- Wealth Stack Weekly

- Posts

- My Stocks Just Bought Me Real Estate. I Didn't Sell a Single Share.

My Stocks Just Bought Me Real Estate. I Didn't Sell a Single Share.

How sophisticated investors use debt to control timing, taxes, and opportunity.

Hi ,

I recently sat down with a private banker to set up a new line of credit. When he heard my plan he sat back, smiled and said:

"Walker, I've been at this bank for fifteen years. And I've learned there are really only three kinds of people when it comes to debt:

There are people who carry a mortgage because they need one.

There are people who hate debt and work hard to pay everything off.

And then there are rich people, who leverage as much as they can to make investments.”

That day, I made a mid-six figure investment using my stock portfolio as leverage.

But let’s back up.

Early in my career, debt showed up in a very different form. I secured millions in bank debt I used to acquire small businesses. These were personally guaranteed loans where operational risk and lumpy cash flow could crush me. My loan payment had to show up every month or things broke.

That kind of debt sharpens you. It forces discipline and is not to be trifled with. Debt not only enabled me to acquire businesses I could work on and grow, but it led to 3 exits and accelerated my wealth. I also had some punishingly close calls along the way. It’s a great teacher of what drives true value in business models, and the level of risk in a capital stack.

Perhaps I had to put millions at risk years ago to feel so calm at this moment? The PG millions were millions I didn’t have, and were multiples of my net worth. I had no assets to leverage.

By contrast, this new debt showed up after years of building resilience after my mistakes had already been paid for.

That sequence matters.

Used before intimately understanding operational risk, debt can be a strategic tool, but it amplifies risk. Used after these lessons, it completely reshapes one’s ability to capitalize on opportunity via calculated risk (a.k.a. asymmetric returns).

That's the line this issue explores.

We'll look at how leverage affects outcomes through capital structure, where it predictably breaks portfolios, and how experienced investors think about borrowing as a liquidity decision rather than a reflex.

I’m also sharing my recent investment as an example: how I borrowed against my public equities to fund a real estate investment that returns capital early, while my stock portfolio stays intact. It’s the deal that brought me into that banker's office in the first place.

The real work here is understanding the conditions that had to exist before a move like that made sense.

Some of this will be uncomfortable. Good.

Let's get into it.

— Walker Deibel

WSJ & USA Today Bestselling Author of Buy Then Build

Founder, Build Wealth

SHIFT YOUR STACK

Same instrument. Different intent.

Most debt is used to buy things that we need, or want, but don’t produce returns on their own. A car, a vacation, any big purchase or an unexpected expense. Paid off through monthly payments to smooth the cash flow hit. Aside from your mortgage, most of your debt will not result in value creation.

When you heavy up on non-productive debt and income slows or something unexpected happens, debt can create pressure in our lives and limit our options. This is a real and accurate depiction of debt for most people.

But that’s not the type of debt we’re talking about.

Wealthy investors use debt to create new value without sacrificing existing value. They borrow to keep capital moving and to avoid selling productive assets too early. Debt can be used to control timing of liquidity, of taxes, and especially opportunity.

These investors have the deal flow, information edges, and diversification to make that faster deployment higher quality. Speed without those inputs is just impatience with a credit line.

It’s What You Don’t Realize That Counts

Asset-backed borrowing is one of the least understood strategies of wealth preservation. Securities-backed lines of credit, borrowing against real estate equity, pledging business assets allow for accessing liquidity without triggering taxable events.

Wealthy investors are borrowing against their best assets. Assets they don’t want to sell.

Buy, borrow, hold.

That's how generational wealth compounds fast. Defer gains indefinitely while the underlying assets continue to appreciate.

Know The Devils And Their Details

Sophisticated investors almost never borrow from an existing asset to fund a new investment unless at least one of these conditions is true (and usually it’s more than one):

The existing investment’s cash flow is stable and predictably arrives on schedule.

The new investment has a clear path to liquidity — not an open-ended wait.

And if things go sideways for either, the downside remains survivable.

Without those conditions, the downside of asset-backed leverage can be precipitous.

This is the same framework that separates successful acquisition entrepreneurs from those who overextend. If the underlying asset can't service its debt under a downside scenario, the upside is irrelevant.

Financial Engineering At Scale

McKinsey, Blackstone, and Bain don’t bat an eyelash when using leverage to boost IRR. They underwrite and engineer it. This practice is ubiquitous and carefully measured.

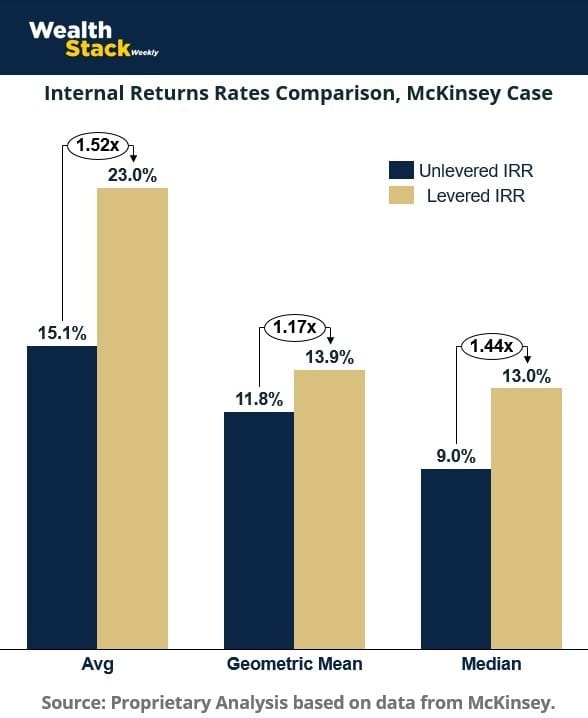

Institutions break down IRR into its core drivers (baseline business cash flow, operational improvements, strategic repositioning, and leverage) to understand how much value is actually coming from performance versus financial engineering. Here the average IRR increase is 15.1% → 23.0% (1.52x). Geometric & Median follow similar patterns.

Like family offices and institutional investors, sophisticated individual investors deliberately isolate where leverage sits across the portfolio. When they don’t, it’s a recipe for trouble.

Some assets are designed to stay unlevered — durable, boring, steady. Others can safely carry debt because they're structurally predictable, cash-flowing, or short in duration.

Liquidity makes leverage survivable. Structure makes it repeatable.

Debt becomes useful only after the rest of the portfolio can absorb it.

Anything earlier tends to feel productive – right up until it isn't.

For those who want the data behind this framework, our weekly report, Debt as a Liquidity Provider and IRR Booster goes deeper on how debt can be a powerful wealth builder. HERE’s the report.

CASE STUDY

My plan to turn $83k into $1.5m with asset-backed leverage.

Now, I’ll just go ahead and say this move isn’t for everyone.

But when you have conviction, access, and a portfolio that can absorb volatility, it’s at least worth the thought experiment.

How It Started

I held a sizable public equity portfolio I had no interest in selling. Those positions are long-term by design. Selling would have triggered taxes and interrupted compounding at exactly the wrong moment.

At the same time, I had high conviction in a ground-up multifamily project called The Nicholas. This is my real estate A-team: operators I partner with across multiple projects, in my local market, in a location I know well.

The site sits adjacent to a major medical university and hospital campus that draws hundreds of thousands of people daily. I've been close enough to this deal to stress-test it.

The capital structure was designed to return a meaningful portion of capital early in the life of the deal. I wanted a substantial allocation. More than I had sitting around.

So instead of selling assets, I borrowed against them.

What I Did (And Expect to Happen)

I used an equity-backed line of credit (EBLOC) at 5.5% interest-only and deployed $600,000 in capital into the project.

If all goes according to plan, my only cost is $83k to generate $1.5m in incremental value beyond my stocks alone.

Let me break it down.

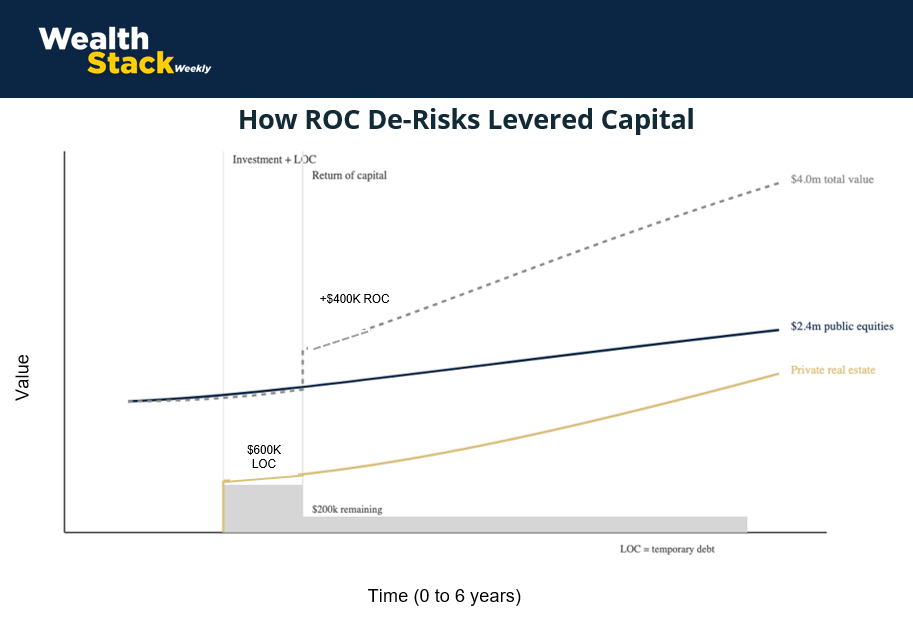

In 12 months, the deal should return 66% of my invested capital (~$400k). That return of capital will go directly toward paying down the loan. My public equity portfolio will stay fully invested the entire time. And I will still own the $600k in equity in the real estate project.

Once I receive that return of capital, the risk profile of the investment will change. My capital at risk becomes just shy of $200k. I will then carry the remaining balance at a modest interest cost for the remainder of the anticipated six year cycle.

About nine cents on every dollar deployed over the life of the deal will go to debt service, while still holding equity in a project targeting a 3.5x outcome over six years.

My only out of pocket investment will be the ~$83k in interest payments, which are tax deductible and spread across 6 years.

I kept my stocks. I’m building equity in real estate. My only cost is interest only debt service (which is tax deductible!).

Comparing this to my millions in personally guaranteed debt for business acquisitions earlier in my career, I’m not losing sleep.

How the EBLOC Structure Worked

The mechanics behind the move were straightforward:

Borrow against appreciated public equities

Deploy that capital into a high-conviction private project

The only “out of pocket” investment is tax deductible, interest only, payments.

Receive return of capital early

Use that cash to reduce the loan balance

Keep both the public portfolio and the private equity intact

The key insight is that ROC, not the final exit, is what de-risks the leverage.

What Could Go Wrong?

Everything about debt still applies and must be underwritten.

If public markets drop materially, the line could trigger margin pressure which forces an equities sale at exactly the wrong time. Maintaining conservative loan-to-value ratios can help, but doesn't make the risk disappear.

If the project underperforms or fails, I'll still be on the hook for the outstanding balance. The line is secured by my securities, not the deal itself. That's the recourse asymmetry: non-recourse on the project side creates full recourse on the portfolio side.

And then there's conviction bias. Being close to a deal — knowing the operators, understanding the market, watching Phase 1 perform — can feel like certainty. It isn't. Proximity to information is an edge, and I believe it's a meaningful one but confusing an edge with a guarantee is how smart investors make big mistakes.

This only works when the rest of the portfolio can absorb the constraint. Capital is committed to the private deal on one end and pledged against the line on the other. I could win or lose on one or both fronts.

The good news? A complete meltdown is unlikely. What’s more likely is a market downturn or a delay or softening in the real estate outcome projections. If I have to sell the equities to cover a margin call, I’m not losing the cash–it’s being reallocated to the real estate project. I may only get the more profitable deal…instead of both. If the real estate deal delays or softens, it just costs me more in debt service.

Repeat: This Move Isn’t For Everyone.

This kind of structure tends to make sense for investors who:

Hold substantial appreciated portfolios

Have access to high-conviction deals with a short path to return of capital

Can underwrite both sides of the trade independently

It doesn’t work well for investors who:

Need near-term liquidity or optionality

Are new to private markets

Are following a clever structure instead of a repeatable process

I’ll keep you informed as this unfolds. Stay tuned.

THE PLAYBOOK

How to Use an EBLOC Like a Pro (Not a Tourist)

You've seen the framework. But is it for you?

Borrowing against your portfolio can be useful. It can also destroy flexibility when used without discipline. Start by understanding when leverage earns its place in your system and when it doesn't.

Test for ‘No Go’s

Before moving ahead with debt, run your portfolio through two pressure tests.

Durability. How much can your portfolio absorb during a 30-40% drawdown without forced selling? If a market correction would trigger liquidation, leverage is already broken before you deploy a dollar. Durability comes before optimization. Make sure you know your limits so you don’t push your loan-to-value ratio too far.

Survivability. How much can you leverage before failure causes a meltdown? If the investment fails completely, will it impact your lifestyle or core assets? If so, stop or pull way back on the allocation until no systemic risk remains.

Passing both tests doesn't mean you should borrow. It means you know how much you can borrow when the right opportunity presents itself.

Find the Right Deal

Before deploying EBLOC capital into any opportunity, the deal should look like this:

Fast return of capital (ideally 12–18 months) to retire the debt early and reduce your capital at risk. Without early ROC, you're holding borrowed money for the full duration of the deal, which fundamentally changes both the cost profile and the risk.

Wide enough return spread so long-term equity clearly beats the cost of carry. If the deal returns 1.5x over six years and you're paying mid-single digits on the carry, the spread is thin and the structure adds complexity without proportional upside.

Independent underwriting so conviction comes from analysis, not a pitch. You want to be close enough to evaluate the operator, the market, the capital stack, and the execution risk on your own terms.

If a deal doesn't meet these criteria, it likely doesn't fit as a candidate for EBLOC regardless of how attractive the opportunity appears in isolation.

Monitor Both Sides of the Trade

Once capital is deployed, you're managing two positions simultaneously — and they move on different timelines.

On the portfolio side: your LTV ratio is shifting with the market every day. Set alerts at meaningful thresholds — well above the margin call trigger, not at it. If the market drops 15%, do you deposit additional securities? Reduce the balance from other sources? Hold and ride it out? Make those decisions from a plan, not from a single phone call with your broker.

On the deal side: stay close to the capital milestones. ROC timing is the hinge of the entire structure. For example, a three-month delay means three additional months carrying the full borrowed amount.

Remember to Respect the Invisible Costs

Some of the real costs of leverage never show up on a statement. Borrowing against personal assets can reduce flexibility, increase emotional pressure during volatility, and limit your ability to act when new opportunities appear.

When you have personal collateral funds for a non-recourse deal, the risk doesn’t disappear if the investment fails, it just shifts back to you. That doesn’t make the structure wrong, but it does mean you should ask, if this goes to zero, what breaks?

Debt belongs after durability is proven.

If your portfolio can absorb volatility, timing risk, and temporary illiquidity, borrowing can help capital, you can make a deal. If it can't, leverage compresses mistakes faster than it accelerates wealth creation.

For readers who passed all three tests in step 1 and are evaluating a specific deal: we've published an operational deep dive covering lender mechanics, margin risk, and ROC paydown dynamics. Note: It explains how EBLOCs work, not whether you should use one. You can check out our EBLOC Playbook Deep Dive HERE.

WEALTH STACK REBELLION

“I would rather earn 1% off a hundred people’s money than 100% of my own.”

— John D. Rockefeller

We are taught to fear debt.

The wealthy learn how to use it.

The mindset comes down to sequence.

Durability first. Leverage second.

Until your portfolio can absorb volatility, debt is dangerous.

Once durability is proven, debt can become a tool for moving capital without breaking the flow of compounding.

If you know the line that divides leverage that compounds wealth and leverage that compresses mistakes, you’ll be ready when you see a chance to use it.

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.