- Wealth Stack Weekly

- Posts

- Why 2026 Sets Up as a Constructive Year for Real Estate

Why 2026 Sets Up as a Constructive Year for Real Estate

After several years defined by volatility, affordability pressure, and uncertainty, the U.S. real estate market is entering 2026 on far more stable footing.

The conditions forming beneath the surface point not to a speculative boom, but to something arguably healthier: a broad-based normalization driven by easing financial conditions, improving affordability metrics, and more rational supply-and-demand dynamics.

Rather than dramatic price corrections or runaway appreciation, 2026 appears positioned as a year where real estate regains its role as a durable, income-producing, long-term asset. Moderating mortgage rates, wage growth that finally outpaces home prices, rising transaction volume, and regional rotation are combining into a set of reinforcing drivers that support values and activity across residential and selected commercial segments.

This environment favors patience, selectivity, and disciplined capital—conditions that historically reward long-term investors.

Cheaper Mortgage Rates: The First Catalyst

One of the most important tailwinds for real estate in 2026 is the gradual decline in borrowing costs. Mortgage rates are not returning to the ultra-low levels of the pandemic era, but they no longer need to. A move from the mid-6% range toward the low-6% range materially changes monthly affordability, buyer psychology, and transaction viability.

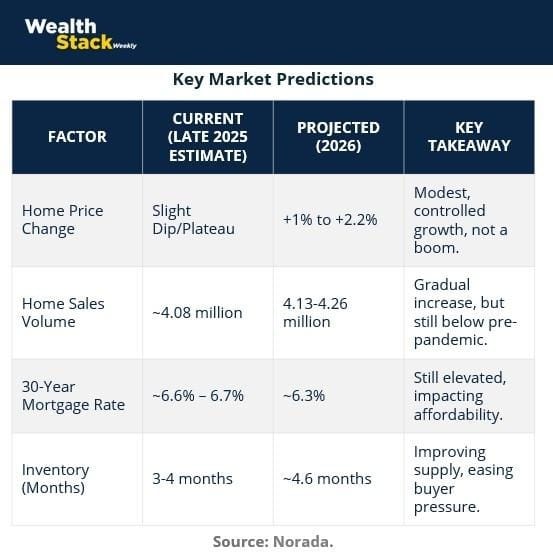

The projected average 30-year mortgage rate of approximately 6.3% represents a meaningful improvement from recent years. Even modest rate compression has an outsized effect on purchasing power, especially for first-time buyers and move-up households. As rates stabilize and volatility subsides, buyers gain confidence that waiting indefinitely is no longer rewarded, while sellers gain clarity on pricing expectations.

Importantly, this rate environment supports price stability without reigniting speculative excess. Financing is cheaper—but not free—encouraging disciplined decision-making rather than fear-driven bidding wars.

Affordability Improves as Wages Catch Up

For the first time in many years, a critical imbalance is beginning to correct: incomes are rising faster than home prices. This shift is foundational to the case for real estate in 2026.

While home prices are expected to rise modestly—roughly 1% to just over 2%—wage growth is projected to remain stronger. This differential improves affordability organically, without requiring price declines or financial stress. Monthly housing costs, while still elevated, grow at a slower pace than household income, easing pressure on buyers over time.

This dynamic does not produce instant relief, but it restores sustainability. Markets become functional again when participants can plan, save, and transact without relying on speculation or leverage expansion. Historically, periods where wage growth exceeds price growth are associated with healthier, longer-lasting real estate cycles.

Inventory Expands Without Oversupply

Another constructive shift in 2026 is the gradual improvement in housing supply. Inventory levels are expected to rise from roughly three to four months toward a more balanced level near four and a half months.

This matters because the market is not being flooded with distressed or forced sellers. Most homeowners hold substantial equity, low delinquency rates persist, and sellers can afford to wait. As a result, supply increases through normalization—not panic.

More inventory restores negotiating balance, reduces price volatility, and increases transaction velocity. Buyers gain options, sellers gain liquidity, and the market functions more efficiently. Rising sales volume—projected to exceed 4.1 million transactions—reflects this renewed equilibrium rather than speculative demand.

Regional Rotation Creates Opportunity

The national averages mask a more important trend: real estate opportunity in 2026 is increasingly regional. Markets that overheated during the pandemic are cooling, while overlooked or undervalued regions are emerging as relative winners.

Affordability, job stability, climate considerations, and proximity to employment centers are driving renewed interest in Midwestern, Great Lakes, and Northeast commuter markets. Areas surrounding major metros benefit from hybrid work patterns that still require access to offices, while offering lower housing costs and higher quality-of-life tradeoffs.

Conversely, some high-growth Sun Belt markets face headwinds from rising insurance costs, climate risk, and excess supply. This dispersion is not a sign of systemic weakness—it is a hallmark of a maturing, more rational market where capital allocates based on fundamentals rather than momentum.

For investors, this environment rewards geographic selectivity and local knowledge.

Price Stability Is a Feature, Not a Flaw

A common misconception is that strong real estate markets require rapid price appreciation. In reality, the most durable real estate cycles are built on stability.

In 2026, prices are expected to rise modestly in most markets, decline slightly in a minority, and remain flat in others. This moderation reduces downside risk, supports refinancing and renovation activity, and encourages long-term ownership. It also prevents affordability from deteriorating further, which would otherwise cap demand.

Stable pricing combined with improving financing conditions creates a favorable backdrop for both homeowners and investors. Real estate performs best when it compounds steadily rather than surging unsustainably.

Rental Demand and Income Remain Resilient

While homeownership affordability improves, renting remains a necessity for many households. Slowing apartment construction and persistent demand are expected to push rents higher at a pace roughly in line with inflation.

This environment supports cash-flow stability for rental assets without introducing political or social pressure from runaway rent inflation. Moderate rent growth combined with stabilizing cap rates enhances income predictability, a key factor for institutional and long-term private capital.

In addition, refinancing and home-equity access become more attractive as rates ease. Many owners will choose to improve existing properties rather than sell, supporting construction activity, property values, and neighborhood quality.

The Bigger Picture: A Market Reset, Not a Recession

What makes 2026 compelling is not a single variable, but the alignment of multiple second-order effects. Lower rates improve affordability. Improved affordability supports demand. Demand absorbs rising inventory without stressing prices. Stable prices reduce risk and encourage participation. Together, these forces create momentum.

This is not a return to the excesses of the early 2020s. It is a reset toward a more functional, investable real estate market—one where fundamentals matter again.

For buyers, 2026 offers more choice, more negotiating power, and clearer pricing. For owners, it provides value stability and incremental appreciation. For investors, it creates an environment where disciplined underwriting, geographic selection, and patience are rewarded.

Conclusion: Why 2026 Works for Real Estate

Real estate in 2026 is not about chasing rapid appreciation. It is about positioning capital in a market that is healing, normalizing, and re-establishing long-term viability. Lower mortgage rates, improving affordability, balanced inventory, and regional opportunity form a solid foundation for sustainable growth.

In many ways, this is precisely the type of environment in which real estate performs best—not spectacularly, but reliably. For those willing to look beyond short-term noise, 2026 stands out as a year where the signals align and real estate once again becomes a constructive place to allocate capital.

Sources & References

CBS News. (2025). Home prices are poised to dip in 22 U.S. cities next year, a new analysis says. See where. https://www.cbsnews.com/news/housing-market-forecast-2026-price-declines-real-estate-mortgage/

Redfin. (2025). Redfin’s 2026 Predictions: Welcome to The Great Housing Reset. https://www.redfin.com/news/housing-market-predictions-2026/

Norada Investments. (2025). Housing Market Predictions 2026: No Crash, No Boom, Just Rebalancing. https://www.noradarealestate.com/blog/housing-market-predictions-2026-no-crash-no-boom-just-rebalancing/

Wealth Stack. (2025). Revitalization: Real Estate’s Strategic Reset. https://wealthstack1.com/p/revitalization-real-estate-s-strategic-reset

Wealth Stack. (2025). The Sub-Institutional Gap in Real Estate Investment. https://wealthstack1.com/p/the-sub-institutional-gap-in-real-estate-investment-e63cbb03238571a4

Wealth Stack. (2025). Commercial Real Estate: Why the Cycle Looks Like 2013—and Why Multifamily Is the Opportunity of the Decade. https://wealthstack1.com/p/commercial-real-estate-why-the-cycle-looks-like-2013-and-why-multifamily-is-the-opportunity-of-the-d

Premium Perks

Since you are an Wealth Stack Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Visit our website.