- Wealth Stack Weekly

- Posts

- Forget Unicorns. Fund Operators.

Forget Unicorns. Fund Operators.

The overlooked $10T transfer is happening in the middle market—and the real builders are already there.

Hi ,

It seems like everyone either wants to catch the next Silicon Valley unicorn or they want to buy a charming shop on Main Street.

I live and breathe privately held companies. My nineteen years of buying small companies across industries, brokering 100+ deals, and negotiating several exits, showed me the power of acquisition entrepreneurship as a vehicle for wealth creation. That experience positioned me to spot a new opportunity in private equity emerging. It’s not in the Bay Area or on Main Street, it’s in the middle: the middle market.

In Main Street’s sub–$1 million EBITDA world, most operators are still becoming leaders. They’re figuring out how to stabilize teams, build cash flow, and survive volatility. The learning curve is steep, and resilience is everything.

Cross the $3–5 million EBITDA line, and the picture totally changes. Systems replace instincts. Leadership depth appears. Cash flow steadies. These are companies with structure, management, and recurring cash flow—large enough to reward discipline and still agile enough to respond to vision.

That’s the zone we’re entering today: the lower middle market, where enterprise values range from $20–$50 million.

Few investors deploy here. Scale-focused funds have moved upstream; individual searchers stay smaller. The space between them has opened into a rare window—a market where entrepreneurial capital can partner with institutional-quality operators to create durable wealth.

Over the next few years, this is where private equity investing will grow fastest.

The future belongs to investors who figure out how to underwrite people, recognize process maturity, and move capital toward execution.

Here’s what you’ll take away from this edition of Wealth Stack Weekly:

Shift Your Stack: Why the lower middle market is emerging as the next frontier for private wealth creation & how independent sponsors dominate this unique market.

Case Study: MERK Capital’s U.S. Cabinet Depot deal (and what it signals for 2026).

The Playbook: Learn how the Fund-the-Finder model turns alignment with independent sponsors into scalable, repeatable wealth creation.

Let’s dive in,

— Walker Deibel

WSJ & USA Today Bestselling Author of Buy Then Build

Founder, Build Wealth

P.S. Build Wealth has some big PE plans for 2026. Join our investor list to stay up to date on new offerings. Sign up at: buildwealth.com.

SHIFT YOUR STACK

The Lower Middle Market Is the Next Great Frontier

The lower middle market — roughly $3 to $15 million in EBITDA or $20 to $50 million in enterprise value — is silently emerging as the most investable layer of the private economy.

For LPs and co-investors, this segment offers:

Valuation resilience with room for operational lift

Diversified exposure without index correlation

Deal complexity without institutional overhead

Cash flow that scales with capability, not cost

Businesses notoriously come with more risks than real assets like buildings or oil. The attributes of the middle market allows for all the risk-mitigators that main street lacks. And it’s unexplored territory for large private equity and Wall Street.

Is it the next frontier?

Savvy investors are finding opportunities in these businesses that larger funds don’t touch. Those big funds just don’t appreciate the raw scrappy potential.

Deal values have multiplied five-fold since 2009, from $76 billion to more than $350 billion today. It doesn’t appear to be a passing cycle - it’s a structural expansion that includes what’s always been there, but unaccessible. These businesses reach the size and stability that make them underwritable.

The Underwritable Zone

Once a company crosses $3–5 million in EBITDA, three things appear:

Consistent cash flow

Professional management depth

Reliable data for due diligence

While smaller-deal data is fragmented, the pattern is clear: multiples expand quickly once you enter the $5–25 million lower-middle-market range, where businesses attract both strategic and financial buyers. The business becomes analyzable instead of anecdotal. At that point, risk shifts from story to statistics, and value creation comes from disciplined execution.

Scale Without Saturation

Deals are growing, but the middle market is still a local, relationship-driven environment. A place where founders still pick up the phone, and value still hinges on judgment. It’s the sweet spot between small-business risk and big-fund competition. And scale and cash flow meet opportunity. The inefficiency is what makes it ideal for investors who know where to look.

Enter: The Independent Sponsor.

These individuals, or small teams, source, operate, and fund acquisitions deal-by-deal with investor backing. They bridge entrepreneurial sourcing and institutional capital.

They’re the agile bridge between founder-led companies that need succession solutions and institutional investors seeking proven operators with skin in the game.

Independent sponsors find founder-led companies, structure control positions, and assemble the capital stack from a network of aligned LPs and lenders. The model’s built for the middle market: entrepreneurial but disciplined.

Recently, family offices and mid-market funds have been following their lead, joining deals they didn’t originate — a clear signal of capital migration and model validation.

All of a sudden, underwriting is more about the sponsor than the business they plan to acquire.

The Investor’s Edge

The lower middle market has become the quiet engine of private-wealth creation — large enough to institutionalize, small enough to stay human.

We compiled a comprehensive analysis of how the U.S. middle market became the engine of private deal activity — including PitchBook data, sector breakdowns, and valuation trends.

Download the report: The U.S. Private Middle Market — Momentum in Motion

→ Access the Full Report

CASE STUDY

The Deal That Reframed the Playbook

Image: USCabinetDepot.com

StoneCreek Capital × U.S. Cabinet Depot (March 2024)

StoneCreek Capital has been doing middle-market deals long before independent sponsors were trending on term sheets. They focus on what matters most—sourcing control, managing operations, and structuring capital around the deal instead of the other way around.

In March 2024, the firm acquired U.S. Cabinet Depot, a Georgia-based distributor of ready-to-assemble kitchen and bath cabinetry. It’s a straightforward business model with consistent demand from real and repeat customers. .

They saw the potential in the middle-market deal.

From Scrappy to Scalable

When a business is below $3 million EBITDA, outcomes hinge on the founder’s endurance. Above $3–5 million, performance reflects systems, cash-flow quality, and management depth.

U.S. Cabinet Depot sat squarely in that range—a company with repeatable economics and the structure in place to grow. It’s the operational inflection point where entrepreneurial effort transitions into scalable execution.

Institutions Follow The Proven Sponsor

StoneCreek sourced and led the transaction, then invited The Riverside Company and MERK Capital, led by Thomas Parro, to join as equity partners. Each brought institutional resources to a platform that was already underwritten and operationally sound.

This is because institutional investors seek exposure to sub-$50 million EV companies, but they prefer to partner with proven sponsors who have already built conviction through diligence and control.

The Model Goes Mainstream

The legal team on the deal, Holland & Knight, now maintains a dedicated Independent Sponsor practice group—proof of how quickly this model has matured.

For investors targeting the $20–$75 million enterprise-value band, access often begins with the sponsor who sourced and de-risked the opportunity. That’s where institutional validation and alpha intersect.

The lower middle market rewards proximity and precision. Sponsors who source, structure, and operate before the crowd create the kind of performance institutions are now chasing.

THE PLAYBOOK

Backing the Next Generation of Owners

The Opportunity

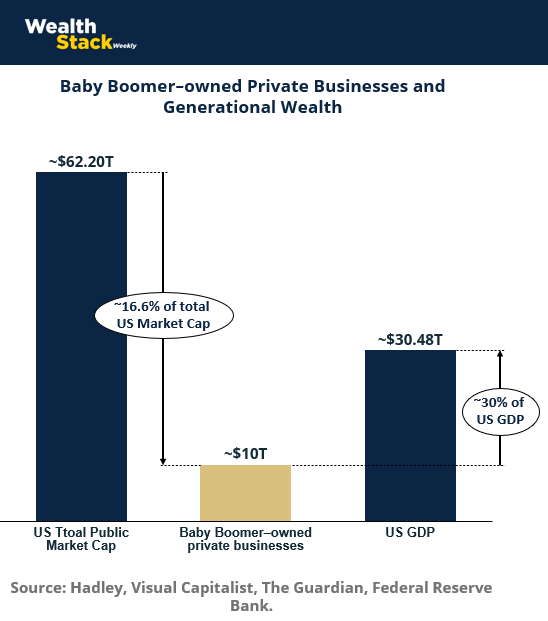

More than half of America’s small and mid-sized businesses are owned by Baby Boomers. Roughly 11,000 owners retire each day, representing over $10 trillion in business assets set to change hands.

This demographic shift is the largest private-market opportunity in decades: a generation of profitable, founder-led companies that now need succession, capital, and leadership.

For operators: this is the window to acquire and build.

For investors: it’s the chance to capture institutional-quality returns from an overlooked layer of the private economy.

The Model: Fund the Finder

Our 2026 strategy centers on independent sponsors—entrepreneurial operators who source, control, and grow companies in the $20–$50 million enterprise-value range.

They bring industry proximity, sourcing edge, and operating discipline.

We bring institutional capital, underwriting support, and structure.

Together, we create direct exposure to private-company value creation without the constraints of a blind-pool fund.

This Fund the Finder model turns alignment into alpha: the closer we are to the operator, the stronger the outcomes.

Our underwriting process follows a simple rhythm:

12 deals for diversified exposure.

30 months for operational transformation.

That’s the cycle where most value creation happens—installing systems, professionalizing teams, and executing bolt-ons.

A $5 million EBITDA company can double its earnings inside that window through disciplined management and capital efficiency.

Each deal is evaluated through three lenses:

Sponsor capability — experience, track record, and operational judgment.

Business fundamentals — recurring revenue, margin profile, and industry stability.

Structure — equity alignment, debt stack, and rollover participation.

Execution and governance, not speculation, will drive returns.

The lower middle market has become the new gateway for institutional-quality returns. Independent sponsors are at the center of it, bridging the gap between founder-led businesses and the capital that scales them.

The Takeaway

A generational ownership transfer is already in motion.

Backing capable independent sponsors gives investors access to the most active segment of private markets—real companies, recurring cash flow, and long-term value creation.

Play the long game: invest alongside the operators leading the next wave of ownership.

P.S. Build Wealth has some big plans for 2026. Join our investor list to stay up to date on new offerings. Sign up at: buildwealth.com.

THE WEALTH REBELLION

The Gap is the Opportunity

“There are decades where nothing happens; and there are weeks where decades happen.” – Vladimir Lenin

Most investors chase scale and status.

The real opportunity lives in the gap—the stretch of market between $10 million and $50 million enterprise value where inefficiency still creates advantage.

Here, founder-led companies generate reliable cash flow, operate with lean teams, and keep relationships at the center of growth. They’ve built real infrastructure yet remain outside the institutional spotlight.

Large funds capitalized upstream. Searchers acquire for themselves.

In the space between them, independent sponsors are compounding quietly—sourcing overlooked companies, installing systems, and unlocking value through proximity and execution.

This band of the market is widening with every Boomer transition and every institutional step toward scale. It’s perhaps the most investable white space in private markets today.

The investors who align early with skilled operators will control the next decade of compounding. They won’t wait for permission or headlines—they’ll move in where capital hasn’t yet.

WHAT WE ARE READING

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.