- Wealth Stack Weekly

- Posts

- Scoring Money: The Business Math Behind the Passion

Scoring Money: The Business Math Behind the Passion

The global sports industry is expanding rapidly, valued at approximately $462.39 billion in 2023. It is projected to approach $1 trillion beyond 2033, reflecting a compound annual growth rate of about 7.48%.

Global Sports Industry Overview

Growth is fueled by rising fan engagement, larger sponsorship deals, advances in digital technologies, and increased investment in sports infrastructure.

Key Growth Drivers

Rising Consumer Participation and Viewership

Sports popularity continues to climb, supported by higher participation, deeper fan engagement, and an expanding calendar of global events.

Digital streaming has broadened access to live and on-demand content, pushing many leagues to record viewership.

Sponsorship and Media Rights Boom

Big-brand sponsorships and increasingly lucrative media-rights packages remain core revenue engines.

Broadcasting rights for the NFL, FIFA World Cup, and the Olympics command premium valuations, lifting overall industry growth.

Technology Integration and Digital Transformation

AI, AR/VR, blockchain, and advanced analytics are enhancing fan experiences, performance tracking, and team decision-making.

NFTs and digital collectibles have unlocked new monetization channels for leagues and clubs.

Expansion of Esports and Fantasy Sports

Esports—one of the fastest-growing segments—is projected to surpass $3 billion in value by 2027.

Fantasy sports platforms fuel engagement and generate revenue through subscriptions, advertising, and sponsorships.

Investments in Sports Infrastructure and Mega Events

Governments and private investors are funding new stadiums, training facilities, and smart venues to meet rising demand.

Hosting global events (FIFA World Cup, Olympics, ICC Cricket World Cup) stimulates near-term economic activity and supports long-term industry expansion.

Growing Health and Wellness Focus

Heightened awareness of fitness and healthy living is driving active participation.

The spread of wearable fitness tech and interactive sports solutions further boosts recreational engagement.

Challenges and Market Restraints:

Despite robust growth prospects, the industry faces headwinds: escalating operating costs, tightening regulatory requirements, and heightened concerns around athlete health and safety. Exogenous shocks—such as pandemics—can also disrupt schedules and attendance, putting pressure on match-day, media, and sponsorship revenues.

Future Outlook:

Propelled by advancing digital platforms, expansion into high-growth markets, and deeper commercialization, the sports sector is poised for durable, long-term growth. As immersive technologies intensify fan engagement and investment in sports properties remains strong, the global industry is on track to surpass $1 trillion in value within the next decade.

Private Equity and Sports: 2024 Resurgence

Private equity and venture capital interest in sports remains intense. In 2024, the sector saw headline-making milestones that reinforced its long-term growth trajectory—propelled by regulatory shifts, marquee transactions, and a widening set of emerging opportunities.

2024: A Year of High-Value Deals

Record transaction value: Sports services deals totaled $31.64 billion through Q3 2024, led by Silver Lake Technology Management’s $21.49 billion acquisition of Endeavor Group Holdings. This single transaction dominated PE activity, underscoring investors’ focus on large, high-value opportunities.

Fewer deals closed: Despite the headline value, only 11 PE/VC-backed transactions were recorded in 2024, continuing a decline in volume amid higher interest rates, persistent inflation, and concerns about consumer spending.

Key Highlights from 2024

Endeavor Group Holdings Inc.

The year’s signature deal: Silver Lake Technology Management LLC’s $21.49 billion acquisition of Endeavor, the largest sports services transaction of 2024 and a cornerstone PE investment.

Dorna Sports S.L.

Liberty Media Corp.’s $4.14 billion purchase of MotoGP’s commercial rights holder, underscoring accelerating investor interest in global motorsports.

Maple Leaf Sports & Entertainment Ltd.

A $3.46 billion transaction highlighting robust demand for multi-sport ownership platforms spanning hockey, basketball, and soccer.

Baltimore Orioles Inc.

A $1.73 billion deal for the MLB franchise, reaffirming the long-term appeal of premier U.S. sports assets.

Rising Focus on Women’s Sports

Investments in Seattle Reign LLC ($58 million), Portland Thorns FC ($63 million), and NCWFC LLC ($108 million) signal growing momentum, fueled by surging viewership and merchandise sales.

Shift Toward High-Value Transactions

Although deal count fell in 2024, aggregate value climbed to $31.64 billion, nearly quadrupling $8.81 billion in 2023. The pattern points to fewer, larger, and more strategically significant bets aimed at long-term value creation.

A Balanced Investment Approach

From headline acquisitions (Endeavor, Dorna) to targeted plays in high-growth niches (women’s sports), PE and VC investors are pursuing a balanced strategy—combining established franchises with emerging segments that offer attractive entry points and scalable upside.

Outlook

These marquee transactions are reshaping the competitive landscape. With 2024 as a pivotal inflection, sports is cementing its status as a prime destination for large-scale investment, laying the groundwork for sustained growth and innovation.

NFL: Opening the Door to Private Equity

In August 2024, the NFL adopted new ownership rules permitting teams to sell up to 10% of equity—spread across multiple private equity funds—subject to a minimum six-year holding period. The move is poised to unlock fresh PE capital for the most-watched sport in the U.S., widening access to a market that has historically been tightly restricted.

What’s changed

Early entrants approved: Arctos Partners LP, Ares Management Corp., Sixth Street Partners LLC, and a consortium of leading investors have already received clearance to purchase minority stakes under the new framework.

A cautious pilot: While more restrictive than the NBA, MLB, and NHL—each of which allows ownership stakes up to 30%—the NFL’s approach serves as a measured “test run” toward broader PE participation.

Implications: With team valuations continuing to rise, many expect the allowable PE stake to increase over time to meet escalating capital needs.

Women’s Sports: A Rising Investment Frontier

Private equity’s interest in women’s sports accelerated in 2024, exemplified by Carlyle’s $58 million investment in NWSL club Seattle Reign LLC. The category presents compelling upside:

Valuations are climbing on the back of surging viewership and merchandise sales, with several teams now topping $100 million in value.

Easier entry points: Properties such as the WNBA and women’s volleyball offer more accessible stakes for funds that may not fit the scale or criteria required for major NFL positions.

2024 Outlook—and Tailwinds for 2025

Growth is set to continue, supported by:

Technology Integration: Expansion of digital collectibles, streaming, and next-gen fan engagement tools.

Emerging Market Trends: Heightened focus on women’s sports and the globalization of leagues.

NFL Rule Changes: Newly opened pathways for PE participation in one of the world’s most valuable sports ecosystems.

Looking Ahead

With supportive regulation, rising asset values, and targeted strategies around scalable opportunities, PE and VC firms are positioned to play a transformative role in the sports industry’s evolution over the coming decade.

US Deep Dive: Major Sports Leagues

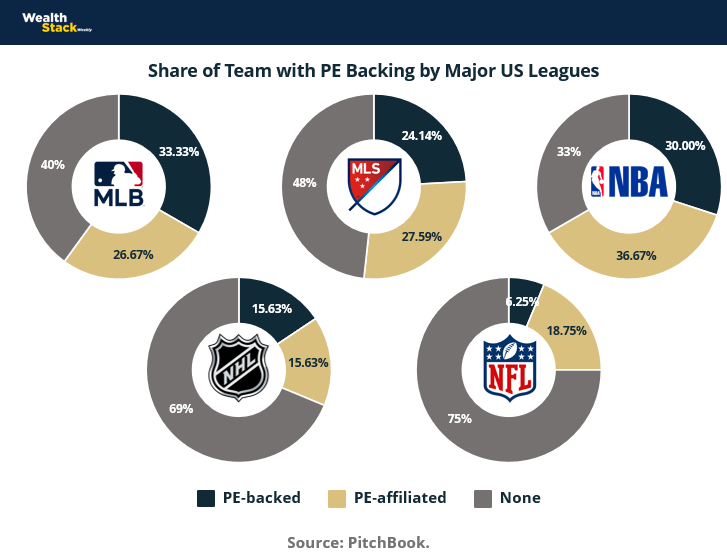

Private Equity’s Growing Footprint Across Major U.S. Leagues

Private equity sponsors are increasingly reshaping the ownership model of U.S. professional sports. Once constrained by strict league rules, institutional capital is now flowing as regulations ease and franchise valuations climb. While MLB, MLS, NBA, NHL, and the NFL each present distinct opportunities and constraints, the depth of PE participation varies widely by league.

MLB: Out in Front on PE Ownership

MLB currently has the most PE-backed clubs—10 teams—thanks to early, PE-friendly ownership rules. The league’s openness to outside capital lets franchises tap institutional resources and operational expertise.

Why MLB leads: A long season, strong regional followings, and historically steady franchise values make MLB especially attractive.

NBA: A Fast-Growing PE Opportunity

The NBA follows with 9 teams backed by PE sponsors. Over the past decade, the league’s global reach and expanding media rights have elevated its investor appeal.

Key drivers: A younger, tech-savvy audience aligns with digital innovation plays, while growth in markets such as China and Europe adds long-term revenue upside.

MLS: Rising Star Status

Major League Soccer counts 7 PE-backed teams, reflecting its rapid ascent within the U.S. sports landscape. Franchise values are climbing on the back of higher attendance, sponsorship momentum, and improving media deals.

Why attention is building: Soccer is the fastest-growing U.S. sport, buoyed by marquee international talent and partnerships with global brands.

NHL: Solid Base, Room to Run

The NHL has 5 PE-backed teams, fewer than MLB and the NBA but with meaningful headroom given a loyal fan base and strengthening media economics.

NFL: New Doors Opening

The NFL—America’s most valuable league—has only recently admitted PE capital and currently has 2 PE-backed teams. The 2024 rule change allowing up to a 10% aggregate sale to multiple PE funds marks a significant shift.

Challenges: Strict rules keep investors in minority positions with longer holding periods, limiting control-oriented strategies.

Opportunities: Enormous media rights, unmatched engagement, and rising valuations ensure sustained PE interest despite structural constraints.

The chart illustrates wide variation in private-equity penetration across major U.S. leagues. MLB leads with 40% of teams PE-backed, underscoring its openness to institutional capital. The NBA follows, with 33% of teams directly PE-backed and an additional 36.67% PE-affiliated—reflecting its global reach and premium valuations. MLS also shows meaningful participation, with 24.14% PE-backed and 27.59% PE-affiliated, signaling strong momentum. By contrast, the NFL and NHL exhibit limited involvement—6.25% and 15.63% PE-backed, respectively—though the NFL’s recent rule changes and rising franchise values could catalyze greater PE activity. Collectively, these dynamics point to substantial room for expansion, particularly in the NFL and NHL.

The US Sports Franchise Game: A High-Stakes Arena for Investors

Franchise Values: Scale of the Opportunity

The chart underscores the high-stakes nature of sports investing. The NFL leads with an average franchise value of $5.93 billion, reflecting its position as the most valuable and lucrative league globally. Unmatched media deals, a massive fan base, and recent ownership rule changes make it a premier target for future capital. The NBA follows at $4.0 billion, propelled by global appeal, superstar-driven marketing, and a powerful digital footprint. MLB averages $2.64 billion, remaining a dependable play thanks to strong regional markets and a deep historical legacy. Meanwhile, the NHL ($1.31 billion), MLS ($0.68 billion), and NWSL ($0.66 billion) offer more accessible entry points with significant upside across emerging markets, women’s sports, and younger fan demographics. Together, these value tiers create pathways for both large-scale and mid-market investors to match league profiles with their capital strategies and long-term objectives.

Private Equity in Team Ownership: From Rarity to Mainstream

PE investment in teams has evolved from a fringe concept to a shaping force across the industry, driven by surging franchise valuations, regulatory liberalization, and investors’ push for diversified portfolios.

Early Hesitation and Barriers

Historically, leagues were wary of PE’s perceived short-termism, fearing misalignment with community and long-term franchise interests. PE firms, for their part, often viewed teams as complex, lower-yield assets due to modest past valuations and intricate ownership rules.

The Turning Point

As valuations climbed through the early 21st century, high-profile sales—such as the Dallas Cowboys purchase by Jerry Jones in 1989 for $140 million—signaled expanding financial potential and prompted a reassessment of the category by institutional investors.

Regulatory Shifts Enabling Entry

A key milestone arrived in 2024, when the NFL updated its ownership framework to allow PE investors to acquire minority positions. Teams can now sell up to a 10% aggregate stake to multiple funds, each with a minimum six-year holding period—bringing the NFL closer in approach to the NBA, MLB, and NHL, which had already opened doors to PE participation to varying degrees.

Diverse Investment Strategies Across Leagues

Private equity participation varies by league, shaped by market dynamics, regulatory frameworks, and league-specific policies:

Major League Baseball (MLB): With 10 PE-backed teams, MLB leads in institutional involvement. Early, PE-friendly ownership structures paved the way for integration of outside capital.

National Basketball Association (NBA): Close behind with nine PE-backed teams, the NBA’s global reach and progressive investment posture make it a prime target for sponsors.

National Football League (NFL): Despite being the most valuable league, the NFL only recently opened to PE. The 2024 rule change represents a significant inflection point, enabling minority PE stakes under defined parameters.

Growth of Major Sports Leagues by Average Franchise Value (2007–2023)

Over the past 16 years, North America’s top leagues have seen sharp increases in average franchise valuations—highlighting both their rising investor appeal and the substantial revenue potential of professional sports.

NFL: Steady, Market-Dominant Growth

Average franchise value reached $5.1B in 2023, reflecting a 11.03% CAGR since 2007. The NFL’s leadership stems from unmatched media rights, a massive fan base, and a highly structured revenue-sharing model—together with stable ownership rules that make it the industry’s investment benchmark.

NBA: Explosive Global Upside

The NBA posted the highest long-run growth among major leagues—16.11% CAGR—with average franchise values rising from $353M (2007) to $3.85B (2023). Rapid gains are fueled by global appeal, star power, and effective monetization of digital platforms and international markets (notably China and Europe).

MLB: Durable, Long-Horizon Growth

MLB delivered an 11.09% CAGR, lifting average franchise values from $431M (2007) to $2.31B (2023). Strength comes from deep regional support, lucrative local broadcasting rights, and the league’s enduring legacy.

NHL: Expanding Footprint

The NHL recorded a 12.55% CAGR, with averages increasing from $200M (2007) to $1.33B (2023). Growth reflects rising interest in non-traditional markets, richer TV deals, and broader international exposure—especially across Canada and Europe.

NBA: The CAGR Standout (2014–2024)

Over the last decade, the NBA has been the fastest-growing major league, compounding at 21.42% (2014–2024). Average franchise values surged from $634M (2014) to $4.42B (2024), underscoring the league’s ability to capitalize on shifting market dynamics.

Key Drivers (2014–2024)

Global expansion: Aggressive growth in China and Europe unlocked new revenue streams.

Digital innovation & fan engagement: Early adoption of streaming and interactive platforms (e.g., NBA League Pass) reshaped global consumption.

Media & sponsorship uplift: Successive rights cycles and blue-chip partnerships outpaced prior decades.

Superstar-driven brands: Icons like LeBron James, Stephen Curry, and rising international stars amplified global reach and franchise brand value.

NBA Franchise Values (2024)

The Golden State Warriors top the league at $8.8B, followed by the New York Knicks ($7.5B) and Los Angeles Lakers ($7.1B). The Boston Celtics ($6.0B) and Los Angeles Clippers ($5.5B) round out the top five—each benefiting from global fan reach, iconic brands, and premium sponsorship and media deals. Even lower-ranked clubs retain significant value; for example, the Memphis Grizzlies are estimated at $3.0B, underscoring the NBA’s broad-based market strength.

US Sports Franchise Financial Returns Metric: The Ross-Arctos Sports Franchise Index (RASFI)

Michigan Ross. (2024). Ross-Arctos Sports Franchise Index (RASFI): Sports Asset Class Returns Over the Long-Term. LINK

Developed by the University of Michigan’s Ross School of Business in collaboration with Arctos Sports Partners, RASFI is a benchmark index that tracks the financial performance and market dynamics of professional sports franchises across major leagues. It offers a consolidated, data-driven view of franchise valuation trends and industry momentum for investors and operators.

The Ross–Arctos Sports Franchise Index (RASFI): Overview

Developed by the University of Michigan’s Ross School of Business in partnership with Arctos Sports Partners, RASFI is an innovative benchmark that tracks the financial performance and market momentum of professional sports franchises across major global leagues.

How RASFI Works

Data Inputs

RASFI synthesizes metrics such as franchise valuations, media-rights agreements, sponsorship revenue, ticketing, and other income streams. Coverage spans leading leagues—including the NFL, NBA, MLB, NHL, MLS—and select international competitions.

Weighting Methodology

Teams are weighted by factors like market size, historical growth, and profitability so the index reflects the broader health of the franchise ecosystem rather than any single club or league.

Index Construction

Proprietary algorithms aggregate these inputs into a single index value, updated on a regular cadence to capture evolving market conditions.

US Sports Performance vs Other Assets

US Sports vs S&P 500

The comparison highlights the resilience and upside of sports franchise investments. RASFI outperformed the S&P 500 in multiple years—most notably 2013 (32% vs. 10%) and 2021 (29% vs. 26%)—reflecting sustained growth in franchise valuations. In broader market pullbacks, performance converged, with both indices declining -4% in 2018 and -18% in 2022. For 2024 (Q1–Q3), both rebounded, with RASFI up 22% versus 17% for the S&P 500.

Key Insights

Strong Growth Potential

RASFI’s repeated outperformance in expansionary years points to rising franchise valuations powered by media rights, sponsorships, and global fan engagement.

Resilience in Volatile Markets

While it tends to mirror broader downturns, RASFI has historically rebounded quickly, underscoring the sector’s durable fundamentals.

2024 Recovery Momentum

This year’s gains reflect renewed investor confidence and the post-pandemic revival of the sports ecosystem, signaling robust growth ahead.

Compelling Diversifier

Sports franchises offer an attractive alternative asset—combining long-term appreciation with steady returns—consistent with RASFI’s multi-year performance.

US Sports Performance vs Equities

Decade Total Returns: RASFI vs. Traditional Equities

1960s–1970s: Early Outperformance

RASFI delivered 21% and 20% decade returns versus 9% for equities in both periods—reflecting the early commercialization of sports through burgeoning media rights and sponsorships.

1980s–1990s: Strong but Converging

RASFI remained robust at 17% and 18%, while public equities also posted solid gains, narrowing the gap.

2000s: A Pause in Momentum

RASFI slowed sharply to 0%, amid macro headwinds and structural shifts in the sports market; equities returned 10%.

2010s–2020s: Mature, Market-Aligned Growth

RASFI posted 13% in both decades, closely tracking equities at 14%, signaling a more mature, institutionally capitalized asset class.

Takeaways

Sports franchises have evolved from outsized winners in formative decades to resilient, long-duration assets whose returns now more closely mirror broader markets. Despite cyclical swings—especially in the 2000s—the category continues to attract capital, balancing a history of outperformance with steadier, market-aligned results in recent years.

Risk/Return Profile: RASFI vs. Other Asset Classes (Post-2000)

Since 2000, the Ross–Arctos Sports Franchise Index (RASFI) has delivered an annualized return of 11.5%, broadly in line with net-of-fee buyout funds, while exhibiting lower volatility than private credit and 10-year Treasuries. This combination positions RASFI as a high-performing asset with a notably attractive balance of risk and return relative to both traditional and alternative benchmarks.

RASFI’s lower volatility underscores the durability of premier sports franchises. Unlike many entertainment and leisure segments, these assets have been less exposed to abrupt demand shocks—even amid systemic disruptions such as the Global Financial Crisis and the COVID-19 pandemic.

European Football (Soccer) Economy

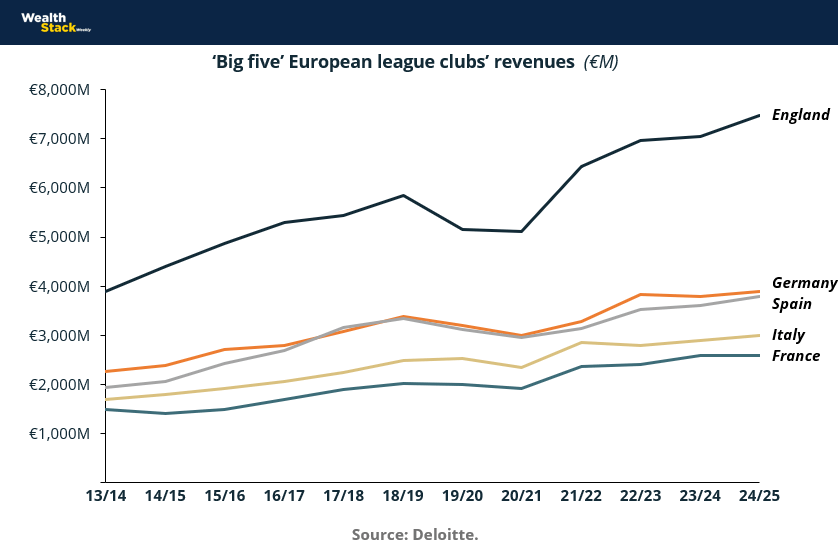

The European football market remains a highly attractive arena for private equity. Deloitte projects total market value to rise from €28.9 billion in 2018/19 to €39.1 billion by 2024/25. Growth is anchored by the Big Five leagues—the Premier League, La Liga, Bundesliga, Serie A, and Ligue 1—which are expected to generate €20.8 billion in 2024/25, accounting for nearly 69% of the market.

Key Growth Drivers

Media Rights & Sponsorships

The Big Five leagues benefit from rich broadcasting packages and blue-chip sponsorships that consistently lift revenues. The Premier League, in particular, continues to set records with domestic and international rights, extending its global reach.

Post-World Cup Momentum (2022/23)

Argentina’s 2022 World Cup triumph helped catalyze engagement heading into the 2022/23 season. Combined with full stadium reopenings and stronger matchday income, the sector staged a robust post-pandemic recovery.

Heated Transfer Market

Clubs have accelerated player spending—Premier League teams alone invested a record €2.8B in 2022/23. While aimed at on-field performance, this underscores the need for disciplined cash-flow and balance-sheet management.

Rise of Women’s Football

Viewership gains, sponsor interest, and infrastructure investment point to substantial upside. Profitability, however, will require sustained, long-term commitment from stakeholders.

Revenue Growth in Europe’s Big Five Leagues (2014–2025)

Revenues have climbed steadily across the Premier League, La Liga, Bundesliga, Serie A, and Ligue 1, propelled by expanding media rights, sponsorships, and matchday receipts. The Premier League leads overall value with a 5.58% CAGR and projected ~€8B in 2025, while La Liga is the fastest-growing at 5.79% CAGR. The Bundesliga (4.59%), Serie A (4.85%), and Ligue 1 (4.70%) also post solid gains—underscoring European football’s attractive investment profile.

La Liga leads the Big Five in growth, with indexed revenues rising 96.59% from the 2013/14 baseline to 2024/25. This performance equates to a 5.79% CAGR, the highest among its peers, confirming La Liga as the fastest-growing major European league.

While the Premier League remains the largest by absolute revenue—with 91.87% total growth—La Liga’s sharper trajectory underscores its success in international expansion and ecosystem development. The Bundesliga (71.43%), Serie A (76.47%), and Ligue 1 (73.56%) have grown more moderately, reflecting smaller global audiences and less aggressive media-rights strategies.

La Liga’s indexed surge highlights its evolution into a global powerhouse, driven by innovation, strategic partnerships, and rising worldwide visibility. For investors, it presents a compelling opportunity to participate in the rapid commercial maturation of European football.

European Big Five: Club Financials Snapshot

Premier League — €6.97B total revenue, driven by industry-leading €3.72B in broadcasting; average revenue per club: €348M.

Bundesliga — €3.83B total, with a balanced mix from sponsorship (€1.12B) and broadcasting (€1.52B).

La Liga — €3.54B total, anchored by strong sponsorship (€1.77B).

Serie A — €2.86B total revenue.

Ligue 1 — €2.38B total, bolstered by €737M in other commercial income; lowest average per club at €119M.

Takeaway: The Premier League’s commercial reach remains unrivaled, while other leagues have clear headroom to grow—particularly through enhanced sponsorships and global media-rights strategies.

The Premier League leads on operating profitability, with multiple cycles of outperformance and peaks above €1 billion (notably in 2016/17)—a function of superior broadcasting economics and commercial execution. The Bundesliga delivers steady profits, reflecting disciplined operations and cost control, while La Liga has been more variable but has rebounded following COVID-19 disruptions.

By contrast, Serie A and Ligue 1 have posted persistent operating losses, underscoring the need for tighter wage discipline and more prudent transfer spending. Across all leagues, improving cost efficiency alongside durable revenue growth is essential to strengthen profitability and remain competitive globally.

Private Equity, Venture Capital, and Debt Across Europe’s Big Five

Premier League: Leads with 9 PE-backed clubs, reflecting powerful global branding and commercial appeal to institutional investors.

Serie A & Ligue 1: Each counts 7 PE-backed teams, signaling meaningful openness to external capital.

Bundesliga: Limited PE activity with 1 PE-backed club, consistent with its conservative, member-oriented ownership norms.

Venture Capital: Still niche—2 VC-backed clubs in Serie A and 2 in La Liga.

Private Debt: Most prevalent in Serie A and Ligue 1.

“Other” ownership (Bundesliga): Dominant structures remain fan-based/traditional, underscoring ongoing resistance to external investors.

Bottom line: The investment landscape is heterogeneous. The Premier League and Ligue 1 attract institutional capital, while the Bundesliga hews to traditional models. These contrasts create distinct opportunities and risks for investors navigating Europe’s football ecosystem.

Conclusion

The sports industry is at an inflection point—and a compelling entry for private equity. With the global market on track to approach $1 trillion after 2033 and a ~7.48% CAGR, growth prospects remain durable. Across North America and Europe, leagues and franchises are unlocking new revenue streams through premium broadcasting, digital innovation, and expanding sponsorships.

Key Investment Drivers

Global Growth & TAM Expansion

Leagues are scaling internationally via streaming, cross-border fan engagement, and monetized digital content—driving both revenue growth and higher franchise valuations.NFL: A PE Catalyst

The NFL’s 2024 policy shift allows teams to sell up to 10% to multiple funds, opening the most valuable league to institutional capital. With average franchise values above $5.9B, unrivaled media contracts, and massive fan reach, the NFL offers long-duration, cash-generative exposure.NBA: The Growth Leader

Posting a 16.11% CAGR since 2007, the NBA benefits from global markets (notably China and Europe), a younger digital-first audience, and scalable media assets. Flagships such as the Golden State Warriors ($8.8B) underscore the league’s commercial strength.European Football: Diversified Upside

The Big Five provide a spectrum of opportunities. The Premier League is projected to near €8B in 2025 revenue, while La Liga’s 5.79% CAGR highlights momentum from international expansion and sponsor-led growth. As regulations evolve and financial sustainability improves, the investable universe widens.

The Path Forward

PE is well-positioned to professionalize operations, scale global monetization, and back platform assets across leagues and regions. With deepening digital engagement and increasingly supportive ownership frameworks, sports should continue to deliver resilient growth and attractive, long-term returns for institutional investors.

Sources & References

Deloitte. (2024). Annual Review of Football Finance. https://www.deloitte.com/uk/en/services/financial-advisory/research/annual-review-of-football-finance-europe.html

Meketa. (2024). Private Equity and the Evolution of Sports Assets. https://meketa.com/wp-content/uploads/2024/12/MEKETA_Private-Equity-and-the-Evolution-of-Sports-Assets.pdf

Michigan Ross. (2024). Ross-Arctos Sports Franchise Index. https://michiganross.umich.edu/faculty-research/partnerships/ross-arctos-sports-franchise-index

Michigan Ross. (2024). Ross-Arctos Sports Franchise Index (RASFI): Sports Asset Class Returns Over the Long-Term. https://michiganross.umich.edu/sites/default/files/uploads/Inst-Cntrs/RASFI/files/Arctos%20Insights%20White%20Paper%20-%20Introduction%20to%20RASFI%20Sports%20Asset%20Class%20Returns%20Over%20the%20Long%20Term%20vF_0.pdf

Pitchbook. (2024). Every PE connection to Europe’s top football clubs. https://pitchbook.com/news/articles/private-equity-european-football-dashboard

Pitchbook. (2024). Major league investors: Private equity’s pro sports ties. https://pitchbook.com/news/articles/private-equity-sports-investment-dashboard

Sportico. (2024). Sports Grow From Private Equity Afterthought to Booming Market. https://www.sportico.com/business/finance/2024/when-did-private-equity-start-investing-in-sports-teams-1234779117/

Statista. (2024). Average franchise value of NBA teams from 2001 to 2024. https://www.statista.com/statistics/193442/average-franchise-value-in-the-nba-since-2000/

Statista. (2023). Major sports leagues by average franchise value in North America from 2007 to 2023. https://www.statista.com/statistics/202758/franchise-value-of-us-sports-teams/

Statista. (2024). National Basketball Association franchise value by team in 2024. https://www.statista.com/statistics/193696/franchise-value-of-national-basketball-association-teams-in-2010/

Statista. (2022). Sports industry revenue worldwide in 2022, with a forecast for 2028. https://www.statista.com/statistics/370560/worldwide-sports-market-revenue/#:~:text=Total%20sports%20market%20revenue%20worldwide%202022%2D2028&text=The%20global%20sports%20industry%20revenue,facilitating%2C%20or%20organizing%20sports%20activities

S&P. (2024). Private equity eyes sports resurgence after NFL rule change. https://www.spglobal.com/market-intelligence/en/news-insights/articles/2024/10/private-equity-eyes-sports-resurgence-after-nfl-rule-change-83481411

The Business Research Company. (2024). Sports market 2024. https://www.thebusinessresearchcompany.com/report/sports-market#:~:text=The%20global%20sports%20market%20reached,reach%20$862%2C585.5%20million%20in%202033.

Premium Perks

Since you are an Wealth Stack Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Visit our website.