- Wealth Stack Weekly

- Posts

- NVIDIA is a mirage. Here’s where the real AI money is flowing.

NVIDIA is a mirage. Here’s where the real AI money is flowing.

Forget the tickers. The real compounding is in power, property, credit, and factories — and family offices are already there.

Hi ,

AI isn’t just eating software. It’s eating capital.

When most people hear “AI,” they think ChatGPT, NVIDIA, or the next stock that might 10x. But the real “aha” moment for me wasn’t watching stocks soar, it was watching data centers scramble for electricity.

That’s when it clicked: this isn’t limited to a tech boom, it’s an infrastructure crisis. The kind you can’t solve with better code or a higher EPS. You solve it with power plants, cooling systems, and private capital.

And that’s exactly where the next decade of AI wealth will be built. Not in who launches the next chat model, but in the assets every model depends on.

The public markets will eventually catch up. They always do. But by then, the asymmetric gains will be gone as they mature into an efficient market.

This week we’re pulling back the curtain on The AI Mirage, and showing you where the real compounding happens:

Stack Shift: Why NVIDIA is just surface level, and how AI is really a capital story.

Case Study: Jony Ive’s $6.5B pivot with OpenAI — where design, capital, and infrastructure converge.

Playbook: How the top 0.1% are stacking data centers, energy, credit, and industrial supply chains to profit from AI — without touching a single stock.

Wealth Rebellion: The mindset shift to stop renting hype and start owning the grid.

By the end of this issue, you’ll see AI for what it really is: a capital formation story. And you’ll know how to own it.

P.S. Want to see how I’m playing this macrotrend personally? We’re rolling up cash-flowing oil wells to position into the energy demand surge. Our base projections target a 30%+ IRR and ~29% average cash-on-cash returns. You’ll find all the details in the From Our Sponsor section below.

SHIFT YOUR STACK

The AI Mirage: Why NVIDIA Isn’t the Play

Wall Street wants you to believe there’s only one way to own AI: buy NVIDIA. It’s the top holding in QQQ, it’s added trillions in market cap, and it’s minted more paper millionaires than any other stock in the last two years.

Here’s the truth: NVIDIA powers AI, but it doesn’t capture the compounding engine.

The real wealth story sits in the infrastructure.

AI’s impact isn’t measured in EPS, it’s measured in megawatts. Global electricity demand from data centers is projected to more than double by 2030—to 945 terawatt-hours, more than the annual power consumption of Japan. Goldman Sachs forecasts AI workloads alone will account for over a quarter of all data center energy use by 2030, driving power demand up as much as 165%. There is a major energy shortage upon us.

And grids are already groaning. U.S. utilities have received interconnection requests for nearly 400 gigawatts of new data center projects—over half of the Lower 48’s peak demand. This isn't an incremental load. Instead, this is a shock to the system that demands trillions in new capital to expand and harden infrastructure.

That money isn’t flowing into ETFs. It’s being deployed through private markets.

Just look at the capital stack today:

Brookfield is committing $15B to hyperscale data centers with a $50B pipeline by 2030.

Blackstone has already put $25B into digital infrastructure.

Apollo is underwriting credit deals that finance the power and transmission backbone.

And in August 2025, Vantage Data Centers announced a $25B AI campus in Texas with a staggering 1.4 gigawatt power demand—enough to run a small city.

Industrial giants are moving too. Hitachi just announced a $1 billion investment to manufacture grid transformers in Virginia to support AI-driven load growth. Vistra Corp., one of the largest U.S. power generators, is forecasting $6.8B in EBITDA by 2026, propelled by nuclear and renewable contracts tied to data center demand. And even the tech firms themselves are signing long-term power deals: Google struck an agreement with TVA and Kairos Power for up to 500 MW of nuclear capacity to keep its AI campuses running.

History is rhyming. In the railroad era, fortunes weren’t made by running trains — they were built by owning the land, steel, and rights-of-way. Today, the same dynamic is unfolding. The investors who control the power, property, and contracts behind AI will capture the durable compounding.

For accredited investors, this insight doubles as a roadmap. The way to capture the AI boom is through ownership slices of the infrastructure stack: infrastructure funds that collect long-duration colocation leases, private credit deals financing grid expansion, and specialized real estate that houses data clusters. These structures deliver contracted cash flows, inflation protection, and exposure to trillion-dollar secular growth—the kind of compounding that can turn a $1–5M portfolio into $10M+.

Public investors are left with crowded, sentiment-driven tickers. Private investors are securing patient, structured ownership of the infrastructure that AI runson—backed by long-duration contracts, inflation-hedged assets, sovereign co-investment, and durable yield.

That’s the inversion most people miss: the story of AI isn’t about chasing the next product cycle. It’s about the capital stack fueling the entire ecosystem.

LP lesson: If your managers say they have AI exposure, ask: Where does your AI exposure really live? If it isn’t anchored in servers, substations, and the land under the data centers, the compounding is happening at a foundational level elsewhere.

Check out our full download on AI datacenters and energy infrastructure alternatives in this week’s report.

CASE STUDY

Jony Ive & OpenAI’s $6.5B Bet on “io”

©OpenAI

Jony Ive, Apple’s design oracle, just pulled off one of the most overlooked capital shifts in the AI boom.

In May 2025, OpenAI acquired his startup, io Products, in an all-stock deal valued at $6.5 billion — the largest acquisition Open AI has made to date.

For perspective, the median tech M&A deal is around $200 million. This move was thirty times that size and stands as the largest AI hardware design acquisition on record.

But here’s the twist: Ive didn’t cash out. His LoveFrom collective remains independent, while 55 ex-Apple designers are now embedded inside OpenAI’s product and research core. Their stated mandate: build physical embodiments of AI (cars, wearables, humanoids) devices that pull generative intelligence off the screen and into everyday life.

This is where the AI hype cycle takes on physical form. The next leap is embodiment: the tools, interfaces, and distribution channels that determine how billions of people experience AI. Ive positioned himself at the capital layer, where design discipline shapes adoption, trust, and ultimately value creation.

Why It Matters for Investors

Scale: A $6.5B acquisition in hardware design is a signal of where capital is shifting.

Moat: Control over interaction and trust is a durable edge, just as it was in the iPhone era.

Access: These bets are private long before the products hit public markets.

Investor Lesson: When legends like Ive pivot from apps to assets, it’s a wealth signal.

Ive is embedding himself in the infrastructure of interaction. For LPs, the takeaway is simple: when diligencing a fund, ask how it’s positioned to capture AI’s hardware and interface layers.

Are you backing the rails of interaction? If not, you may be missing the compounding edge.

From Our Sponsor — BuildEnergy I

Our founder, Walker Deibel, recently gave a talk about the widening supply–demand imbalance in oil and gas, driven in large part by demand for AI. After years of under-investment in fossil fuels, demand is climbing toward levels we simply can’t meet with today’s production. That gap is already creating opportunity for disciplined investors. And it’s exactly what we’re doing with BuildEnergy I: rolling up cash-flowing oil wells at scale.

To execute, we’ve partnered with Mohajir Energy Advisors, veterans who’ve been running this same playbook for decades. This is their 7th fund. The prior six averaged a 50% IRR for investors. I’m personally invested in both Fund VI and VII, and through Build Wealth, we can actually deliver investors better economics than going direct.

If you’re interested in capitalizing on what we see as a mispricing in energy markets — while generating tax-efficient cash flow and significant upside potential — take a look at BuildEnergy I on our portal and schedule a call with our investor relations team.

So far in 2025, we’ve deployed $23.5 million across our funds from 300+ investors — built on GP-level diligence, family-office negotiations, meaningful co-investment, and improved terms for the Build Wealth community.

Sponsor track record:

Investor distributions since inception: $300+ million

Assets Under Management: $1+ billion

Years of Experience: 40

Target Returns for BuildEnergy I (Base Case):

30+% IRR

Tax efficient, 29% average annual cash flow

Here’s a projection for a sample $150,000 investment:

THE PLAYBOOK

How the Top 0.1% Play the AI Boom

AI exposure needs to go much deeper than your chat logs. The ultra-wealthy are allocating into the underlying assets: the energy, property, credit, and industrial capacity that AI actually runs on.

Here’s where serious capital is moving:

1. Real Estate — Data Centers as Compounders

Behind every model is a warehouse of steel, fiber, and cooling systems. In 2025, data center construction outpaced office building for the first time, a signal of where demand is flowing. REITs specializing in data centers are oversubscribed, and private buyers are consolidating smaller operators.

How it pays: Appreciation of specialized real estate, long-term hyperscale leases, and premium rents where power is scarce.

Investor lens: The compounding play. Scarce, strategically located assets that grow more valuable as AI scales.

LP diligence question: Who are the tenants, and what is the duration of their commitments?

2. Energy — Powering the Grid

AI workloads are straining electricity demand. U.S. utilities face 400 GW of new interconnection requests — more than half of national peak demand. Big Tech will spend $300B in 2025 on AI infrastructure, much of it tied to power supply. Meta alone committed $60–65B to new campuses, locking in 20-year nuclear contracts.

How it pays: Yield from royalties, inflation-hedged returns from power purchase agreements, and upside from long-duration pricing power.

Investor lens: The asymmetric upside: a once-in-a-generation demand shock that resets the energy curve.

LP diligence question: How much of the return profile is secured by PPAs or royalties versus exposed to spot pricing?

3. Credit — Financing the Backbone

From server halls to cooling towers, AI infrastructure is capital-intensive. As banks retrench, private credit is stepping in. Apollo and peers are raising multi-billion dollar funds aimed at digital infrastructure lending.

How it pays: Predictable yield from senior-secured loans, collateral tied to physical assets, and priority in the capital stack.

Investor lens: The yield play. Stable, contracted cash flow in a market desperate for financing.

LP diligence question: What assets secure the loans, and what covenants protect lenders if projects stumble?

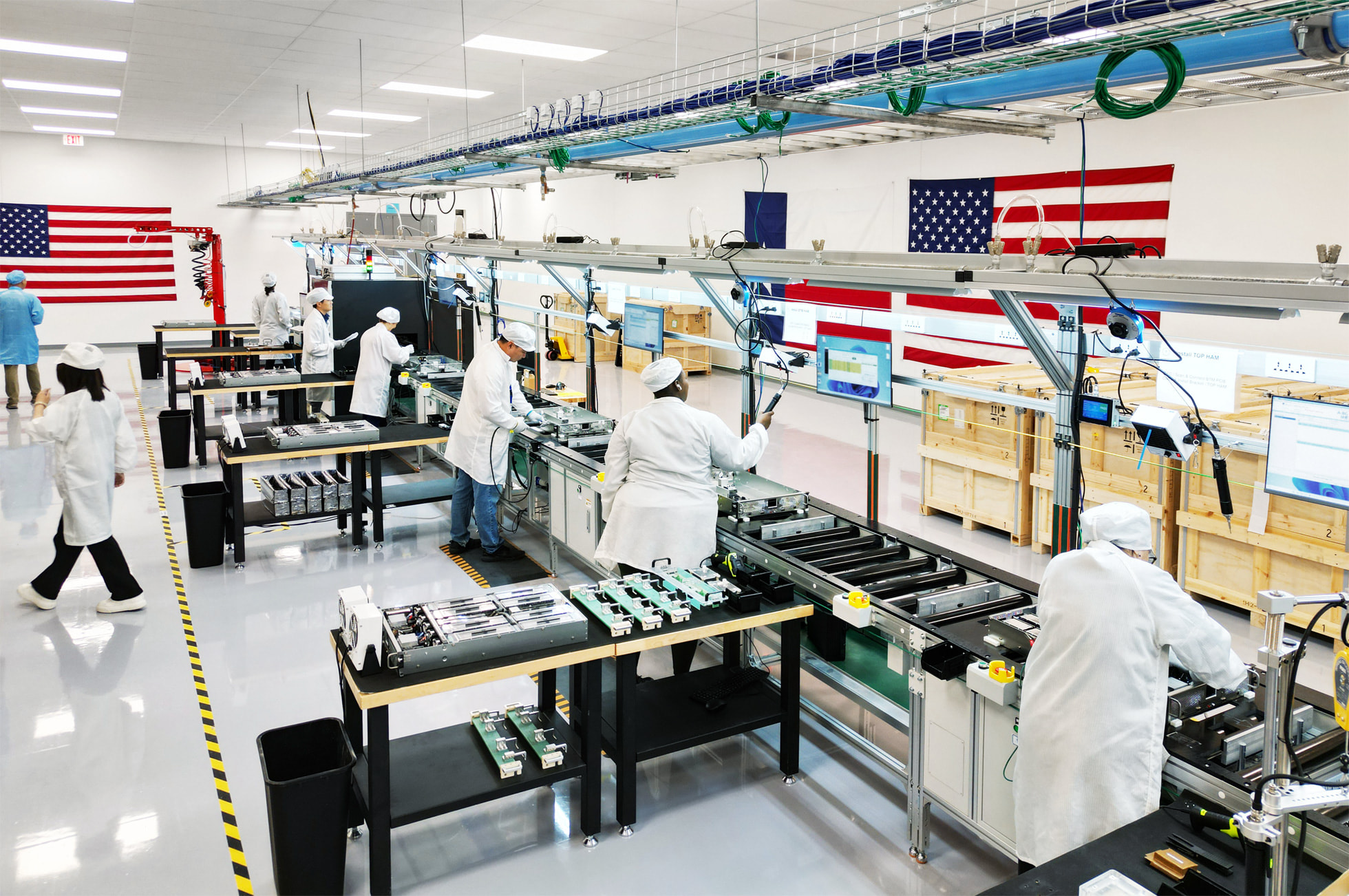

4. Industrial Manufacturing — The “Bonus” Fourth Channel

The factories and suppliers that make AI hardware possible are growing double digits annually. Semicon tooling, advanced cooling, robotics, with many niches posting 10–20% CAGR through 2030, with liquid cooling projected at 25%+. These markets don’t trend on CNBC, but they form the industrial backbone of AI.

How it pays: Cash-generative businesses with strategic buyers lined up.

Investor lens: This is the industrial shovel play — less glamorous, more essential, and with scale-driven tailwinds.

LP diligence question: Which subsectors (cooling, robotics, tooling) show the steepest demand curves over the next five years?

Tactical Stack

The top 0.1% stack exposure across these rails:

Credit for steady yield.

Data center real estate for compounding appreciation.

Energy royalties & nuclear projects for asymmetric upside.

Industrial manufacturing for indispensable growth.

Audit your AI exposure. If all you hold is Nvidia, you’re still trading the headline-hype cycle. Add one private-market channel: infra real estate, nuclear royalties, private credit, or industrial suppliers and only then have you stepped onto the compounding side of the trade.

Which of these AI rails are you most interested in entering? |

WEALTH REBELLION

Burn the Ticker, Buy the Grid

"A new industrial revolution has started. The AI race is on...We see $3 trillion to $4 trillion in AI infrastructure spend by the end of the decade." - Jensen Huang

Investors have been herding into Nvidia like gamblers at a slot machine. That’s renting the hype.

The real rebellion is owning the infrastructure. The substations, campuses, and contracts that every AI model must run through.

AI is a capital story, not a stock story. The mindset shift is moving from speculator to owner, from betting on the next headline to compounding the real assets behind the evolution.

The 0.1% aren’t asking, “Which AI company should I buy?” They’re asking, “Which part of the grid do I own?”

Burn the ticker, buy the grid. Audit your exposure and if all you hold is stocks, you may be financing someone else’s fortune.

WHAT WE ARE READING

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.