- Wealth Stack Weekly

- Posts

- Private Credit Is Eating the Fixed Income World

Private Credit Is Eating the Fixed Income World

The private credit market expanded to $2.1 trillion in 2023, up from $1.84 trillion in 2022—a notable increase that reflects a 15% compound annual growth rate (CAGR) over the past decade.

Introduction

This momentum is largely fueled by the rising demand for alternative financing solutions that provide flexible terms and appealing yields. North America continues to lead globally, representing approximately 60% of the market with $1.25 trillion in assets, while Europe’s private credit segment reached $270 billion, supported by a 17% CAGR.

Investor appetite remains strong, as evidenced by the $490 billion in "dry powder” capital raised but not yet deployed—highlighting preparedness to capitalize on opportunities in a higher interest rate and tighter liquidity environment.

The market’s evolving risk-return profile is also noteworthy. Average annual credit losses stand at 0.9%, lower than those of traditional high-yield bonds at 1.47%. Secured loans dominate the deal landscape, making up 55.8% of all transactions across sectors like software and healthcare. On the funding side, public pension funds account for 19% of total commitments, although 35% of capital sources remain unidentified.

Default rates have declined as well, with sponsored leveraged loans falling to 2.3% and non-sponsored loans to 7.8%, reflecting improved market stability.

This report delves into these developments, shedding light on the forces driving growth and the emerging risks that could shape the future of private credit.

Private Credit Overview

This diagram outlines the structure of the private credit market, highlighting the main participants, types of intermediary funds, and their links to corporate borrowers. At the core of the funding ecosystem are end investors such as pension funds (PFs), insurance companies (ICs), sovereign wealth funds (SWFs), and retail investors. These groups bring distinctive traits—like long-term investment horizons and substantial capital—that contribute to the market’s resilience and expansion. Retail investors typically gain exposure indirectly, primarily via Collateralized Loan Obligations (CLOs), where banks provide leverage to help diversify credit risk.

Intermediary entities—including closed- and open-ended funds, Business Development Companies (BDCs), and CLOs—serve as vital bridges between capital providers and borrowers. These vehicles commonly invest in floating-rate loans with strong covenant protections, giving lenders more control and flexibility. They are particularly geared toward mid-market and corporate borrowers, offering adaptable financing options that suit small to medium-sized firms with higher leverage demands.

This structure allows investors to access the private credit market’s attractive yield opportunities while meeting the diverse capital requirements of corporate borrowers.

Private Credit market Size 2013 -2023

The private credit market has experienced remarkable expansion over the past decade, growing from $500 billion in 2013 to $2.1 trillion by 2023. This translates to a compound annual growth rate (CAGR) of 15%, highlighting increasing interest in private credit as an alternative to traditional financing methods, thanks to its flexible terms and attractive returns.

North America continues to lead the market, with its share reaching $1.25 trillion in 2023—around 60% of the global total. Meanwhile, Europe’s private credit sector has also gained significant momentum, rising from $50 billion in 2013 to $270 billion in 2023, supported by a higher CAGR of 17.26%.

The market’s growth is further underscored by the accumulation of “dry powder”—undeployed capital—which has climbed to $490 billion. This indicates a strong investor appetite and readiness to deploy funds amid a backdrop of higher interest rates and tighter liquidity conditions.

Market Expansion and Investor Demand:

The private credit market has expanded significantly, rising from $500 billion in 2013 to $2.1 trillion in 2023—reflecting a 15% compound annual growth rate (CAGR) over the past decade. This strong upward trajectory underscores increasing demand for alternative financing solutions that offer more flexible terms and competitive yields compared to traditional lending.

Interest in private credit has surged as institutional and private investors look beyond public markets, especially in the face of rising interest rates and tighter access to conventional credit.

Regional Developments:

North America continues to lead the global private credit space, with market size growing from $260 billion in 2013 to $1.25 trillion in 2023, registering a CAGR of 16.97%. This dominance is supported by a mature financial infrastructure, strong borrower demand, and a broad investor base.

Europe has seen even faster growth, with a 17.26% CAGR over the same period, expanding from $50 billion to $270 billion. This growth reflects a shift toward private credit as traditional banks face increasing regulatory and economic headwinds.

Undeployed Capital ("Dry Powder"):

Dry powder has increased from $180 billion in 2013 to $490 billion in 2023, growing at a CAGR of 10%. This rise signals robust investor interest and a strong pipeline for future deployment.

These large reserves of undeployed capital highlight investor readiness to act on new opportunities, particularly as the current macroeconomic environment favors private debt due to tighter credit conditions and increased borrower demand.

Future Outlook:

The continued growth in both market size and dry powder suggests a positive outlook for private credit. With ample investor interest and significant capital waiting to be deployed, the sector is well-positioned for further expansion.

As the need for flexible financing persists, especially among mid-market and corporate borrowers, private credit is poised to play an increasingly vital role in meeting funding needs in a challenging economic landscape.

High Growth: Private Credit Growing share in High Yield Bond Market

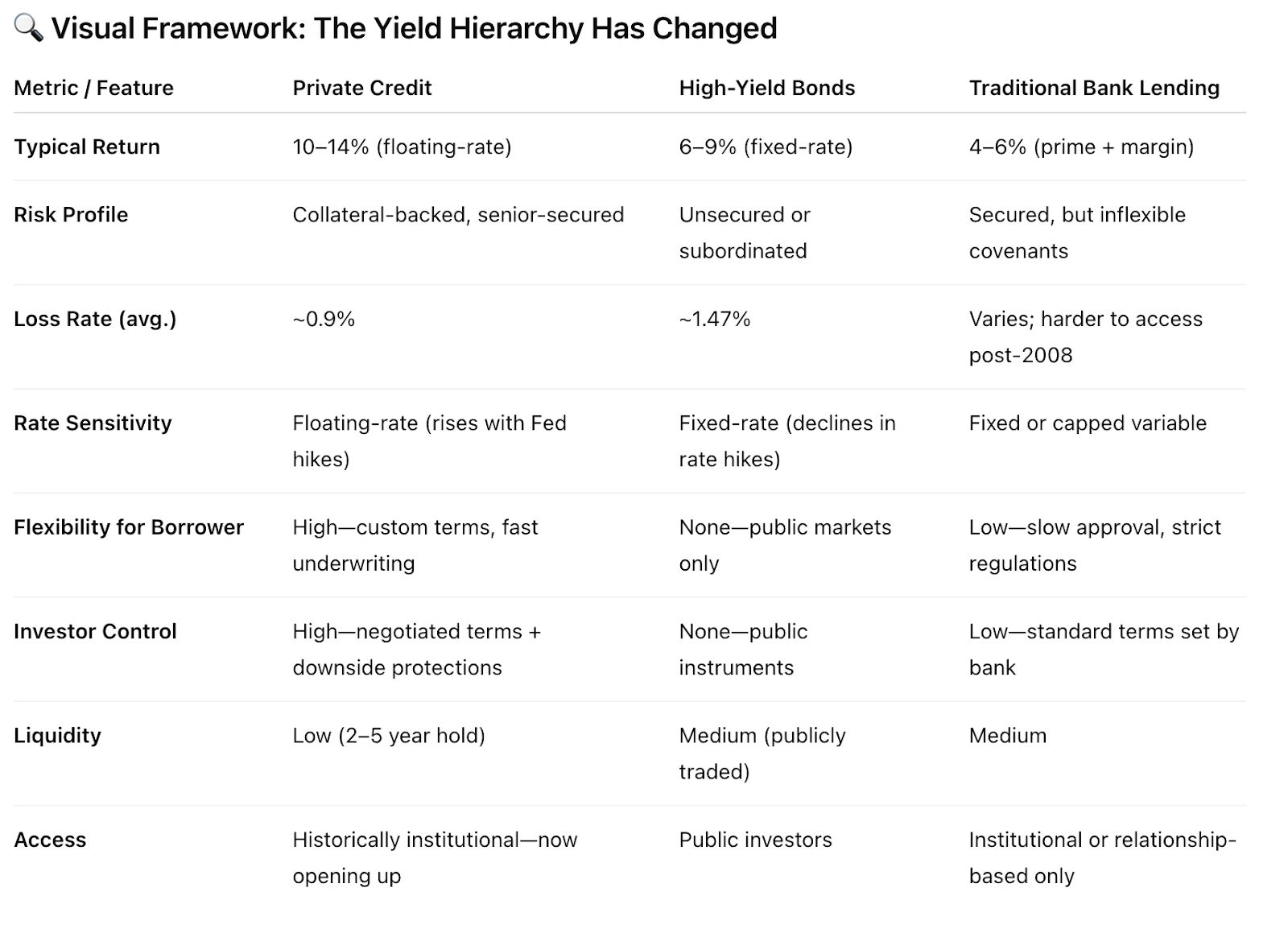

Occasionally, structural shifts in financial markets unfold quietly—only becoming widely recognized once the transformation is well underway. Private credit is a prime example.

In 2005, private credit was a niche asset class, managing approximately $200 billion. Today, it has evolved into a $2.5 trillion industry, playing a central role in corporate financing and challenging traditional capital market structures.

What catalyzed this shift?

Three structural trends converged:

Post-2008 Regulatory Tightening – Following the global financial crisis, banks scaled back lending activities due to heightened regulatory constraints and a diminished risk appetite.

The Search for Yield – In a prolonged low-interest-rate environment, investors sought alternatives capable of delivering higher returns.

Borrower Demand for Speed and Flexibility – Companies increasingly favored the streamlined execution and tailored structuring offered by private lenders over the protracted processes typical of public debt markets.

Private credit emerged to fill this gap, becoming the preferred source of capital for leveraged buyouts, growth financing, and opportunistic transactions. Private equity sponsors value its bespoke terms; portfolio companies appreciate the agility; and investors benefit from enhanced yields and a senior position in the capital stack.

But the implications go further. This asset class is not merely expanding—it is redefining deal-making across private markets. For those seeking stable, predictable income streams with reduced exposure to public market volatility, private credit presents a compelling opportunity.

However, its private nature brings opacity. Risk is increasingly migrating away from public view, emphasizing the importance of partnering with experienced managers and conducting rigorous due diligence. In today’s environment, institutional capital is flowing not where the noise is loudest, but where the returns are quiet and disciplined.

Not Only High Growth, also High Returns: The IRR Math in Private Credit

Private credit’s rapid ascent is not only a story of capital growth and structural market evolution—it is also one of consistent return outperformance. Beyond its role as a flexible financing tool, private credit has delivered robust internal rates of return (IRR) that have meaningfully exceeded those of traditional public market equivalents.

Consistent Outperformance Across Time Horizons

Over the past two decades, private credit has generated superior returns compared to public loans and high-yield bonds. Across 10-, 15-, and 20-year periods, private credit IRRs have materially outpaced Public Market Equivalent (PME) benchmarks. The data illustrates a structural return premium for investors willing to access illiquidity and complexity in exchange for more attractive economics.

Higher Returns Per Unit of Volatility

Return generation in private credit is also compelling on a risk-adjusted basis. Direct lending—the dominant strategy within private credit—delivers higher returns per unit of volatility than both leveraged loans and high-yield bonds. This enhanced Sharpe-like profile reflects the senior secured nature of most direct lending positions, strong covenants, and active sponsor engagement.

Outperformance in Rising Rate Environments

Private credit has demonstrated exceptional resilience in rising interest rate cycles—periods that typically challenge fixed-income assets. With most instruments structured on floating rates (e.g., SOFR), private credit benefits directly from higher base rates. Over seven distinct rising-rate periods between 2008 and 2023, direct lending generated average returns of 11.6%, substantially outpacing leveraged loans (5%) and high-yield bonds (6.8%).

Resilience in Stress Scenarios

Even during systemic dislocations—such as the COVID-19 pandemic—private credit demonstrated downside mitigation. From early 2020 through Q3 2023, direct lending posted lower drawdowns (-1.1%) compared to leveraged loans (-1.3%) and high-yield bonds (-2.2%). This defensive profile reinforces private credit's role as a stable income generator within institutional portfolios.

The $32.75 trillion GAP in US Private Credit

Private credit has rapidly evolved into one of the most dynamic segments of the global financial system over the past 15 years. According to McKinsey, the asset class reached nearly $2 trillion by the end of 2023—representing a tenfold increase from its size in 2009. This dramatic growth reflects a broader structural shift in capital markets, where investors and borrowers alike are increasingly seeking alternatives to traditional bank financing.

Although private credit still comprises a relatively small share of the overall fixed-income universe, its influence is growing as it proves to be a competitive and often preferable solution. Private lenders offer tailored financing packages, faster decision-making, and greater flexibility in structuring deals—features that are especially attractive in an environment marked by tightening bank regulations and more restrictive lending standards. These advantages have enabled private credit to win market share across a wide range of borrower segments, from mid-market companies to large corporates and even infrastructure and real estate projects.

McKinsey estimates that the total addressable market for private credit in the United States alone could exceed $30 trillion, spanning areas such as commercial and corporate finance, real estate, infrastructure, consumer finance, and securitized products. The chart highlights this expansive opportunity, showing that private credit—currently centered in managed private assets—has the potential to scale into vast segments traditionally dominated by banks and capital markets.

The implications of this shift are significant. For borrowers, private credit provides a vital lifeline when traditional financing is inaccessible or insufficient. For investors, it opens up a growing set of opportunities with potentially higher returns, albeit with liquidity and complexity trade-offs. As private credit continues to scale and mature, it is likely to play an increasingly central role in global capital formation. Ultimately, while the current $2 trillion market may appear modest compared to the full lending landscape, the estimated $30+ trillion in addressable market space in the U.S. underscores the vast runway for future growth. If current trends persist, private credit may evolve from a niche alternative into a cornerstone of institutional investment portfolios and corporate financing strategies alike.

Loan types in Private Credit

Due to the distinct risk characteristics of private credit, the sector encompasses a wide array of loan structures designed to address diverse financing needs across various industries. The data highlights how different loan types—such as secured, mezzanine, unitranche, and others—are distributed across key sectors including software, IT infrastructure, healthcare, and industrial machinery. Secured loans dominate in all sectors, reflecting a preference for lower-risk, collateral-backed lending. Mezzanine financing follows, offering more flexible capital solutions for companies with complex capital structures or growth-oriented strategies. The distribution patterns also underscore sector-specific dynamics, revealing how risk appetite and investment strategies vary by industry.

Secured Loans:

Representing the majority of transactions at 55.77%, secured loans are the most prevalent type across the private credit landscape. Their dominance reflects investor preference for lower-risk, asset-backed lending structures.

The industrial machinery sector shows the highest reliance on secured loans (63.46%), likely due to its capital-intensive nature and the availability of tangible collateral.

Secured lending is also prominent in healthcare (57.37%) and IT infrastructure (50.25%), suggesting a moderate risk appetite in sectors with strong asset bases.

Mezzanine Loans:

Accounting for 25.71% of total deals, mezzanine financing plays a key role in sectors seeking flexible, subordinated capital to support growth and strategic initiatives.

Software (30.5%) and healthcare (23.82%) exhibit high mezzanine activity, reflecting their need for capital that bridges debt and equity while offering higher return potential.

In contrast, IT infrastructure (18.01%) and industrial machinery (19.9%) show more limited use of mezzanine loans, suggesting a tilt toward more conservative lending structures.

Unitranche Loans:

Unitranche structures, which combine senior and subordinated debt into a single facility, make up 7.12% of overall deals. They are especially attractive to mid-market borrowers seeking simplified financing.

The software sector shows above-average use of unitranche loans (22.37%), likely due to its growth dynamics and need for flexible funding solutions.

Adoption is lower in healthcare (5.81%) and industrial machinery (7.84%), where lenders and borrowers may prefer traditional, risk-mitigated approaches.

Other Loan Types:

Comprising 11.62% of total deals, this category includes specialized or hybrid loan structures that fall outside standard classifications.

IT infrastructure stands out with the highest allocation to “other” loans (20.62%), reflecting the sector’s unique and varied capital requirements.

Other sectors show relatively low reliance on non-traditional loan types, indicating a general preference for well-established financing models.

Private Credit Fund Investment by entity

The chart below illustrates how investments in private credit funds are distributed across various investor types. This breakdown sheds light on the primary capital sources fueling private credit—a financing alternative that operates outside the traditional banking system. By examining the investor composition, we gain a clearer understanding of the asset class’s broad appeal and perceived stability among different institutions.

Private credit funds benefit from a highly diversified investor base, with significant participation from pension funds, insurance companies, and other institutional players. Interestingly, a large portion of investments is attributed to “Unknown” sources, indicating growing involvement from undisclosed or emerging investors. This trend underscores private credit’s increasing attractiveness and adaptability across a wide range of capital providers.

Unknown (35%): The largest portion of private credit investment—35%—falls under the "Unknown" category. This segment likely includes private entities, unclassified investors, or emerging capital sources that choose not to disclose their identities. The sizeable share of undisclosed investment may signal increasing interest in private credit from a wide range of institutional players who prefer to remain anonymous or are new to the asset class.

Public Pension Funds (19%): Public pension funds comprise the second-largest investor group, contributing 19% of total investments. Their participation reflects a strong appetite for private credit as a means to achieve higher returns, which can help address long-term obligations in a low-yield environment.

Other Investors (30%): This diverse category includes smaller institutions, private wealth vehicles, and potentially family offices. Making up 30% of investments, it highlights the broad appeal of private credit among a wide variety of investor types, further emphasizing the asset class’s versatility and accessibility.

Insurance Companies (12%): Insurance firms account for 12% of private credit investments. While their allocation is more modest, it underscores the asset class’s role as a reliable source of income. Regulatory constraints and liquidity needs may temper higher exposure, but their involvement points to private credit’s perceived stability.

Private Pension Funds (4%): Representing the smallest identifiable share at 4%, private pension funds appear more conservative in their allocation to private credit. This may be due to tighter regulatory requirements or a more cautious investment approach compared to their public counterparts.

Default Rates in Private Credit

The ability of private equity–backed companies to withstand economic stress is a well-recognized trend in credit markets. Leveraged loans tied to private equity sponsors—known as sponsored loans—typically exhibit lower default rates compared to non-sponsored loans. This resilience is largely attributed to the financial backing, operational expertise, and strategic oversight that private equity firms provide, helping portfolio companies navigate challenging economic conditions.

The chart above compares annual default rates for sponsored and non-sponsored leveraged loans across three major stress periods: the 2009 global financial crisis, the 2020 COVID-19 pandemic, and the high interest rates environment of 2023. The data underscores the stabilizing effect of private equity sponsorship and highlights the fundamental structural differences in risk profiles between these two types of leveraged loans.

2009 – Global Financial Crisis:

During the 2009 financial crisis, non-sponsored leveraged loans experienced a significantly higher default rate of 15.04%, compared to 7.26% for sponsored loans.

This stark contrast underscores the stabilizing influence of private equity sponsors, who often provide both financial support and strategic guidance to their portfolio companies during periods of severe market disruption.

2020 – COVID-19 Pandemic:

Default rates dropped considerably for both loan types in 2020. Sponsored loans posted a default rate of 3.58%, while non-sponsored loans came in at 10.14%.

Although the gap between the two narrowed compared to 2009, private equity-backed firms continued to show greater resilience—likely benefiting from proactive management and sponsor-driven support during the uncertainty of the pandemic.

2023 – Most Recent Data:

By 2023, default rates fell further across the board, with sponsored loans at 2.30% and non-sponsored loans at 7.84%.

This downward trend suggests improved lending practices and a stronger post-pandemic economic environment. However, the consistently lower default rate among sponsored loans reinforces the important role of private equity sponsorship in reducing credit risk and enhancing company stability through market cycles.

Sources & References

BIS. (2025). Collateralized lending in private credit. https://www.bis.org/publ/work1267.pdf

EY. (2024). Private Debt – An Expected But Uncertain “Golden Moment”? https://www.ey.com/en_lu/insights/wealth-asset-management/private-debt-an-expected-but-uncertain-golden-moment

Goldman Sachs. (2024). Understanding Private Credit. https://am.gs.com/en-int/advisors/insights/article/2024/understanding-private-credit

IMF. (2025). Global Financial Stability Report. https://www.imf.org/en/Publications/GFSR

McKinsey. (2024). The next era of private credit. https://www.mckinsey.com/industries/private-capital/our-insights/the-next-era-of-private-credit

Morgan Stanley. (2024). Understanding Private Credit. https://www.morganstanley.com/ideas/private-credit-outlook-considerations

Pimco. (2024). Private Credit: Asset-Based Finance Shines as Lending Landscape Evolves. https://www.pimco.com/us/en/insights/private-credit-asset-based-finance-shines-as-lending-landscape-evolves

Proskauer. (2025). Proskauer’s Private Credit Default Index Reveals Rate of 2.42% for Q1 2025. https://www.proskauer.com/report/proskauers-private-credit-default-index-reveals-rate-of-242-for-q1-2025

S&P Global. (2023). Default, Transition, and Recovery: U.S. Recovery Study: Loan Recoveries Persist Below Their Trend. https://www.spglobal.com/ratings/en/research/articles/231215-default-transition-and-recovery-u-s-recovery-study-loan-recoveries-persist-below-their-trend-12947167

Premium Perks

Since you are an Wealth Stack Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Visit our website.