- Wealth Stack Weekly

- Posts

- Everyone’s Buying Gold. The Wealthy Are Borrowing Against It.

Everyone’s Buying Gold. The Wealthy Are Borrowing Against It.

Inside the system the wealthy use to turn inflation into opportunity.

Hi ,

Last week was wild.

The US dollar hit a multi-decade low, while Gold hit another record high, climbing above $4000 per ounce. Then, at the same time, Bitcoin surged to a new high above $124,000.

Retail and institutional investors looking for ways to hedge against inflation are pouring into metals, crypto, and foreign currencies. These are rational inflationary tactics, but I'm betting on another one: leverage.

Let me explain.

At 30 years old, I signed the loan that changed my life.

It was a seven-figure acquisition loan — the kind of number that makes your pulse spike the moment the pen leaves the paper. The ink was barely dry before the fear set in. I’d taken on more debt than I’d ever imagined.

At 30, I saw debt like Indiana Jones saw the ancient ruins. Something to escape from, not embrace.

Within a few years, that same debt turned into the very thing that created freedom. It built cash flow. It built equity. It gave me control over my time.

Debt didn’t crush me. It became the engine that multiplied my effort.

That moment shifted how I saw the entire system — not just for myself, but for the wealthy who quietly build and protect their empires. Debt isn’t a wall to climb over; it’s a lever to pull.

And the timing has never been more interesting. With the dollar weakening, capital is rotating. Hard assets are rising. Fiat is quietly bleeding purchasing power.

When that happens, those who understand leverage start using it — deliberately and with strategy. Used with precision, debt unlocks liquidity, shields taxes, and compounds returns while everyone else is still paying theirs down.

This issue is about that lever — how the wealthy engineer productive debt, how timing and structure create advantage, and why this next cycle may be the most powerful opportunity in a generation to master it.

If you’ve been sitting on productive assets, this may be the moment to put them to work.

Here’s what you’ll take away from this issue of Wealth Stack Weekly:

A New Mindset: How the wealthy think about debt as a tool for liquidity, control, and compounding.

Case Study: How Elon Musk’s play on the “Buy, Borrow, Die” strategy has already unlocked billions tax-free.

Putting it to Work: A field-tested system for engineering productive debt in this week’s playbook.

By the end, you’ll understand how productive debt creates freedom, why timing matters more than risk, and how to engineer leverage that builds wealth while you sleep.

— Walker Deibel

WSJ & USA Today Bestselling Author of Buy Then Build

Founder, Build Wealth

SHIFT YOUR STACK

How the Rich Really Use Debt

Signing a loan can flood anyone with mixed emotions. But debt has the capacity to open new doors you didn’t know were there. Managed correctly, it’s leverage to build both equity and cash flow.

Most people spend their lives trying to get out of debt. The wealthy spend their lives navigating how to stay in the right kind of debt.

There’s the kind of debt that funds your lifestyle, and the kind that funds your freedom.

Consumer debt fuels consumption. It’s tied to things that lose value — credit cards, car loans, personal spending. Each payment moves wealth backward.

Productive debt fuels growth. It’s collateralized by assets that appreciate or produce cash flow — real estate, business ownership, portfolios, and private market positions. Borrowing against these assets unlocks liquidity, preserves ownership, and accelerates compounding.

That distinction is everything.

Selling assets limits potential. Productive debt multiplies it.

The Macro Window

Right now, the math of money favors the borrower.

The U.S. dollar — once the heavyweight of global reserves — has seen its share fall from 73% in 2001 to just 58% today. That’s not a temporary dip. It’s a long-term shift that’s accelerating.

You can see it reflected in gold.

As the dollar weakens and real yields compress, the purchasing power of cash erodes. In this environment, debt transforms from liability to asset. Borrowing strong dollars today and repaying them later with weaker ones can turn inflation into an ally.

This is how the wealthy engineer asymmetric advantage in inflationary or weak-dollar cycles. Strategic leverage protects purchasing power and amplifies compounding.

The New Playbook: Buy → Borrow → Reinvest

Legacy wealth followed the “Buy, Borrow, Die” model — accumulate appreciating assets, borrow against them tax-free, and transfer them with a step-up in basis.

Builders and investors today play a faster game: Buy → Borrow → Reinvest.

Borrowing becomes a tool for expansion. By locking in long-term debt and deploying capital into assets that yield or appreciate faster than the cost of capital, investors create a continuous wealth loop. Each turn compounds equity, cash flow, and control.

That’s the essence of productive debt — an engine that drives wealth forward while everyone else hesitates to turn the key.

Let’s Visualize It

When long-term debt funds assets growing faster than the interest rate, investors mint wealth while inflation works in their favor.

As the dollar weakens and the asset base strengthens, the spread between debt cost and asset return widens. That’s the arbitrage the wealthy have been compounding for decades.

The Debt Shift

Debt is a tool, not a burden — when it funds appreciating, cash-flowing assets.

Productive debt makes a weakening dollar your ally — fixed-rate debt becomes a shrinking obligation.

Buy → Borrow → Reinvest is the modern engine of wealth acceleration.

The middle class pays off debt. The wealthy deploy it.

As assets like gold and crypto climb, a financial reset may be underway. Dive into the report on the U.S. dollar and the strategic use of debt.

CASE STUDY

How Elon Musk Used Debt to Unlock Billions (Tax-Free)

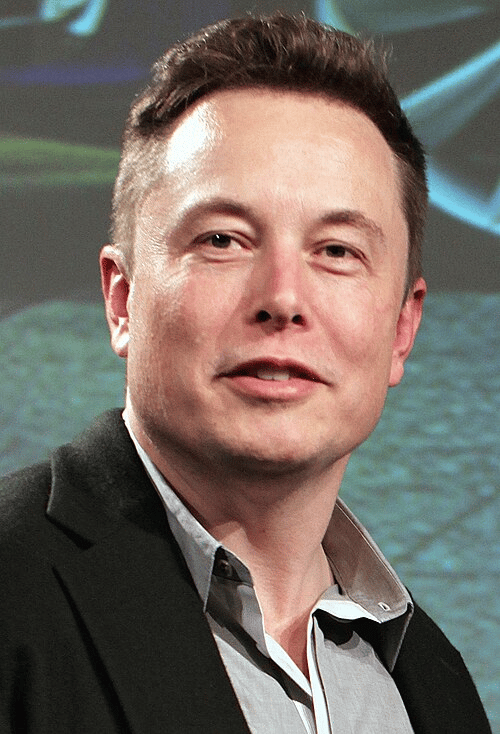

Elon Musk, 2015. Photo by Glenn Hunt/CC BY-SA 3.0.

You’ve seen how productive debt fuels wealth. Over time, some of the world’s most successful investors have taken that principle a step further, turning it into a long-term preservation and tax strategy. When scaled, Buy → Borrow → Reinvest sets the stage for Buy, Borrow, Die. Leveraging productive debt at the ultra-wealthy level means accelerated growth, control, extended compounding, and ability to transfer wealth efficiently. Check out how the world’s richest person engineered it at scale.

According to Tesla’s SEC filings Elon Musk pledged a significant portion of his Tesla stock as collateral for personal loans, giving him access to billions in liquidity.

He didn’t sell a single share and didn’t trigger a single dollar of capital-gains tax.

That’s the Buy, Borrow, Die strategy in motion:

Buy appreciating assets — stocks, businesses, or real estate.

Borrow against them tax-free to create liquidity.

And someday, Die and transfer them with a step-up in basis that erases capital-gains liability.

Musk used debt as a tax shield, accessing billions in cash while preserving both control and compounding. It’s the same blueprint used by founders, private-equity partners, and family offices for decades.

Adapting the Strategy at Any Scale

You don’t need billions in public stock to apply the principle — only assets with equity and endurance.

Private-Market Holdings: Use ownership stakes or LP positions as collateral for a capital line, converting illiquid equity into working capital.

Cash-Value Life Insurance: Borrow tax-free against the policy’s accumulated value; the loan is repaid from the death benefit.

Real-Estate Equity: Refinance or draw a HELOC to access liquidity while keeping gains tax-deferred.

Each move converts paper wealth into productive liquidity — capital that continues to grow instead of sitting idle.

Yes, every loan carries risk. Collateral values fluctuate, and leverage requires discipline. But when managed deliberately, this strategy functions as the operating system of modern wealth — a system that preserves upside, extends compounding, and keeps capital working.

THE PLAYBOOK

Musk mastered the model at scale. Here’s how to run the same play on your own balance sheet.

Wealthy investors approach borrowing as a deliberate strategy. Every dollar of debt serves a defined purpose, supported by structure, collateral, and a clear plan for repayment.

The objective is simple: use borrowed money to amplify compounding — safely, efficiently, and with control.

1. Climb the Leverage Ladder

There are three tiers on the path from debt avoidance to debt mastery:

Tier 1 · Foundational Leverage

Borrow against cash-flowing or appreciating assets such as real estate, credit portfolios, or businesses. Use that capital to acquire or expand productive holdings.Tier 2 · Strategic Liquidity

Access capital through lines of credit or portfolio loans while maintaining ownership. Liquidity creates agility when opportunity appears.Tier 3 · Portfolio Engineering

Combine multiple collateral types — equity, debt, and cash flow — into a structured system of controlled leverage. This approach allows family offices to manage long-duration wealth with short-term flexibility.

Begin where cash flow supports you, then expand as balance sheets and experience grow.

2. The Spread Is the Strategy

The power of leverage lives in the spread between what you pay and what you earn.

Example: Borrow at 6%. Earn at 12%. That 6-point spread compounds year after year.

Over a decade, that difference can double your return profile—even with no additional principal.

A $1 million property financed at 6% that earns 12% annually produces $60,000 of yearly spread—nearly doubling the total equity within ten years.

Sophisticated investors optimize this equation continuously. They build systems where every borrowed dollar generates more than it costs, turning leverage into a self-funding engine for growth.

3. The Debt Design Framework

A five-step filter for deploying productive debt:

Step 1 · Collateral: Identify a durable asset that secures the loan.

Step 2 · Duration: Ensure the asset’s growth timeline exceeds the loan term.

Step 3 · Spread: Confirm the after-tax return remains well above the interest rate.

Step 4 · Safety Margin: Stress-test payments against a 50 percent drop in income.

Step 5 · Duration Match: Align loan terms with the life of the asset. Short-term projects benefit from short-term debt. Long-term holdings rely on fixed, durable capital. Consistent timelines keep cash flow stable and momentum intact.

When these five elements align, equity transforms into compounding capital.

4. Exit Before the Exit

Effective borrowers plan their exits in advance. Every loan includes a timeline — refinance when rates improve, sell into strength, or repay during liquidity peaks.

Liquidity acts as the safety valve that keeps leverage healthy. The most disciplined investors maintain reserves — cash, untapped lines, and recurring income streams that preserve optionality. Liquidity prevents forced decisions and keeps leverage productive.

Treat leverage like oxygen: essential in small doses, hazardous without balance.

Remember These Plays:

Borrow with intention. Every dollar of debt should fund a productive asset.

Monitor the spread. The gap between cost and return drives compounding.

Design your structure. Collateral, duration, and timing create safety and scale.

Protect liquidity. Cash and credit capacity act as insurance against volatility.

Plan the exit. Manage leverage with the same precision used to acquire assets.

When timing and structure align, and assets outpace liabilities, wealth stops growing linearly and starts multiplying.

WEALTH REBELLION

“Good debt makes you rich. Bad debt makes you poor.” -Robert Kiyosaki

Borrow Boldly, Build Freedom

The difference between destructive debt and productive debt comes down to intention and structure.

The debt used to acquire appreciating assets and generate cash flow bridges to larger opportunities. This is productive capital. It accelerates compounding and expands control.

Debt tied to consumption or ego drains energy and future freedom. The purpose behind the borrowing defines the outcome.

This issue wasn’t about financial tactics — it’s about perspective. It’s about shifting from the mindset of a spender to the discipline of a capital allocator.

Because the wealthy treat debt as design. Every dollar they borrow has a job — to buy time, assets, or cash flow.

Choosing purpose over impulse, engineering leverage instead of escaping it.

And right now, with the dollar weakening and real assets gaining ground, those who master that mindset will be the ones who build lasting freedom.

WHAT WE ARE READING

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.