- Wealth Stack Weekly

- Posts

- Real estate is ready for a comeback.

Real estate is ready for a comeback.

The stabilization phase will reward investors who design for duration.

Hi ,

It’s the first full week of 2026, and if you’re still staring at your screen wondering how you did this job just a few weeks ago, you aren’t alone.

The slow restart to the year is normal. The markets are the same way. They are still deciding what story they’re going to tell next. There’s no consensus yet. No dominant narrative. No rush to act.

Those moments matter more than most investors realize. But as I write this, I’m ready to kick into high gear and get moving.

Every cycle has a phase where prices stop swinging, transaction volume normalizes, and fundamentals slowly regain control. It doesn’t feel exciting. It doesn’t show up in headlines. And it rarely rewards people waiting for permission to get involved.

It’s the stabilization phase.

As we head into 2026, real estate has entered that window.

Financing conditions have settled. Prices have adjusted. Income is visible again. Capital is returning — cautiously, selectively, and with far more discipline than in the prior cycle.

This is no longer a market driven by momentum or macro speculation. It’s governed by underwriting, structure, and time.

I’ve lived through enough cycles to recognize what this phase demands — and to act before consensus catches up.

That’s why in 2026, real estate will be my largest personal investment.

I’m committing $1 million of my own capital into a long-term partnership with AHM Group — a vertically integrated operator built for long-duration ownership rather than short-term exits — alongside my platform, Build Wealth. Not as a trade. Not as a rate-cut bet. But as a deliberate alignment with the operators, structures, and assets best positioned for this part of the cycle.

This issue explains why this phase of the cycle matters. Inside, you’ll find:

A clear framework for where real estate sits in the current cycle, and why 2026 looks materially different from the past few years.

An explanation of why stabilization phases tend to reward long-duration, disciplined investors, rather than those focused on timing markets.

A practical lens for how sophisticated investors position and compound through this phase, focusing on access, judgment, allocation, and time.

Plus, our weekly report provides the supporting data and context behind why real estate is becoming investable again—without relying on bold forecasts or rate-cut speculation. So get ready, because this phase isn’t going to last long.

Let’s dive in.

— Walker Deibel

WSJ & USA Today Bestselling Author of Buy Then Build

Founder, Build Wealth

SHIFT YOUR STACK

Real Estate in 2026 Deserves Your Attention

Right now, real estate sits in the uncomfortable middle: after the reset, before the rush. Prices have adjusted. Capital has pulled back. Assumptions are being tested again. What’s missing is consensus — and that absence is precisely what creates the opportunity.

Most investors are waiting for cleaner signals.

They want clearer rate direction. Louder headlines. A sense that the coast is clear. But by the time those signals arrive, the work has already been done by investors willing to move earlier — when conditions were stable but sentiment was unresolved.

This phase doesn’t reward speed. It rewards judgment.

Rates Have Stopped Being the Story

Mortgage rates peaked in 2025 and have since stabilized. They haven’t collapsed by any means. And they don’t need to.

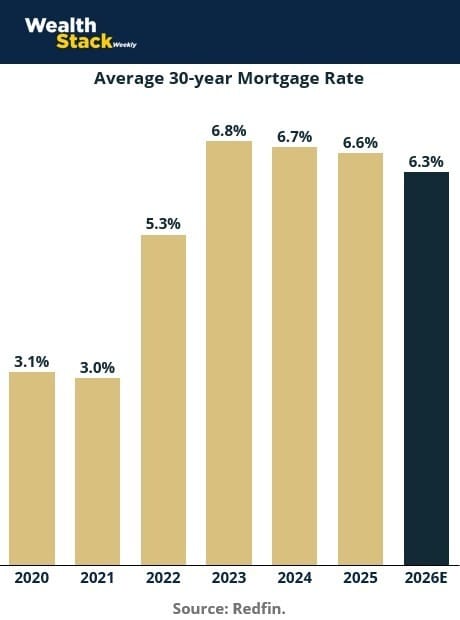

What matters is that volatility has declined. Financing costs are now knowable. Underwriting can be done with confidence rather than guesswork. Mortgage rates peaked in 2025 at an average of 6.6%. But with fed rate cuts and inflation easing, 2026 should see rates come down slightly.

Waiting for dramatically lower rates misses the signal the chart is actually sending:

the market has adapted.

Real estate doesn’t require falling rates to function. It requires stable ones.

Pricing Has Already Adjusted

Prices have reset across much of the market. Cap rates moved. Sellers adjusted expectations. Buyers stepped back — then slowly returned.

This is what post-reset pricing looks like. Not cheap or euphoric. But grounded.

Investors waiting for a second leg down are looking for confirmation that may never arrive — because the data already reflects the correction.

By the time prices feel “obviously attractive,” competition has usually returned with them.

The Return Profile is Shifting Towards Income

One of the most important shifts in the data is the return of income as the primary driver of returns.

During the last cycle, appreciation did most of the work. Income was almost incidental.

In 2026, that’s reversed.

If the prior real estate cycle was driven by appreciation.

Then this next one is driven by income.

Across residential and commercial real estate, expected returns in 2026 skew toward in-place income with optional appreciation happening slowly, over time. That shift reflects a healthier market structure.

When income leads:

Underwriting tightens

Leverage becomes disciplined

Time works in the investor’s favor

This is not a weaker return profile. It’s a more durable one.

Income-led markets reward investors who plan to hold — not those waiting for the perfect entry headline.

The Spread Between Markets Is Widening

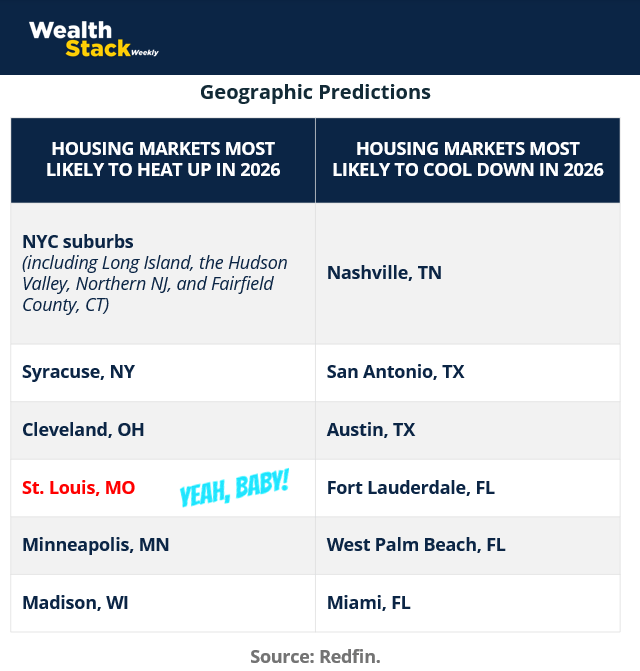

One of the clearest signals in the data is dispersion. There is no single “real estate market” in 2026.

Some regions are compounding quietly, supported by affordability, stable demand, and replacement-cost dynamics. Others are still digesting excess supply or capital that arrived too quickly.

Returns depend on geography, asset quality, pricing, and operator skill over trends.

For example, some regions are benefitting from long-term affordability, demographic stability, and replacement-cost dynamics. Others are digesting excess supply or capital that arrived too quickly.

We’ll see some areas cool off in 2026 and others heat up. (Hello to our own St. Louis! Home of the Build Wealth team!)

Investors waiting for a universal green light won’t find one — because outcomes now depend on selection, not exposure.

Stabilization Is Where Long-Duration Wealth Is Built

A stabilization phase is where the best long-duration positions are built.

What you don’t see in the charts is just as important as what you do see.

So, what’s not there:

A dramatic inflection point

A unanimous “buy” signal

A moment where risk suddenly disappears

That moment never comes before the opportunity.

You don’t need perfect signals to act.

You need to recognize when the market has stopped punishing patience — and started rewarding discipline.

The data shows stabilization, not certainty. And stabilization is when long-duration investors reallocate — not when they wait.

The goal is to move during this stabilization phase. Even if it’s not obvious in real time.

Want to see the bigger data picture?

We break down the rates, income dynamics, inventory trends, and regional dispersion shaping real estate in 2026 — and why they point to a more investable, long-duration environment.

Read our full report: Why 2026 Sets Up as a Constructive Year for Real Estate

CASE STUDY

A Concentrated Strategy Taking Shape in St. Louis

St. Louis’ Central West End: The City’s Largest Populated Neighborhood (Photo: Eric Bowers)

Speaking of St. Louis real estate heating up…our team just closed on 11 properties in the Central West End in St. Louis, MO. This officially makes us the largest owner of commercial real estate in the neighborhood. Those assets now sit inside the BuildLegacy Fund I, alongside a growing pipeline of proprietary opportunities—including a co-GP position in the last remaining one-acre, ground-up development site in the neighborhood’s core.

Yes, it feels a little like playing Monopoly in real life. But the strategy is very intentional.

The goal is simple: capital sits in the exact same structures, with the same operators, and in the same assets we believe are best positioned for this phase of the cycle.

This is all in partnership with AHM Group. In case AHM is new to you, here’s what you need to know: AHM is the multi-disciplinary commercial real estate development team we trust with these deals.

AHM operates differently than most real estate groups. They don’t just invest in neighborhoods—they become the dominant owners within them. That concentration creates an information edge and real influence over outcomes. They’re vertically integrated across development, construction, and operations, and they reinvest value back into the assets rather than stripping it out through layers of fees.

That operating model matters most during stabilization phases—when capital is selective, execution matters, and scale creates advantage.

By concentrating ownership at the district level, controlling execution, and reinvesting locally, we’re building a long-duration portfolio designed to compound over a 10-year hold. For investors who join us, the objective is straightforward: build a diversified real estate portfolio the way institutions do—patiently, deliberately, and with real control.

If you’re curious about the structure and how this strategy works, and how investors are participating, take a look at the data room and learn more here.

THE PLAYBOOK

Get Ready to Compound Through a Stabilization Phase

Stabilization periods reward design.

When markets stop moving on momentum and start responding to fundamentals, investors are forced to rely on process, judgment, and structure. This is where durable real estate portfolios are built.

Here’s how to align to that environment.

Step 1: Access Over Speed

In stabilized markets, access beats alpha.

Public listings reflect consensus pricing. The better opportunities surface earlier, through operators, lenders, and local partners who understand capital constraints and timing long before a deal becomes competitive.

Sophisticated investors invest in proximity. They build relationships before they need them and maintain visibility even when they’re not actively deploying.

Your move: Stop competing on price and start competing with relationships.

Step 2: Use Underwriting as an Advantage

Stabilization compresses error tolerance.

When appreciation slows and exits normalize, deals are carried by in-place performance and downside resilience. Assumptions matter. Scenarios matter. Structure matters.

Judgment shows up in how projections are pressured, how leverage is constrained, and how quickly marginal deals are declined. Conservative underwriting becomes a source of optionality rather than a limitation.

Your move: Spend less time defending upside and more time understanding & testing risk.

Step 3: It’s Not About Any One Deal

Strong deals don’t compensate for weak portfolio design.

Allocation determines whether outcomes compound or cancel each other out. Diversification across asset type, market, sponsor, and time horizon creates resilience that individual deals can’t.

This is where a pizza-by-the-slice approach outperforms concentrated bets: smaller, intentional positions stacked across cycles and risk layers.

Your move: Don’t waste time trying to ‘win’ every deal, start designing a system that wins in the long run.

Step 4: Time is an Asset

Stabilization favors investors who design for longer holds.

Returns accrue through income, operational improvements, and gradual normalization. Liquidity arrives unevenly.

When investors plan for duration can refinance instead of sell, hold through volatility, and allow compounding to unfold without pressure.

Your move: Use time strategically. Structure deals to hold, don’t plan to rush or exit quickly.

Step 5: Pay Attention to After-Tax Outcomes

Depreciation, entity design, distribution timing, and reinvestment planning determine what investors actually keep. Many otherwise solid investments underperform after taxes due to misalignment at the structure level.

Your move: Evaluate after-tax outcomes before committing capital.

Step 6: Recycle the Capital

Compounding slows when capital sits idle.

Investors who plan their next allocation before the liquidity arrives maintain momentum and reduce downtime.

Be aware that stabilization tests temperament. It’s hard to stay focused and patient especially when the headlines are rotating. Temptation to react can creep in.

But investors who compound through cycles operate from principle. They define constraints, document decision rules, and let process govern action.

Stabilization phases reward those who invest with discipline, design portfolios for duration, and allow time to do its work. Long-term real estate wealth is built without waiting for consensus to catch up.

WEALTH STACK REBELLION

“Most fortunes are built during periods that feel uneventful.”

Real estate booms turn everyone’s heads.

But stabilization is where you should be looking.

Anyone can invest during a boom when prices are rising.

Few savvy investors know how to be patient, act even if progress appears like it’s slow, and build through that stabilization.

This cycle rewards investors with a different approach: those who operate with discipline, design for duration, and act without waiting for consensus.

That mindset shift is your edge.

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.