- Wealth Stack Weekly

- Posts

- How to turn $100k into $1M with capital stacking

How to turn $100k into $1M with capital stacking

Early return of capital across deals changes portfolio math

Hi ,

People like to invest in scale.

As investors, we focus on how much. We aim for big multiples. Scrutinize the holding period. Compare annualized returns. We want to know: if we allocate before, what will we have after?

But outcomes are shaped equally by velocity. Not just how much, but when capital comes back.

It’s easy to miss the nuance. We all know a 3x return over five years beats a 4x over ten. Time matters. Speed matters.

But return of capital changes the math. What if that 4x over ten years also returned most of your original investment in year two? What if capital you assumed was locked could be redeployed into a second deal all while the first one continued compounding in the background?

That’s when investors begin to behave differently.

Capital stacking is built around this idea: structuring investments so capital doesn’t have to wait for a final exit to become productive again. Capital can return early, move forward into another deal, and still remain exposed to long-duration upside where it first started. The same dollars working across multiple deals 🤯

One dollar, two deals. (Don’t worry, the math checks out!)

This approach is largely unique to the private markets. In public markets, the closest comparison is leverage—borrowing against assets you continue to hold (which creates valuation risk). By contrast, return of capital creates liquidity while reducing risk. That difference matters.

As portfolios grow, idle capital becomes one of the biggest drags on compounding. Capital stacking is a way to reduce that drag without heroic risk or perfect exits. It’s not about chasing faster wins. It’s about designing portfolios where capital can quite literally be in two places at once.

This issue looks at capital stacking from three angles.

How to spot it – how experienced LPs identify return-of-capital structures that materially change the risk equation.

A real live deal example – where capital is returned before exit, while equity continues to compound along with the world’s largest IPs.

A practical framework you can use to assess whether your own portfolio is designed to recycle capital or quietly trap it.

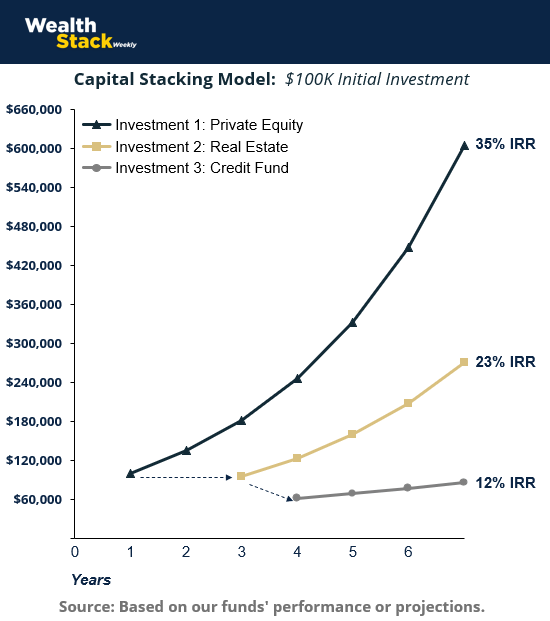

Plus, don’t miss our Capital Stacking Model at the end of Shift Your Stack.

Let’s dive in,

— Walker Deibel

WSJ & USA Today Bestselling Author of Buy Then Build

Founder, Build Wealth

SHIFT YOUR STACK

Capital Stacking: Let the Same Dollar Work Twice (or More)

Capital stacking is built on a simple premise: capital doesn’t have to wait for an exit to become productive again.

To see how this works in practice, consider this sequence:

An investor starts with $100,000 and places it into a private equity investment structured to return capital quickly. Within the first year, roughly 95% of the original capital is returned. A small equity position remains invested and continues to compound, but most of the risk has already been reset.

That $95,000 doesn’t sit idle. It moves directly into a second opportunity.

The second investment is a ground-up real estate deal designed with meaningful return of capital early in its life. Within the first year, approximately 65% of invested capital comes back, while the remaining equity continues compounding over a multi-year horizon. At this point, the original private equity position is still working, the real estate investment is still compounding, and a meaningful portion of capital has been freed again.

By year three, roughly $62,000 has been recycled into a third strategy — a credit fund designed for stability rather than upside. This capital produces consistent cash flow, paid monthly, with minimal volatility. That income compounds in the background while the earlier equity investments continue on their own timelines.

What matters in this example is not any single return figure. It’s the structure. Capital is returned, redeployed, and reactivated while previous investments remain intact. The original $100,000 is exposed to private equity upside, real estate growth, and steady credit income — not sequentially, but in parallel.

This is why experienced LPs focus so heavily on distribution profiles.

Early return of capital shortens exposure without giving up ownership. Cash flow creates optionality. And sequencing allows compounding to happen in layers instead of straight lines.

Over time, this approach changes how portfolios behave. Capital is no longer a one-time input, it starts functioning as a system. Investments are evaluated not only on their standalone returns, but on how they interact, overlap, and unlock the next move. The outcome feels intentional rather than accidental.

Capital stacking doesn’t require heroic assumptions or excessive risk. It requires discipline around structure, patience with sequencing, and a clear plan for redeployment before capital ever comes back.

That is the real shift. Wealth doesn’t have to wait for an exit. It compounds continuously when it can be in two places at once.

Want to check how your own investments stack up? Test the impact of capital stacking with our newest model. Download our Capital Stack ToolBox

CASE STUDY

Delphi Interactive: When Access Becomes Structure

Many believe asymmetric returns come from taking early risk.

In reality, some of the most compelling results come from a different skill: recognizing when the most meaningful risk has already passed, and then positioning capital to benefit from what remains.

Our allocation in Delphi Interactive illustrates that distinction.

I was the first investor in the company, which may seem at odds with my view on startups in Buy Then Build. But it follows the same framework – it just looks really different from a business acquisition play.

Delphi was built around a rare asset: the licensed rights to develop a James Bond video game. On its own, that license wasn’t a business. The real work was turning it into one.

First, it meant raising a nine-figure AAA game development budget, assembling a top-tier development partner, IO Interactive (of Hit Man fame), and locking in a commercial roadmap that de-risked execution. Over time, those pieces came together.

By the time the game was fully funded and development underway, Delphi no longer looked like a speculative studio. The most fragile part of the risk curve—capital formation and production uncertainty—had largely been eliminated. What remained was long-duration upside tied to a globally recognized IP.

That moment is when capital stacking became possible.

Because of my position already inside the deal, I was able to create a secondary opportunity for Build Wealth investors that reflected this changed risk profile. We offered a structure that returns 95% of investor capital in first position with the 007: First Light revenue, while still retaining equity in the company’s future value. This structure essentially eliminates capital risk, while equity ownership remains intact.

Since then, the business has continued to strengthen.

The James Bond title is scheduled for release this May. Delphi has now announced additional development tied to FIFA 2026 and a distribution relationship with Netflix. None of those outcomes were required for the structure to work, but all of them compound the equity investors still hold.

That’s the point. This outcome wasn’t driven by guessing which startup would win. It came from understanding where the real risk lived, recognizing when it had already been addressed, and structuring capital so it could be returned, redeployed, and still participate in long-term upside.

Our next deal puts capital stacking into practice: A ground up construction project with 65% ROC in 12-15 months. (Hit reply on this email to get materials when they’re available.)

THE PLAYBOOK

How to Build a Capital Stack That Compounds

Capital stacking works when capital is allowed to move with intent. This playbook is a set of principles meant to guide how you evaluate stacking opportunities and design your portfolio over time.

1. Locate the Real Risk—and When It Clears

Before focusing on returns, isolate where risk actually lives in a deal.

That risk may sit in development, capital formation, execution, or distribution. What matters most is when it meaningfully declines.

Stacking becomes possible after the dominant risk has been addressed. As an investor you’ll need to understand the business and the structure well to identify when risk is neutralized.

2. Favor Credible Paths to Early or Partial Capital Return

Early return of capital should be structural, not aspirational.

This can take many forms: asset-backed distributions, refinancing events, secondary liquidity after de-risking milestones, or contractual cash-flow waterfalls tied to specific outcomes.

The objective is a reset in exposure while ownership continues.

3. Keep Long-Duration Upside Intact

A durable capital stack allows capital to return without dismantling the future.

Equity remains in place. Upside is preserved. Compounding continues quietly in the background.

When early liquidity eliminates asymmetry, the stack loses its power.

4. Plan Redeployment Before Capital Comes Back

Experienced allocators decide what capital will do next before it returns.

That planning includes where the capital will go, the role it will play, and how it changes the behavior of the portfolio as a whole.

Remember, capital with a destination can compound. Capital without one tends to stall.

5. Stack Across Time Horizons

Capital stacking works best when investments differ by time, not just by category.

A well-designed portfolio often includes short-duration capital that returns early, mid-term capital with visibility, and long-duration capital carrying asymmetric upside.

When these overlap, compounding becomes parallel rather than sequential.

6. Revisit Existing Positions for ROC Potential

Stacking opportunities often exist inside portfolios that are already built.

Review current positions and ask whether risk has already declined, whether partial liquidity is possible, and whether capital can be reactivated while ownership remains intact.

Often, the opportunity lies in timing rather than in sourcing something new.

Capital stacking favors discipline over complexity. Each layer funds the next.

Capital stacking becomes your engine—not just your structure.

WEALTH STACK REBELLION

“Money is a terrible master but an excellent servant.” — P.T. Barnum

Smart investors structure deals to return capital, keep it moving, and compound across multiple investments at once.

That’s hard to do in the stock market.

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into the private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.