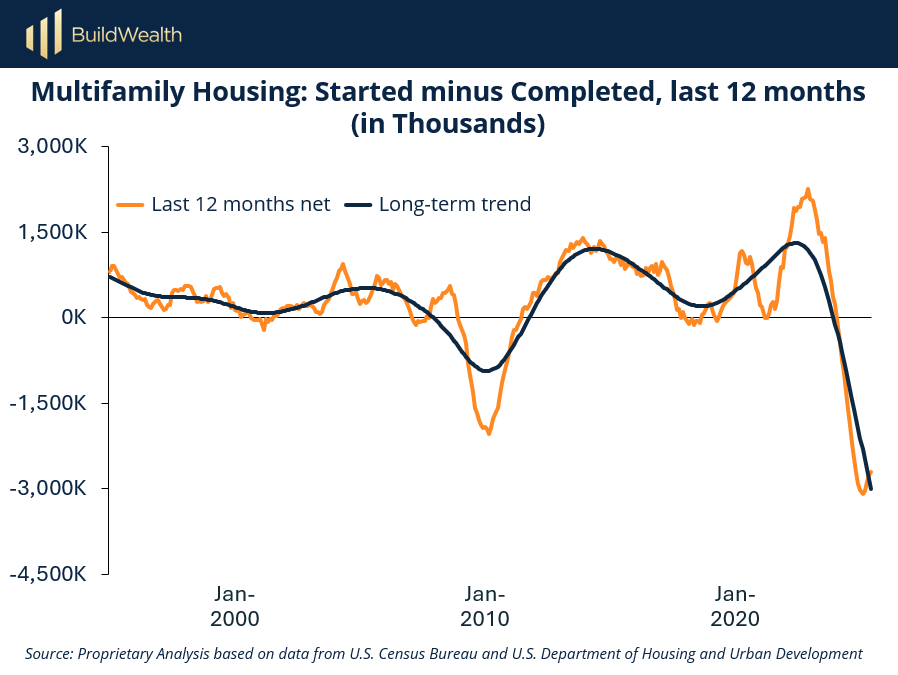

Nationwide, multifamily starts have dropped to their lowest level since 2021. Developers broke ground on just ~316,000 to 414,000 units in the latest readings—down from the 530,000-unit peak in 2022. Meanwhile, completions remain elevated. Over the last 12 months alone, 222,800 more units were completed than started. That kind of supply-demand gap hasn’t been seen in at least a decade.

So what does that mean for investors?

It means we’re staring down a supply cliff. The completions we see today are the result of decisions made 2–3 years ago. But the projects not getting started now? That’s tomorrow’s shortage. And in real estate, shortages do create pricing power for owners and investors.

On the flip side, it can mean tighter housing options for renters and buyers alike. Demand doesn’t go away. In other words, we’re entering a market where multifamily housing is both a compelling investment case and a pressure point in our lives. Understanding both sides of that equation will matter—for strategy, balancing opportunity, and long-term sustainability.

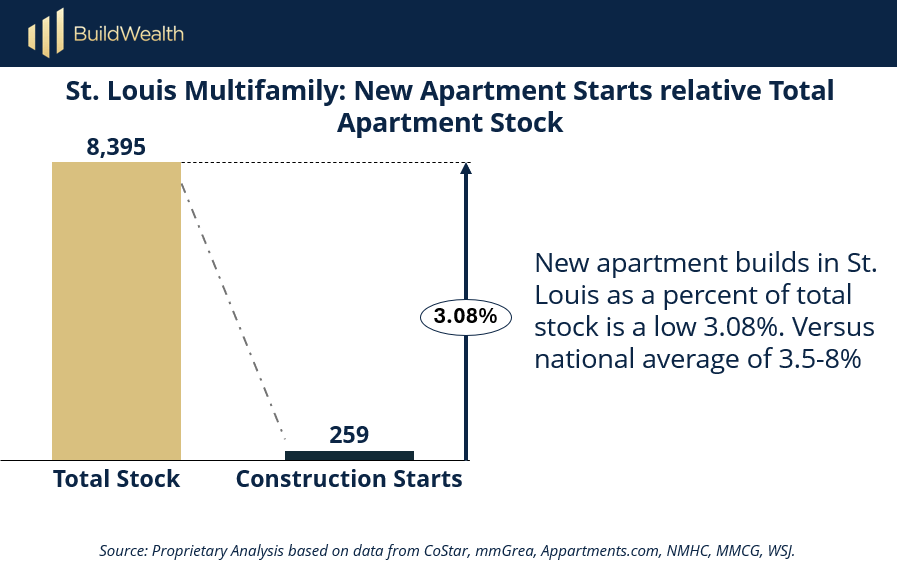

Zooming in, this mismatch hits hardest in high-demand urban and infill markets. These are the spots where local operators who know their submarkets—and can navigate entitlements, renovations, or creative deal structures—will hold the advantage.

Here’s how this shakes out for your portfolio:

Rent Growth Tailwinds: With fewer units in the pipeline, competitive pressure eases. Expect stickier rents in tight markets.

Asset Appreciation: When supply gets constrained and demand holds steady, cap rates compress. That’s your equity upside.

Operational Leverage: For sponsors with strong property management and local insights, this environment is ripe for yield expansion.

Look, I’m not saying every multifamily deal is a slam dunk. But if you’ve been waiting for the market to reset—this is your moment. The data is clear. Supply is drying up, and the smart money is already repositioning. The best multifamily returns of the next cycle? They’ll belong to investors who acted before the headlines caught up.

CASE STUDY

One Company is Proving How to Win the Game

Inside AHM’s Compounding Edge Strategy

AHM Group is a commercial real estate company focused on acquiring entire neighborhoods in St. Louis, Missouri. Their deals are focused on transforming the downtown with a series of developments.

Their approach is unique. They engineer value into their investments rather than just look for good, one-off deals.

They’re vertically integrated, extremely selective on where they move in, are the largest real estate owner in every neighborhood they play in, and compound their investments by upgrading the area around their buildings.

They perfectly capitalize on the middle market real estate gap.

They’ve built a value-creating flywheel.

This is why AHM is now the official real estate arm of Build Wealth.

I’ve personally invested more money with AHM (as a GP and LP) than any other team or company–including the 8+ companies I acquired and ran directly.

This is partially because of the volume of opportunity, partially because of the risk adjusted return real estate provides, and very much because of how well I’ve gotten to know the team–and how they work. Their system has fueled AHM’s $250M+ AUM—and is now driving the $200M vision for the BuildLegacy Fund.

They’re buying the whole board and they are playing the long game.

Learn about AHM’s Vertical Strategic Approach. Click here or on the video below to watch how they create their own edge.

IN PARTNERSHIP WITH BUILD WEALTH

Stack Move of the Week

Our newest Build Wealth offering BuildLegacy I, is open for investment from accredited investors.

If you ever dreamed of your own 7-figure real estate portfolio than this Legacy fund offers a clear (and passive) path to do just that.

It's a 10 year real estate strategy focused on long-term ownership and neighborhood revitalization in the Central West End of St. Louis—a dense, high-demand, culturally anchored district with real fundamentals.

We’re starting with 11 off-market properties from a seller who spent 40 years assembling the portfolio–and is rolling $8.3M into the deal to support the transition.

But our role is to grow it.

We’re raising $4.5M to close on the initial portfolio, followed by $5.5M for expansion.

There’s a 12% preferred return available for early LPs and a long-term plan to turn this $10M seed into a $200M neighborhood portfolio.

It’s one of the most compelling real estate plays I’ve ever stepped into, and we’ve built it with the Build Wealth community in mind.

Like all our offerings, I’m investing personally.

Portfolio Strategy

10-12% preferred return

10-year hold

5.3x multiple at base case projection (~235% higher than avg stock market returns over same period)

If you want to access the dealroom, hit the link below:

Portal: Build Legacy I Offering

Schedule a call: Book time with Mike at Calendly

MINDSET SHIFT

Control is the name of the game

Winning at Monopoly - and in real estate - means more than access

Most investors are taught to “get exposure” to real estate by buying a REIT, allocate to a fund, and diversify.

That mindset works fine in efficient markets. But it’s nowhere near the goal in private real estate. The game changes. Exposure isn’t enough. Access isn’t the finish line.

Control is what builds wealth.

In Monopoly, winning isn’t about landing on a property. It’s about owning the block, deciding what gets built, and shaping the game around your strategy. That’s how players gain power, generate income, and ultimately create a legacy.

Private markets are no different.

To play this game well, you have to think like a portfolio architect.

It means understanding the levers of control and using them intentionally to build, shape, and invest.

The good news is you don’t need to operate it personally. Being able to recognize who’s controlling the game board means you can scale your own wealth by backing those that have it.

Access is the starting point.

Control over a market is the ultimate lever.

And legacy is what comes next.

Build it.

WHAT WE ARE READING

"If you really look closely, most overnight successes took a long time"

Steve Jobs

"I think it`s wrong that only one company makes the game of monopoly"

Stephen Wright

DISCLAIMER

OFFER: This presentation (“Presentation”) is neither an offer to sell nor a solicitation of an offer to buy any security, nor is it an offer of any sort of investment advice. Instead, it is intended to describe an investment vehicle sponsored by Build Wealth, LLC, TBD (the “Offering”). An offer may only be made via a written offering document (“Memorandum”) provided by the Fund that offers Units of limited liability company interests in the Fund (“Units”). We have prepared this Presentation solely to enable you to determine whether you are interested in receiving additional information about the Fund. This Presentation is not intended to be relied upon as the basis for an investment decision, and is not complete.

LIMITATIONS: While many of the thoughts expressed in this Presentation are stated in a factual manner, the discussion reflects only beliefs about the markets in which the Fund may invest when following its investment strategies as described in more detail in the Memorandum. Any descriptions of the investment strategy herein are in preliminary form, are incomplete, and do not include all of the information needed to evaluate any potential investment in the Offering. An investment in the Offering involves substantial risks, some of which are discussed in the Memorandum, and which include risks associated with mortgages investments generally, risks associated with the Offering’s investments, conflicts of interest risks, regulatory risks, and tax and management risks. Only by carefully reviewing and considering those factors and the disclosures provided in the Memorandum (in addition to other independent investigations) could an investor or their representative determine whether such risks, as well as BuildWealth experience and compensation, conflicts of interest, and other information contained therein are acceptable to the investor. Material in this Presentation, including any projected returns for the Offering, does not account for the impact of taxes on the Offering, its structure or its investors that may be imposed by the U.S. or any other jurisdiction. BuildWealth and its Affiliates have complete control over the Offering’s operations and the management of its assets. There are significant restrictions on the transferability of the Units, there is no market for Units, and no person should invest with the expectation of monetizing Units other than as permitted in the Offering’s Operating Agreement. The Offering’s fees and expenses, which include compensation of BuildWealth, may outweigh the Offering’s gains, if any.

CONFIDENTIALITY: BuildWealth reserves all copyright and intellectual property rights to the content, information, and data within this Presentation. The contents in this Presentation are protected by copyright, and no part or parts hereof may be modified, reproduced, stored in a retrieval system, transmitted (in any form or by any means), copied, distributed, published, displayed, broadcasted, used for creating derivative works, or used in any other way for commercial or public purposes without the prior written consent of BuildWealth. The recipient agrees to keep the contents of this Presentation confidential and use it solely to evaluate whether further investigation of the Offering is warranted.

FORWARD-LOOKING STATEMENTS: Some of the material contained in this Presentation is not based on historical facts and is deemed to be “forward-looking.” Forward-looking statements reflect BuildWealth's current expectations and are inherently uncertain, and actual results may differ significantly from projections herein. Although BuildWealth believes that the expectations reflected in all forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance, or achievements. Neither the Offering, BuildWealth, nor any other person assumes responsibility for the accuracy and completeness of any forward-looking statements. BuildWealth is under no duty to update any of the forward-looking statements to conform them to actual results or to changes in its expectations.

PROJECTIONS: While projections about the Offering’s performance are based on Build Wealth's experience and good faith judgments, the recipient should understand that projections are based on numerous assumptions about how the Offering may perform, including that applicable tax regimes do not change, that existing asset performance trends will continue to track business plans, that historical behavior of BuildWealth loan types will not change fundamentally, that perception of market opportunities for acquisition and disposition will hold true, and that the competitive landscape within which each asset operates will not change fundamentally. Any number of factors could contribute to results that are materially different.

PERFORMANCE INFORMATION: Information about BuildWealth's prior investment vehicles it has sponsored (the “Vehicles”) contained herein has not been audited or reviewed by any third party. The recipient should understand that the Vehicles’ performance was achieved in different economic cycles, BuildWealth's participation and/or management responsibility varied, and the Vehicles utilized investment strategies and capital sources that may differ considerably from that which the Offering will use. Additionally, the Offering’s terms may differ materially from the Vehicles’ governing documents. Therefore, the recipient should not assume that the Offering would be able to replicate any Vehicle’s performance, even though there may be overlaps in the Offering’s strategies and the strategies that may have been utilized by any of the Vehicles. With respect to performance presented in the Presentation, the recipient should consider the following: all investments carry risk, and the Offering’s strategies may experience losses.

DISCLAIMER: All information contained in this communication should not be considered investment advice, but education and entertainment only. Buy Then Build, Build Wealth, Acquisition Lab, and Pivotal LLC does not render tax, legal, accounting, investment, or other professional advice. If tax, legal, accounting, investment, or other similar expert assistance is required, the services of a competent professional should be sought. This is neither an offer to sell nor a solicitation of an offer to buy any securities described herein, which only can be made through official offering documents that contain important information about risks, fees and expenses. Investing in private or early-stage offerings (such as Reg A, Reg S, Reg D, or Reg CF) involves a high degree of risk. Investing in private or early stage offerings requires a tolerance for high risk, low liquidity, and a long-term commitment. Investors must be able to afford to lose their entire investment. Such investment products are not FDIC insured, may lose value, and have no bank guarantee.