- Wealth Stack Weekly

- Posts

- What is a Hedge Fund?

What is a Hedge Fund?

Beyond the Gloss and Glamour of Hedge Funds.

Introduction: Beyond the Gloss and Glamour

Walk into a room of investors and mention the words "hedge fund," and you may witness an interesting cocktail of reverence, confusion, and suspicion. The irony? Even some accredited investors, the very people legally cleared to invest in these vehicles, often struggle to clearly articulate what hedge funds actually are.

Despite being one of the most ubiquitous symbols of high finance, hedge funds remain elusive, complex, and frequently misunderstood. This report endeavors to lift the veil on the modern hedge fund: its origins, strategic evolution, current structure, and the dichotomy between myth and math that defines this powerful corner of the investing universe.

Origins and Intentions - Where Hedging Actually Began

The term "hedge fund" was born out of a very specific purpose: to hedge risk. The idea was simple yet revolutionary when Alfred Winslow Jones launched the first hedge fund in 1949. He used a combination of long equity positions (buying stocks he believed would rise) and short positions (betting against stocks he believed would fall) to create a market-neutral portfolio. In plain terms, the fund's fate wasn’t married to whether the market went up or down—it was tied to how good he was at picking winners and losers.

This concept of mitigating market risk by "hedging" long positions with shorts formed the philosophical backbone of the industry. However, the reality today is more nuanced and often contradictory. Many hedge funds now create more risk than they hedge.

Modern hedge funds range across an astonishing variety of strategies: from equity-focused and event-driven to macro and relative value. Each category includes myriad sub-strategies, and the only real common thread among them is the pursuit of absolute returns, regardless of market direction. The diversity of approaches, from sector-focused equity plays to currency trades across global time zones, has broadened the hedge fund playbook far beyond its original intent.

Evolution or Mutation? From Market-Neutral to Alpha-Chasing Machines

If Jones would look at today’s hedge fund titans, he might be equally awestruck and appalled. The evolution from market-neutral, low-fee funds to highly-leveraged, high-fee alpha-chasing machines has been fueled by institutional appetite and technological advances.

The industry's value proposition moved from risk-adjusted returns to absolute returns. Hedge funds evolved into "all-weather" vehicles promising to outperform in any environment. The incentive structures helped shape this evolution: the 2-and-20 fee model (2% management fee + 20% of profits) encouraged managers to chase outsize gains. Over time, managers took bigger, bolder bets—sometimes with leverage and opaque instruments like derivatives.

Meanwhile, the quest for informational edge gave birth to quant funds, HFT (high-frequency trading), and massive data-driven operations. As the financial markets digitized, hedge funds adapted by becoming information-processing juggernauts.

What was once about hedging is now often about outperforming benchmarks, sometimes by a hair and sometimes by a mile. The strategies have diversified, but so have the outcomes.

The Billion Dollar Club and the Power Laws of Performance

A fascinating characteristic of hedge funds is their winner-takes-most nature. Average hedge fund returns may appear modest, but that’s partly because the top 1% of funds drive the narrative—and the inflows.

As of 2023, there were 524 hedge funds managing more than $1 billion each, controlling over $3.13 trillion in total AUM. This represents a 26.3% growth in total BDC AUM and a 22.3% increase in the number of $1B+ funds since 2015. These mega-managers attract the bulk of institutional capital and typically post the most impressive performance stats.

Yet, the distribution is telling: half of these funds fall within the $1B to $3B range, and only 13% manage more than $10B. This shows a heavily skewed landscape where a handful of elite firms dictate the industry's reputation. Think Citadel, DE Shaw, Renaissance Technologies.

Survivorship bias also complicates performance data. The poorly performing funds quietly close, while the stars make headlines and draw in the next round of capital.

Risk and Return - Debunking the Myths

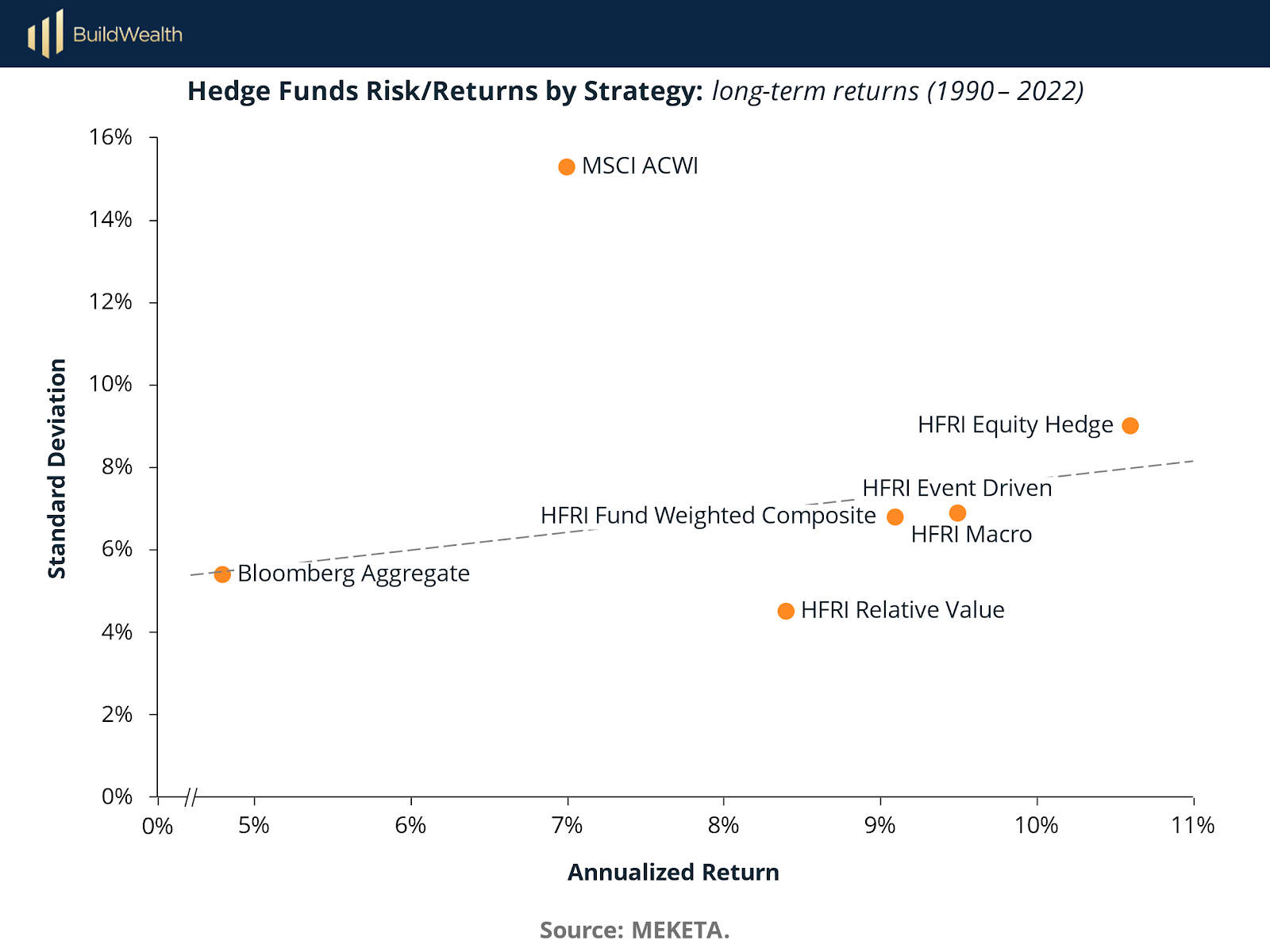

What do hedge funds actually return? The answer is, it depends. While some have beaten the S&P 500, many do not. Yet they often perform better on a risk-adjusted basis.

In a long-term context (1988–2019), hedge funds provide a compelling balance of return and volatility. They outperform fixed income instruments and approach equity-level returns, with notably lower standard deviation. This is why institutions use hedge funds as a portfolio diversifier, not just a return enhancer.

Over recent years, strategies like equity hedge and macro have shown decent performance, even in volatile markets. But not all hedge funds are created equal. The dispersion between top and bottom performers can span tens of percentage points in a single year.

In 2024, Point72 returned 19%, Third Point delivered 28.7%, and Light Street Capital scored 59.4%. These headline numbers contrast with the industry average of 10.7% and show how selective exposure matters. Funds like DE Shaw and Rokos also posted double-digit gains, driven by macro plays and tech positioning.

The Barbell of Hedge Funds - From Long/Short Purists to Quant Wizards

The modern hedge fund world is not monolithic. Think of it as a barbell. On one end, you have the traditional long/short equity shops—sector-focused managers betting on fundamental mispricings. On the other end, you have global macro gods and quant wizards running algorithmic strategies at breakneck speeds.

Global macro funds operate like geopolitical betting shops. They trade currencies, commodities, and interest rates across continents. Discovery Capital's 52% gain in 2024 came from this model.

Then there are the quant shops. These are hedge funds powered more by data scientists than portfolio managers. Firms like Two Sigma, DE Shaw, and Renaissance have made billions parsing terabytes of data to detect microscopic market inefficiencies. They're less about Wall Street bravado and more about cloud computing and code.

These structural differences are evident in the asset base. Hedge fund assets have climbed steadily since 2014, nearing $2.2 trillion in net assets. Much of this has gone to quant-driven and multi-strategy funds.

Total financial assets under hedge fund management have exceeded $3 trillion, with data as the main driver of this growth.

The Data Arms Race - Why Information is the New Alpha

Forget inside tips from cigar-filled boardrooms. The new source of edge is data.

The evolution of hedge funds from gut-based investing to data-driven decision-making mirrors the broader transformation of global finance. In the early days, funds relied on traditional data: earnings reports, analyst models, and economic releases. Today? Hedge funds tap into credit card transactions, satellite imagery, sentiment analysis, and web scraping.

The explosion of corporate equity holdings under management speaks to this shift. Hedge funds now rely on high-frequency, alternative datasets to size positions in equities and spot trends before they become consensus.

In the bond space, a similar trend applies. Treasury security exposure has surged post-2020 as funds navigate macro dislocations with greater informational precision.

The use of machine learning models, real-time portfolio dashboards, and integrated analytics platforms like Sigma or Snowflake is becoming the new standard. Hedge funds are becoming less about managing capital and more about managing information.

Institutions and Allocation - The Big Money Believers

Why do pensions, endowments, and sovereign wealth funds invest in hedge funds despite mixed headlines?

Because hedge funds offer something few other vehicles can: non-correlated returns. Institutions crave diversification. And hedge funds deliver it in ways that neither public equities nor fixed income can consistently provide.

In the first half of 2025 alone, hedge funds attracted $37.3 billion in new inflows—the highest since 2015. Most of these inflows went into large funds ($5B+ AUM), underscoring institutional confidence in elite managers. With the S&P 500 hitting record highs, investors still saw value in active, uncorrelated strategies.

This isn't an all-out vote of confidence in the entire hedge fund industry—it's a vote in favor of the best-performing shops. Institutions are doing their due diligence and concentrating their bets on proven winners.

Conclusion: So, What the F*** is a Hedge Fund?

It’s a shape-shifting, alpha-chasing, data-obsessed, high-fee investment vehicle that was supposed to hedge risk—and sometimes still does.

But mostly, a hedge fund is what its manager makes it. It can be a fortress of macroeconomic insight, a shrine to deep fundamental analysis, a sandbox of quantitative genius, or a cocktail of all three. The industry’s evolution mirrors the evolution of finance itself: more complex, more computational, and more cutthroat.

For investors, hedge funds are neither saviors nor scams. They are tools. Tools with the power to both hedge and amplify risk. In the hands of the few who wield them wisely, they can be market-beating, institution-worthy juggernauts. For others? They’re just very expensive ways to underperform.

Understanding hedge funds isn’t just about decoding returns—it’s about understanding incentives, strategy, data, and the rapidly shifting terrain of global markets. Hopefully, this report helped make sense of what the f*** a hedge fund really is.

Sources & References

Borealis Strategic Capital Partners LP. (2025). HEDGE FUND NEW LAUNCH LANDSCAPE: 2024 EDITION. Observations from the front lines. https://www.borealisstratcap.com/wp-content/uploads/2025/03/Hedge-Fund-New-Launch-Landscape-2024-Report.pdf

Dimeo Schneider & Associates LLC. (2019). GUIDE TO HEDGE FUNDS. https://www.fiducientadvisors.com/media/DiMeo-Schneider-Guide-to-Hedge-Funds.pdf

Meketa. (2022). An Overview of Hedge Funds. https://meketa.com/wp-content/uploads/2022/12/MEKETA_An-Overview-of-Hedge-Funds.pdf

New York Post. (2025). Hedge funds score double-digit returns as ‘Trump Trade’ helps cap strong year. https://nypost.com/2025/01/03/business/hedge-funds-score-double-digit-returns-as-trump-trade-helps-cap-strong-year/

Research Gate. (2024). Evolution and innovation of hedge fund strategies: A systematic Review of literature and framework for future research. file:///C:/Users/gasto/Downloads/evolution_and_innovation_of_hedge__29_40.pdf

Reuters. (2025). Hedge funds lure record inflows in first half of 2025. https://www.reuters.com/business/hedge-funds-lure-record-inflows-first-half-2025-2025-07-18/

Sigma. The Evolution of Hedge Funds in the Data Era. https://www.sigmacomputing.com/blog/the-evolution-of-hedge-funds-in-the-data-era

Premium Perks

Since you are an Wealth Stack Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Visit our website.