- Wealth Stack Weekly

- Posts

- The Infrastructure Gap No One Is Pricing In

The Infrastructure Gap No One Is Pricing In

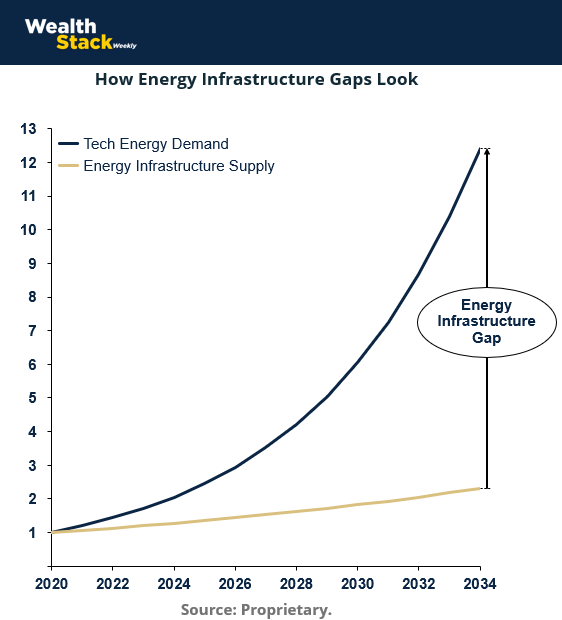

Technology is accelerating. Energy infrastructure isn’t. That’s where returns emerge.

Hi ,

I love my EV.

It’s nearly silent, fast, and low-maintenance. It’s hard to imagine going back.

My wife feels differently.

She prefers to drive her traditional car. Not because she dislikes the EV, but because she doesn’t like the uncertainty around the infrastructure. She doesn’t want to think about where the next charging station is. She doesn’t want to plan routes around range. She doesn’t want friction layered onto a routine drive.

And she’s not alone.

A lot of people love the benefits of EVs. Uncertainty around charging access (especially on longer trips) remains a real barrier. Gas stations are everywhere. Charging stations are improving, but they’re not there yet.

Demand grows fastest when infrastructure can make adoption feel dependable.

We’ve seen this pattern before.

New technologies stall when the systems supporting them lag behind. EVs are a clear example. Interest surged. Adoption followed. Then reality set in: range anxiety, charging availability, grid capacity, reliability.

Today, that same dynamic is playing out across energy more broadly.

AI workloads are doubling electricity demand every 12–18 months.

Data centers are growing faster than utility plans can adjust.

EV adoption continues to expand.

Industrial automation and cloud computing add pressure to a grid that was never designed to move at the speed of software.

The curve keeps steepening.

The grid does not.

Energy infrastructure moves slowly because it has to. Pipelines, substations, transmission corridors, storage, and regulatory approvals all operate on timelines measured in decades. Building and maintaining these systems requires physical labor, capital, and coordination that simply cannot move at the pace of software.

That gap between accelerating demand and slower system expansion is where opportunity (eh hem…financial return) emerges.

For most investors, attention naturally gravitates toward the technology.

Technology, however, depends entirely on the infrastructure beneath it.

This issue unpacks that growing gap, and shows how sophisticated LPs build durable positions when innovation races ahead of the physical systems that support it.

Here’s what you’ll find inside:

The Infrastructure Gap — the future of energy depends more on the physical systems that deliver it than the technologies built on top.

A Century-Long Case Study — how Rockefeller’s infrastructure still shapes American energy, and why renewables remain a smaller share despite trillions invested.

Three Paths for LPs — to design an energy sleeve that works in today’s real-world system.

The Energy Allocation Playbook — proven developed & producing assets, operator discipline, and the dual-sleeve structure experienced LPs use to build compounding exposure.

Whether you read every section or jump straight to the one most relevant to your goals, the aim is the same:

clarity in a moment when tech headlines are loud and infrastructure is silent.

Let’s dive in.

— Walker Deibel

WSJ & USA Today Bestselling Author of Buy Then Build

Founder, Build Wealth

P.S. If the infrastructure thesis resonates with you, take a look at BuildEnergy Fund I. It’s our PDP-driven strategy designed for tax-advantaged income and long-horizon appreciation tied to existing energy systems.

The fund closes next week (12/23): Get the details HERE.

SHIFT YOUR STACK

The Infrastructure Gap: Why Technology Is Running Ahead of the Energy System That Powers It

Every exponential wave hits suddenly and then we have to wade backwards to avoid knocking into the same obstacle over and over: infrastructure.

In the early 2000s, scaling the internet meant waiting for broadband.

In the 2010s, e-commerce ran headfirst into last-mile logistics.

Today with AI, EV adoption, and the electrification of everything, the limiting factor isn’t compute, capital, or chips. It’s power.

The next phase of the exploding tech economy won’t be shaped by innovation curves. It will be shaped by infrastructure—specifically, how quickly the physical systems underneath our digital world can scale to meet demand.

This gap between fast technology and slow infrastructure is widening, and it’s setting up one of the clearest multi-year opportunities in the private markets.

Technology’s Demand Curve: Fast and Relentless

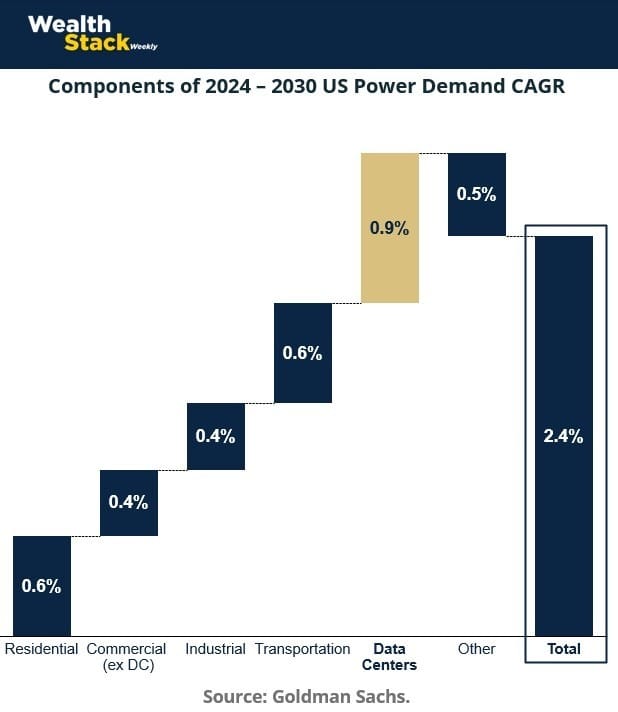

AI workloads are doubling every year and the data centers that operate it all are on track to become one of the largest sources of new U.S. power demand through 2030.

A single ChatGPT query consumes roughly 10 times the energy of a Google search, and that’s before the next wave of LLMs, industrial robotics, and AI-native applications hit scale.

Tech accelerates relentlessly.

In doing so,it puts pressure on systems that weren’t built to respond at that speed.

This is the core mismatch the market isn’t pricing in.

Infrastructure’s Supply Curve: Slow, Constrained, & Years Behind Need

Now look at the physical system expected to meet this demand:

Nearly a decade of underinvestment in oil and gas development

Decline curves that erode production daily

Renewable projects stuck in 5–10 year interconnection queues

Transmission expansion running far below electrification needs

Pipelines requiring multi-year permitting

Capital flight that shifted investment away from upstream

Skilled operators leaving the basin

Infrastructure moves at the speed of steel, labor, regulation, and geology—not software.

And the strain is already visible.

EVs are the perfect example of this gap: demand surges, infrastructure lags, frustration builds, progress stalls.

Now apply that same mismatch to the U.S. grid, industrial electrification, and AI power loads.

The Collision: When Fast Demand Meets Slow Supply

This is where the curves converge.

Demand steepens while the supply lags.

This is when bottlenecks multiply, volatility rises, and floor prices drift higher.

Assets already connected to functioning infrastructure become more valuable.

Data centers alone are projected to drive more incremental power demand than any other category.

The next five years aren’t defined by “peak oil.”

They’re defined by whether we can deliver enough electrons to power the AI economy.

Public markets respond to narratives.

Private investors focus on capacity.

Energy infrastructure operates on capacity.

That’s why the opportunity sits in the private markets long before it shows up on public tickers.

A Private Advantage Emerges: The Case for PDP

When infrastructure is slow and demand is fast, the most valuable assets aren’t future projects, they’re the ones already producing output today. That’s where PDP (Proven Developed Producing) assets take the lead. In Oil and Gas this may mean wells that already exist and produce products.

This is why family offices and sophisticated LPs focus on accumulating PDP:

The wells are already drilled

Production already flows

Midstream and transport access are already built

Cash flow begins immediately

Operator and production data are real, not modeled

Value compounds as new production becomes more expensive and slower to bring online

PDP thrives in environments where infrastructure can’t keep up. You don’t need

new pipelines, new grid capacity, or multi-year permitting cycles. Instead the value is already integrated into the physical system the world depends on today.

We’re entering a decade where technology is accelerating energy demand faster than infrastructure can scale to deliver it. And the gap is widening.

Public markets aren’t calibrated to this dynamic yet. Which spots the opportunity squarely on private.

Private investors who understand the infrastructure timeline are positioning ahead of the repricing—owning assets that generate yield today and sit directly in the path of long-term demand.

The infrastructure gap is the defining force behind the next era of energy investing.

And PDP is one of the few places where that entire story translates into monthly cash flow.

CASE STUDY

Rockefeller Built the Energy Groundwork So Progress Could Reach the Streets

Source: Wikimedia Commons, John D. Rockefeller

Whenever oil and gas comes up, many investors ask the same question:

“Wouldn’t we rather invest in renewable energy?”

It’s a fair instinct. Renewables are scaling quickly, and innovation is advancing in meaningful ways. There is space for its continued growth and for investments to scale it well. But the larger energy systems the world needs to expand the current tech progress looks very different when you zoom out.

Global investment in renewables has exceeded $4 trillion over the last decade, yet they supply only around 20% of total U.S. energy consumption.

The constraint is infrastructure, the slowest-moving part of the entire system.

Rockefeller’s Century-Long Lesson

John D. Rockefeller is known as an oil tycoon, but this undersells his vision.

He saw the need to build a network that moved energy at scale: pipelines, rail links, refineries, storage, and distribution.

His insight was simple:

The world bet on Ford. Rockefeller bet on what Ford needed.

Rockefeller had started Standard Oil in 1870 with an eye on the future benefit it would have to the expansion of the country and building faster innovation.

Expanded Standard Oil’s pipeline network to move crude more efficiently from Pennsylvania and Ohio to refineries and markets.

Built refineries, storage tanks, and distribution terminals to ensure gasoline was available where and when it was needed.

Secured railroad shipping agreements and bought tank cars to control transport reliability.

Raised capital and attracted investors to fund large-scale infrastructure projects, rather than just drilling more wells.

The result: by the 1910s, Standard Oil controlled over 90% of U.S. oil refining and transportation. Ford’s cars could reach the masses because the fuel system was already in place.

The lesson a century later: Even after historic renewable investment, the U.S. still runs on the backbone Rockefeller built.

Long-term forecasts echo the same pattern.

By 2050, oil and gas are expected to still supply roughly 50% of U.S. energy demand. Technologies including AI and EVs will see their growth demand continue to soar.

Infrastructure turns on generational timelines shaped by permitting, geology, capital cycles, and physical buildout.

Innovation can sprint, but the energy system moves at the speed of steel and concrete.

For LPs Owning the Backbone Will Prove Valuable

When you consider today’s energy mix and the forecasts for the decades ahead, LPs will generally choose among three paths.

1. Invest in the 80% that powers the economy today

These are tangible assets tied into existing networks, producing cash flow from day one.

PDP and proven infill development live here.

2. Invest in renewables with clear expectations

Renewables will play a major role in the future, yet private investors often face headwinds:

long development cycles

interconnection delays

competitive bidding that compresses margins

less dispersion in outcomes

Institutions with deep scale can operate effectively.

Most individual LPs encounter a narrower return profile.

3. Invest in the next wave of energy expansion

Advanced nuclear, geothermal, hydrogen, and SMRs offer significant potential.These opportunities generally function as long-horizon strategic positions rather than income engines.

Rockefeller understood the staying power of infrastructure, and bet on what every innovation needed.

During this long transition, LPs can construct meaningful positions in assets already tied into the backbone that powers the world today — and is projected to remain central for decades to come.

THE PLAYBOOK

How Sophisticated LPs Build an Energy Sleeve Around the Infrastructure Gap

The advantage begins by putting infrastructure ahead of narrative.

Technology is accelerating faster than the systems that power it, and the investors who position inside existing infrastructure capture yield while the world waits for the energy system to catch up.

This Playbook outlines the architecture sophisticated LPs use to turn that mismatch into income, tax efficiency, and controlled compounding.

1. Start With PDP as the Foundation

Begin with assets already tied into the working energy system.

Proven Developed Producing (PDP) forms the base layer of an energy sleeve:

monthly cash flow

predictable production behavior

stable operating costs

immediate integration into pipelines and power networks

This foundation creates stability and allows the rest of the structure to build on solid ground.

2. Layer in Development Where the Geology Is Proven

Once the PDP base is in place, add exposure to geologically proven, short-cycle infill development inside established producing fields.

In this strategy, development refers exclusively to:

infill drilling within known reservoirs

guided by real offset-well data

executed inside existing infrastructure

timelines measured in months, not years

The purpose is to convert proven geology into new PDP with precision and repeatability.

This is expansion through execution, not speculation.

3. Evaluate Opportunities Through the Three-Lens Underwriting Model

Sophisticated LPs use a consistent framework to evaluate every operator and every project:

The 3 Lenses

1. Physical Integration

The asset should already be connected to critical infrastructure.

Pipelines, grid access, easements, compression — the systems that allow production to scale without new permitting.

2. Subsurface Certainty

Ensure the field’s data supports additional infill drilling.

Historical production, decline behavior, offset-well correlations, structural continuity are all signals that reduce subsurface risk.

3. Cash Flow Profile

Here are the assets produced today and the ability for development to expand over time.

This shapes both the yield curve and the compounding arc.

When these three align, the forward range of outcomes narrows and the investment becomes structurally stronger.

4. Prioritize Operator Discipline

Execution drives results.

The most reliable outcomes come from operators who approach development as a repeatable manufacturing process.

Operator Evaluation Checklist

consistency in cost-per-foot

drilling accuracy across multiple wells

efficient lease operating expenses (day-to-day costs) management

predictable time-to-production

stable hedging philosophy

transparent reporting and field-level data

You’re allocating to skill, judgment, and repeatability.

5. The Two Complementary Structures Create a Complete Energy Sleeve

Sophisticated LPs typically build their energy exposure using two types of vehicles:

A PDP-dominant income vehicle — built for stability, predictability, and long-horizon cash flow.

A tax-efficient development vehicle — built around proven infill drilling that expands future PDP while creating meaningful tax advantages.

Together, these create a balanced sleeve with income today, expansion tomorrow, and alignment with the slow-moving timelines of energy infrastructure.

For new readers, here’s how this maps into our ecosystem at Build Wealth:

BuildEnergy II

A tax-efficient development strategy pairing PDP with disciplined infill drilling. Note that this fund is already closed and not available for new investors. We’ll have another one next year for massive tax savings on active income.

BuildEnergy I

A PDP-dominant, tax-efficient, income strategy built on existing production and long-duration stability. We are actively acquiring cash-flowing oil wells with infill drilling opportunity.

BE-I is still open, but closing next week (Tuesday the 23rd). If you’ve never evaluated an Oil & Gas fund as a potential investment, I encourage you to check out the data room HERE.

Readers who want to implement this Playbook architecture in the current cycle will be doing so through BuildEnergy I, as it is the only open vehicle aligned with this strategy.

6. Engineer Production Timelines (Not News)

Energy systems move slowly.

Development compounds steadily.

PDP yields immediately.

When aligned, these timelines form a structural advantage.

Here’s how it may look:

Day 1: PDP cash flow begins

Years 1–3: Infill development adds new PDP

Years 3–10: Scarcity lifts the value of existing production

Allocating early and holding through the cycle captures the full arc of compounding.

7. Create a Simple, Repeatable Energy Allocation Engine

A well-designed sleeve does four things:

Generates consistent monthly income

Enhances tax efficiency where possible

Scales production through proven infill development

Holds infrastructure-advantaged assets through multi-year demand growth

This becomes your energy engine. The steadiness inside a world where technology is moving faster than the systems beneath it.

Build your sleeve around the widening infrastructure gap.

Investors who structure their exposure around infrastructure-advantaged assets, proven geology, and repeatable execution position themselves to earn yield today and participate in compounding as the system evolves over years.

Owning the right infrastructure is the edge. Compounding it over time creates a durable advantage.

WEALTH REBELLION

“Civilization advances by extending the number of operations we can perform without thinking.”

— Alfred North Whitehead

The future is arriving at faster speeds. But the infrastructure underneath is slow to catch it.

Own the backbone.

WHAT WE ARE READING

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into the private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.