- Wealth Stack Weekly

- Posts

- Consistency is Power

Consistency is Power

Investors are often conditioned to focus on returns—annual performance figures, benchmark comparisons, and headline-grabbing gains.

Yet the defining variable in long-term wealth creation is not simply how much a portfolio earns, but how consistently it earns it. Volatility, drawdowns, structural liquidity, and return composition collectively shape the real outcome of compounding over time.

Two portfolios can share the same average return and produce radically different wealth outcomes. The reason lies in the mathematics of geometric compounding. Variability reduces realized growth rates, deep drawdowns consume years of recovery, and behavioral reactions during periods of stress further erode capital efficiency. In practical terms, instability taxes compounding.

This report examines the structural drivers behind consistent performance. Through the lens of volatility dispersion, market design, risk-adjusted efficiency, recovery cycles, and compounding mechanics, we demonstrate a central principle: long-term wealth is not built by maximizing returns alone, it is built by optimizing stability.

Same Return, Different Volatility, Radically Different Wealth Outcomes

At first glance, an average annual return of 12% appears decisive. Over a decade, most investors would reasonably expect similar wealth accumulation if the arithmetic mean return is identical. Yet this chart demonstrates a fundamental truth in portfolio mathematics: the path of returns matters as much as the average return itself.

Volatility introduces dispersion in outcomes because returns compound multiplicatively, not additively. When return variability increases, the geometric (realized) return falls below the arithmetic average due to volatility drag. Even when three portfolios report the same 12% average annual return, their terminal wealth diverges meaningfully depending on the standard deviation of returns.

This is not a theoretical nuance, it is capital allocation reality. A $1 million portfolio subjected to low volatility compounds to approximately $3.1 million over 10 years. Under moderate volatility, it reaches $2.6 million. Under high volatility, just $2.1 million. The difference is not cosmetic. It represents nearly $1 million in foregone wealth, driven purely by return variability.

Detailed Bulleted Analysis

Volatility Drag (Variance Drain)

Higher standard deviation reduces geometric compounding.

The relationship is mathematically approximated as:

Geometric ReturnArithmetic Return-122

As σ increases from 5% to 25%, the compounding penalty accelerates non-linearly.

Terminal Wealth Dispersion

5% Std Dev → ~$3.1M

15% Std Dev → ~$2.6M

25% Std Dev → ~$2.1M

Same average return; ~32% difference in ending wealth between low and high volatility.

Sequence of Returns Risk

Large drawdowns early in the compounding period materially impair capital base.

Recovery requires disproportionately higher returns (e.g., -25% requires +33% to break even).

High volatility increases the probability of deep interim losses.

Risk-Adjusted Efficiency

Lower volatility portfolios typically exhibit higher Sharpe ratios.

Higher risk-adjusted returns translate into superior long-term compounding efficiency.

Consistency reduces capital erosion and improves reinvestment stability.

Behavioral Implications

High volatility increases investor stress and the likelihood of timing errors.

Behavioral drag (selling after losses) compounds mathematical drag.

Consistency supports discipline and long-term adherence.

Capital Preservation as a Growth Strategy

Avoiding large losses is mathematically equivalent to generating higher returns.

Reducing drawdowns improves both CAGR and investor survivability.

Wealth accumulation is a function of compounded stability, not episodic spikes.

Strategic Takeaway

Targeting return without controlling volatility is incomplete portfolio construction.

Consistency is not conservatism—it is optimization of compounding.

Over long horizons, volatility control is a primary driver of wealth creation.

Structure Shapes Stability: Why Market Design Drives Volatility

Volatility is not solely a function of underlying asset quality—it is often a byproduct of how assets are priced, traded, and accessed. The structural mechanics of public markets and private markets differ materially, and those differences directly influence perceived risk, investor behavior, and compounding outcomes. This chart highlights how architecture, not just asset class, shapes return experience.

Public equities are continuously priced through daily market sentiment. They are marked-to-market every trading day, reflecting flows, headlines, macro shocks, and behavioral reactions in real time. In contrast, private credit and private equity are typically valued quarterly through NAV methodologies or, in some cases, not continuously marked at all. The absence of daily price discovery fundamentally changes volatility exposure.

Liquidity, pricing frequency, and return drivers together determine how smooth—or turbulent—the investor journey becomes. Immediate liquidity in public markets provides flexibility but also amplifies short-term reactionary behavior. Private structures, by design, prioritize cash flow generation and structured returns over daily price movement. The result is not merely different risk profiles, but different compounding dynamics.

Detailed Bulleted Analysis

Public stocks are priced continuously based on daily sentiment and supply-demand imbalances, which introduces significant short-term noise. Even fundamentally stable companies can exhibit sharp price swings due to macro events, ETF flows, or risk-off episodes. This structural feature increases observed volatility regardless of intrinsic business stability.

Private credit and private equity rely on periodic NAV assessments rather than continuous market pricing. Because valuations are updated quarterly and based on fundamental performance rather than intraday trading, return paths appear smoother. Lower observed volatility is largely a function of pricing mechanism rather than absence of risk.

Liquidity is a double-edged sword. Public equities offer immediate exit, which enhances flexibility but also facilitates impulsive decision-making during drawdowns. Private investments are typically locked or managed with capital call structures, reducing reactive selling and limiting behavioral drag.

The primary return driver in public markets is price appreciation, which depends on multiple expansion, sentiment, and growth expectations. In private credit and structured private equity, returns are more often derived from contractual cash flows, yield spreads, and deal structure—elements that can provide steadier return streams.

Structurally reduced mark-to-market exposure may improve the compounding experience by limiting interim volatility. While economic risk still exists, the smoother valuation path can enhance investor discipline and reduce the probability of poor timing decisions.

From a portfolio construction standpoint, blending assets with different pricing mechanisms can meaningfully dampen aggregate volatility. Structural diversification—across liquidity profiles and valuation methodologies—can be as important as sector or geographic diversification.

Risk-Adjusted Leadership: Where Consistency Wins

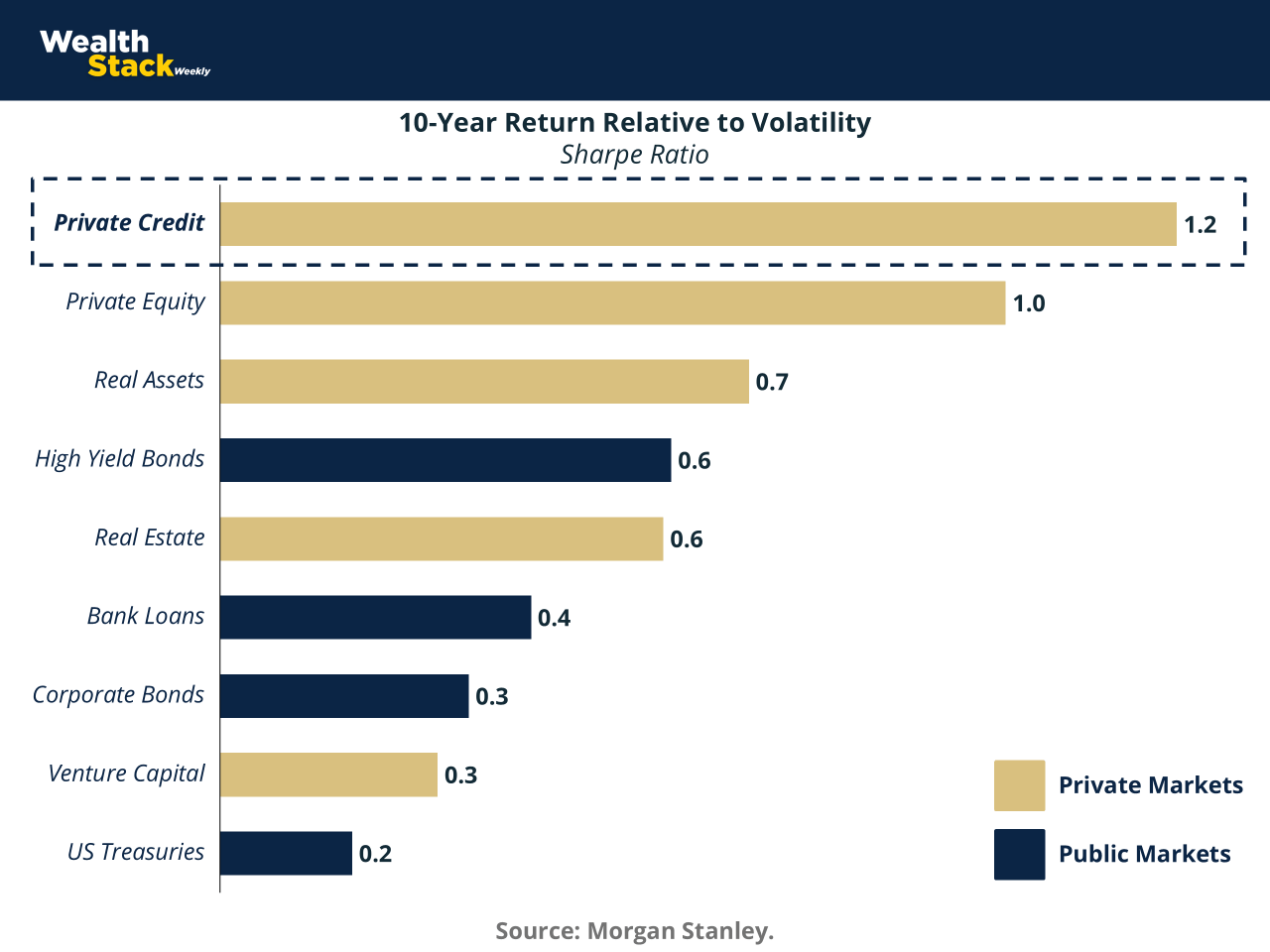

Absolute returns often dominate investment conversations, but professional capital allocators focus on efficiency—how much return is generated per unit of risk. The Sharpe ratio provides that lens. It measures excess return relative to volatility, offering a standardized metric for comparing asset classes across market structures.

Over a 10-year horizon, the dispersion in Sharpe ratios across asset classes is instructive. Private credit leads with a ratio of 1.2, followed by private equity at 1.0. Public market fixed income and traditional instruments lag meaningfully, with U.S. Treasuries at 0.2 and corporate bonds at 0.3. The implication is not simply higher return in private markets—but superior risk-adjusted performance.

When consistency is evaluated through a volatility-adjusted framework, structurally cash-flow-oriented strategies appear advantaged. This reinforces a central thesis of the report: compounding is optimized not by maximizing raw return, but by maximizing return per unit of instability.

Detailed Bulleted Analysis

Private credit leads in risk-adjusted efficiency: With a Sharpe ratio of 1.2, private credit demonstrates the strongest return per unit of volatility. This reflects the contractual nature of yield, senior positioning in the capital structure, and reduced mark-to-market noise, which collectively enhance stability.

Private equity shows strong risk-adjusted performance: At a Sharpe ratio of 1.0, private equity balances growth potential with structured governance and longer holding periods. While underlying businesses carry risk, the smoothing effect of valuation cycles contributes to more efficient compounding relative to many public assets.

Real assets deliver moderate stability with inflation linkage: A Sharpe ratio of 0.7 indicates reasonable efficiency, supported by tangible asset backing and pricing power. However, cyclicality and capital intensity moderate overall volatility-adjusted returns.

High yield bonds provide income but carry spread risk: At 0.6, high yield benefits from coupon income, yet remains exposed to credit cycles and liquidity shocks. Risk-adjusted returns are respectable but materially lower than leading private strategies.

Traditional real estate exhibits balanced but constrained efficiency: Also at 0.6, real estate generates income stability but faces valuation sensitivity to interest rates and macro conditions, limiting Sharpe expansion.

Bank loans demonstrate moderate protection with limited upside: With a 0.4 ratio, floating rate structures mitigate duration risk, but credit sensitivity and lower return ceilings constrain volatility-adjusted performance.

Corporate bonds reflect lower return relative to volatility: At 0.3, investment-grade bonds offer capital preservation characteristics but insufficient excess return to materially enhance Sharpe efficiency over long horizons.

U.S. Treasuries prioritize safety over efficiency: A 0.2 Sharpe ratio underscores their role as defensive ballast rather than growth engine. While critical for liquidity and drawdown protection, they contribute minimally to long-term risk-adjusted wealth creation.

Drawdowns Define the Journey: The Hidden Cost of Market Crashes

Long-term average returns often obscure a critical reality: wealth is built through compounding, but it is disrupted by drawdowns. Major market crashes do not simply reduce portfolio values temporarily—they alter the trajectory of capital growth, sometimes for years. The time required to recover from deep losses can meaningfully delay financial objectives and erode compounding efficiency.

The historical record illustrates this clearly. The Dot-Com Bust saw a nearly 49% decline and required approximately 4.5 years to recover—seven years peak-to-peak. The Global Financial Crisis produced an even steeper 57% drawdown and took roughly four years to regain prior levels. Even though the 2020 COVID selloff was sharp, its recovery was unusually rapid at five months, highlighting how recovery speed materially shapes investor outcomes.

Volatility is not merely about temporary discomfort; it is about time. When portfolios experience large drawdowns, capital is impaired and the recovery process consumes valuable years of compounding. Consistency reduces not only the depth of losses but also the duration of capital stagnation.

Detailed Bulleted Analysis

Drawdowns are capital impairments, not just paper losses: A -49% to -57% decline cuts the compounding base nearly in half, requiring returns of 96% to 133% just to break even. Recovery is mathematically asymmetric and significantly more demanding than the initial loss.

Time to bottom influences behavioral pressure: The Dot-Com decline lasted roughly 929 days and the GFC about 517 days before reaching bottom. Prolonged downturns increase psychological stress, elevating the probability of capitulation and locking in permanent losses.

Recovery duration delays wealth creation: Four to seven years of recovery time represents a substantial opportunity cost. Capital tied up in rebuilding lost value is capital not compounding toward new highs.

Severity and duration compound each other: Deeper drawdowns typically require longer recovery periods because larger percentage gains are needed to offset losses. This creates a drag on long-term CAGR even if average returns appear strong over full cycles.

Rapid recoveries are the exception, not the rule: The 2020 COVID correction recovered in five months, but this was driven by extraordinary fiscal and monetary intervention. Investors cannot rely on similar policy responses in every future downturn.

Consistency mitigates time risk: Portfolios designed to limit drawdown depth typically recover faster and resume compounding sooner. Reducing volatility is not simply about smoother performance, it is about shortening recovery cycles.

Strategic implication—protect the downside to accelerate the upside: Avoiding large losses improves long-term wealth more reliably than attempting to maximize gains in bull markets. Capital preservation enhances the efficiency of every subsequent growth phase.

The Compounding Advantage: When Cash Flow Becomes a Growth Engine

Compounding is often described as the most powerful force in finance, yet not all return streams compound equally. The structure of returns—whether linear, reinvested, or cash-flow-driven—determines how effectively capital accelerates over time. This chart illustrates how different return mechanics transform a $100,000 initial investment across a ten-year horizon.

Traditional bonds generate predictable income, but when interest is not reinvested, growth remains largely linear. Even when coupons are reinvested, compounding remains modest due to lower yield levels. Public equities, while capable of appreciation, often experience episodic volatility that disrupts smooth growth. In contrast, structured credit strategies that emphasize reinvested cash flow can create a materially steeper compounding curve.

Over 120 months, the divergence becomes substantial. Bonds growing linearly return approximately +48%, bonds with reinvestment reach +61%, and the stock market delivers +88%. Yet the credit strategy depicted compounds to approximately +230%. The difference is not incremental, it is structural.

Detailed Bulleted Analysis

Compounding amplifies reinvested cash flow: When income distributions are systematically redeployed into new yielding assets, the return base expands each period. This snowball effect explains why compounding bonds outperform linear bonds and why structured credit, with higher yield capture, accelerates far more dramatically.

Return structure drives outcome dispersion: Linear bond growth reflects static income without reinvestment, capping upside. Compounding bonds improve trajectory modestly, but lower starting yields constrain acceleration. Higher-yielding credit strategies materially steepen the curve because each reinvestment cycle compounds at a higher rate.

Volatility dampens equity efficiency: Although equities show +88% growth, interim fluctuations can interrupt reinvestment discipline and introduce sequence risk. Compounding efficiency declines when return paths are uneven, even if long-term averages appear attractive.

Cash flow stability enhances consistency: Credit-oriented strategies generate contractual or semi-contractual income streams. This predictability supports disciplined reinvestment, reducing reliance on market timing and minimizing behavioral interference.

Time magnifies structural differences: In early years, performance dispersion appears moderate. By year ten, structural compounding advantages dominate. The exponential curve is subtle at first but decisive over longer horizons.

Reinvestment discipline is a strategic lever: The difference between +48% and +61% demonstrates that investor behavior, specifically whether income is consumed or reinvested, meaningfully alters terminal wealth.

Strategic conclusion—consistency fuels acceleration: Sustainable, reinvested cash flow combined with volatility control creates superior long-term wealth trajectories. Compounding is not just about rate of return; it is about repeatability and structural reinvestment.

Conclusion

Across each section of this report, one theme remains consistent: volatility is not merely discomfort; it is a structural drag on wealth accumulation. Higher variability reduces geometric returns, deep drawdowns consume time, inefficient risk allocation lowers Sharpe ratios, and inconsistent return streams weaken compounding power. The cost is often invisible in annual snapshots but profound over decades.

Market structure matters. Liquidity design matters. Return composition matters. Risk-adjusted efficiency matters. The data consistently shows that smoother return paths, disciplined reinvestment, and drawdown control materially enhance terminal wealth. This is not about eliminating risk, it is about managing it in a way that protects the compounding engine.

True performance leadership is not defined by episodic spikes in bull markets. It is defined by durability across cycles. Consistency reduces recovery time, preserves behavioral discipline, strengthens reinvestment capacity, and compounds capital more efficiently. In the long arc of wealth creation, stability is not defensive, it is decisive.

Sources & References

MSCI. Private Capital Indexes.https://www.msci.com/research-and-insights/blog-post/aligning-benchmarks-with-asset-class-reality-the-case-for-private-capital-indexes

Morgan Stanley. Credit Outlook Considerations. https://www.morganstanley.com/ideas/private-credit-outlook-considerations

S&P Global. Valuationshttps://www.spglobal.com/en

Premium Perks

Since you are an Wealth Stack Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Visit our website.