- Wealth Stack Weekly

- Posts

- The next big panic headline is coming. Here’s how to be ready.

The next big panic headline is coming. Here’s how to be ready.

Why coordination (not fundamentals) drives the wildest price swings.

Hi ,

One of the stranger things about building real wealth is you can be right about a business and still feel completely wrong watching your net worth move.

I’ve felt that tension more times than I can count.

Personally, I approach public markets with a long investment horizon. I don’t trade on headlines. This approach is the only way I’ve found to make sense of volatility over time.

You do the work. You understand the risks. You know what you own and why you own it.

And then a headline hits.

Not something that actually changes the business, just something that changes how everyone else reacts. Suddenly the ticker tells a very different story.

Nothing important broke. But prices moved anyway. Hard.

Most investors sell out of fear. I’ve done that myself.

That experience isn’t necessarily a failure of your discipline. It’s a feature of how modern markets work.

Once new information becomes common knowledge, investors stop reacting to fundamentals and start just reacting to each other. Price becomes a reflection of what’s known in game theory as coordination.

Actual footage of coordination in action

Coordination is essentially vibes: for investors, it’s when market sentiment matters more than reality. In public markets, it’s investors' reaction to a trend long before that trend becomes a reflection of value.

That dynamic matters if you’re trying to compound wealth over years, not trade narratives over days.

Here’s what you’ll take away from today’s issue:

The recent market panic event that helps us understand why headlines move prices faster than fundamentals.

What an MIT lab learned about investor “freak outs” and why experience isn’t always protective.

A practical decision framework for staying invested through noise while identifying moments when panic-driven coordination creates real opportunity.

Plus, our weekly report is all about When Headlines Outrun Fundamentals.

Make sense of that gap between what prices are doing and what the business is truly worth. And build the discipline to navigate it with intention.

Let’s dive in.

— Walker Deibel

WSJ & USA Today Bestselling Author of Buy Then Build

Founder, Build Wealth

SHIFT YOUR STACK

When Headlines Outrun Fundamentals

Image Caption: A headline from Reuters that appeared in January 2025, covering DeepSeek and its impact on the AI landscape.

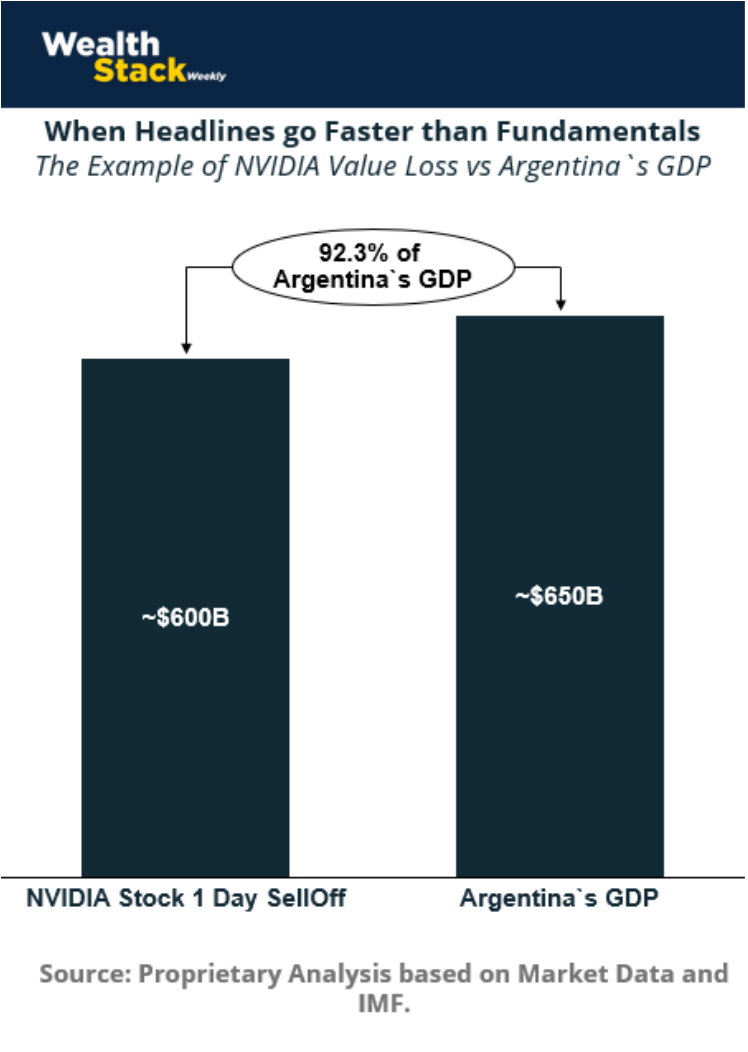

In late January 2025, headlines around DeepSeek — a Chinese AI startup claiming a cheaper, more efficient model — triggered one of the largest single-day repricings in market history. Nvidia fell roughly 17% in one session, erasing nearly $600 billion in market value.

That number grabs attention for good reason. It’s a mind boggling figure. Put into perspective, the value lost that day roughly equaled Argentina’s entire GDP.

Of course in this case, the market panic was short-lived. Within a few days, prices rebounded as investors realized the business itself hadn’t suddenly broken.

So what happened?

Most investors assume sharp price moves reflect new information about fundamentals. In practice, many of the largest moves, including the DeepSeek-Nvidia event, come from investor coordination.

This is how net worth gets hit without the business changing.

In the case of the DeepSeek news, competitive pressure, model commoditization, and margin risk were already part of Nvidia’s long-term distribution. Anyone underwriting the business seriously understood those scenarios existed. The headline did not introduce a new category of risk.

What changed was speed.

Liquid markets compressed years of uncertainty into hours. Once the signal hit, investors knew others would see it, react to it, and adjust exposure. Coordination accelerated ahead of verification. Time collapsed.

In public markets, shared information creates network effects. The more people react, the more rational it becomes for others to follow.

Valuation is “determined” before fundamentals have a chance to speak.

Why Discipline Alone Doesn’t Prevent Whiplash

In The Alchemy of Finance, George Soros identifies why coordination is more than a mere nuisance: Financial markets do not merely reflect underlying fundamentals; they also shape them.

This dynamic affects everyone. Even investors with long time horizons are marked to market every day. Liquidity means prices update continuously, regardless of whether cash flows have changed. This reflexivity, as Soros calls it, explains why it’s not enough to simply ignore coordination.

When headlines hit:

Algorithms respond instantly

Risk managers cut exposure

ETFs rebalance mechanically

Momentum compounds itself

At a certain point, preserving flexibility becomes highly rational, even when conviction remains intact. The decision isn’t driven by disbelief in the business. It’s driven by awareness of how others may act.

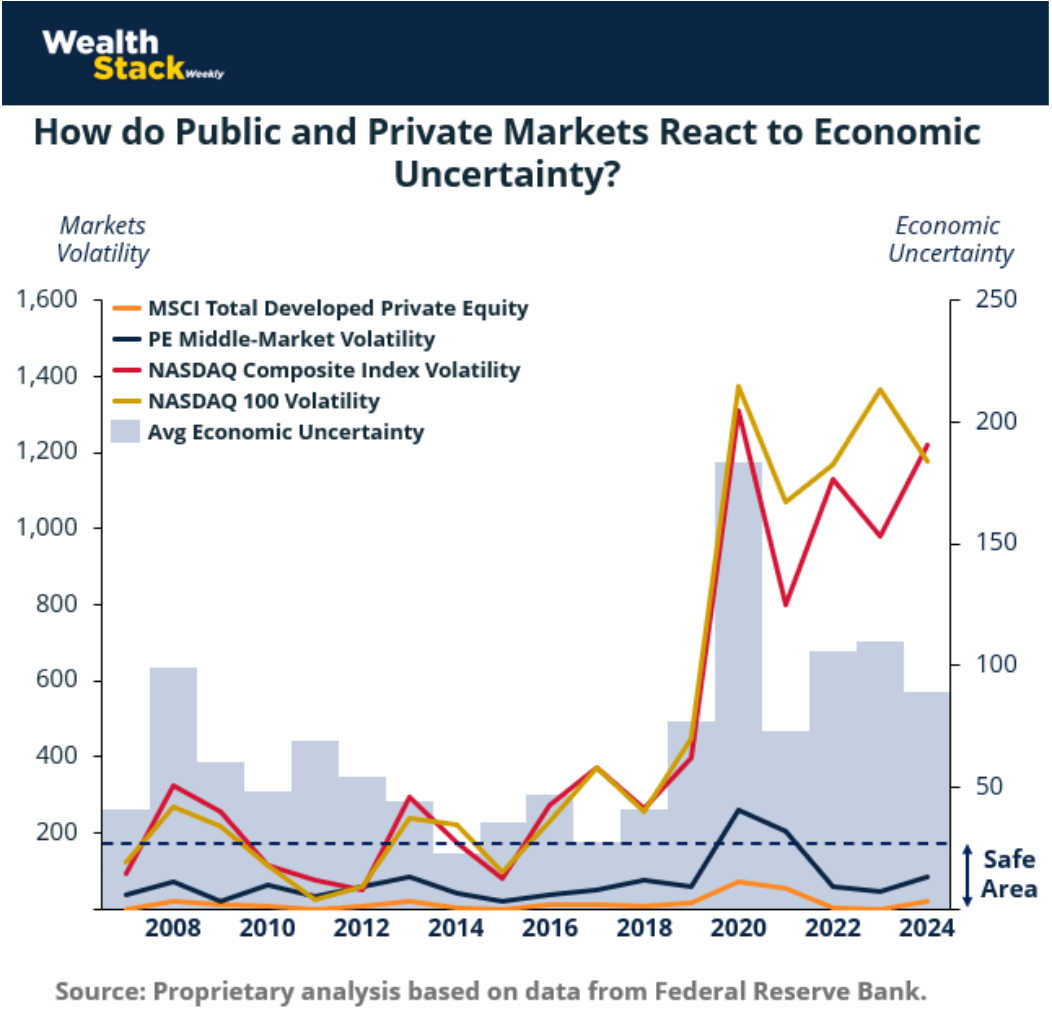

This risk is ubiquitous in public markets, we call it coordination risk.

If prices adjust based on expectations about expectations, the gap between belief and reality is where value moves fastest.

Sometimes it overshoots. Sometimes it undershoots.

Either way, the move happens before fundamentals can assert themselves.

Liquid markets are designed to prioritize speed, and this behavior is a direct result of that design. It’s speed which amplifies coordination.

The Wealth Stack Shift

No one needs to predict the headlines themselves, you need to look at the environment around them.

Liquid markets expose investors to coordination risk dynamics that have little to do with long-term value creation. Knowing that changes how you interpret volatility and learn to react.

That perspective is foundational to stacking capital intentionally.

Want the Full Story?

If you want to see the formal structure behind this, including the coordination dynamics, the underlying game-theory logic, and multiple real-world case studies beyond DeepSeek and Nvidia, our team published this week’s research report walking through it in depth.

It’s the institutional version of the idea you just read. Check it out HERE.

CASE STUDY

Image source: Wikimedia Commons, “MIT Sloan School of Management (MIT Building E62). Home of MIT’s Lab for Financial Engineering.

What Happens When Headlines Trigger Freak Outs — and Why It Matters

Headlines don’t need to change fundamentals to move markets. They only need to change how investors believe other investors will react.

To understand what happens at the extreme end of this process, researchers at MIT’s Laboratory for Financial Engineering studied more than 650,000 individual brokerage accounts to identify moments when investors didn’t just react — they freaked out.

In their framework, a “freak out” meant liquidating roughly 90% of equity exposure within a single month, with at least half of that decline driven by active selling rather than market movement creating a quick and emotional exit.

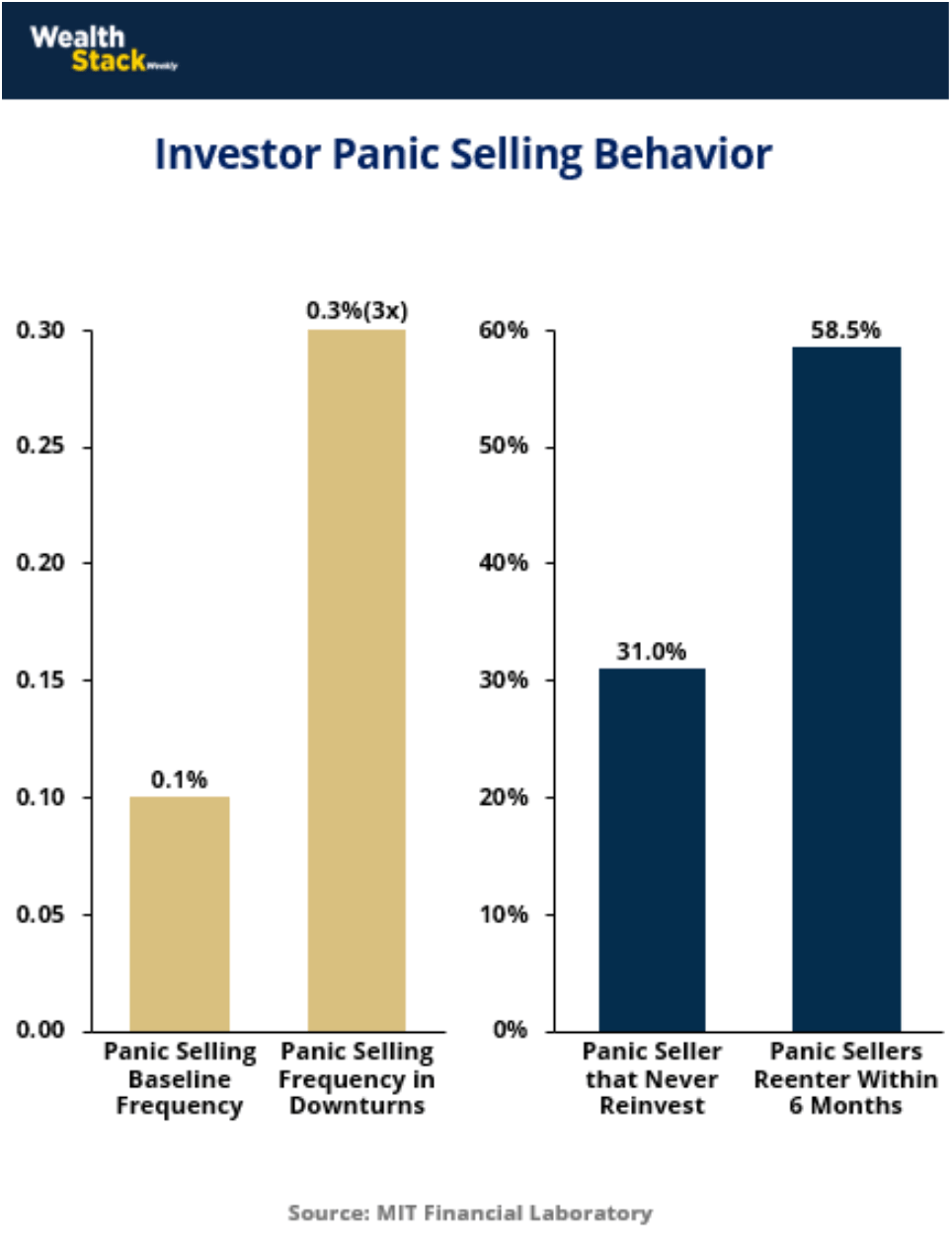

Freak outs were rare. Figure about 0.1% of investors in a normal month but they clustered sharply around periods of market stress. Even then, most investors stayed put. But those who panicked tended to do so completely.

What’s more revealing is who those investors were.

Freak outs were significantly more common among men, married investors, and those supporting dependents, particularly investors over age 45. In other words, those who reacted to the sudden urge to protect.

Perhaps most counterintuitively, freak outs were more common among investors who described themselves as experienced or knowledgeable. Access to information didn’t reduce panic, in fact it only accelerated it.

Why?

Because experience increases awareness of coordination risk.

We’ve already shown how in liquid markets, selling isn’t always a statement about disbelief in a business but often a response to how fast others may react. When volatility spikes, investors aren’t going to ask, “Is this company still good?” They’re going to ask, “How quickly will everyone else move?”

To be the leader of the coordination feels rational.

However, the study showed the outcomes were costly.

Roughly one-third of investors who freaked out never returned to risky assets at all. Among those who did reenter, many did so after prices had already rebounded. Outside of sustained crisis periods, panic selling consistently locked in losses and missed recovery. The damage affected future behavior and thought too. Once an investor exits under stress, their reentry becomes psychologically harder.

At first glance, this seems contradictory. The investors most likely to freak out were often experienced, informed, and highly aware of market dynamics. In many cases, they correctly understood coordination risk and they knew that once a headline hit, others would react, liquidity would amplify the move, and prices could overshoot before fundamentals had time to respond.

But the real problem wasn’t awareness of coordination risk, it was their exposure to it.

Coordination risk doesn’t hurt investors who understand it in theory. It hurts investors who are forced to respond to it in real time, without structural buffers. When portfolios are fully liquid, fully marked to market, and psychologically tied to short-term price moves, understanding coordination risk doesn’t calm behavior — it compresses decision windows.

In that context, panic isn’t ignorance. It’s a rational response to speed.

THE PLAYBOOK

A Playbook for Headlines Without Panic Selling

When markets move, especially wildly, investors confuse the volatility with something important happening. Sometimes it’s important but often it’s not. Staying grounded when the headlines accelerate action is key to long-term thinking.

1. Separate headlines from the business

When a headline hits, pause and ask three questions:

Does this affect revenue, margins, or cost structure right now?

Does this force a durable revision to long-term assumptions (growth)?

Is there a credible, funded path from headline to a real world outcome?

If none of these questions is affirmative, the headline fails this test. It’s likely a coordination event.

Pause and observe without immediate decisions.

2. Match capital to time horizons

Portfolios need to be aligned with time.

0–2 years: Yield and cash flow that cushion volatility

2–5 years: Assets with downside protection and controlled growth

5–10 years: Equity optionality with time to compound

Time horizons filter signal from noise.

Ensure your exposure to coordination risk is weighted towards long time horizons.

3. Reframe volatility as an opportunity

Volatility attracts attention, but attention alone doesn’t dictate value.

When a thesis remains intact and prices adjust materially, the gap deserves examination, not avoidance.

That difference creates opportunity for investors who stay anchored to assumptions instead of headlines. Use volatility to identify where markets moved faster than reality. Those gaps, when paired with intact fundamentals, can create asymmetric opportunities.

Dislocation often marks a favorable entry point when the underlying drivers of value remain unchanged.

Put simply, look for opportunities to buy low.

4. Use illiquidity to lower coordination risk

One way to avoid panic selling is structure.

Illiquid investments slow slow decision-making by design. That delay allows underwriting, operating performance, and cash flow to matter more than narrative momentum.

They may not eliminate volatility but shift when and how it matters, favoring investors who can commit capital through uncertainty rather than trade around it.

Use illiquidity as a counterweight to volatility.

WEALTH STACK REBELLION

“Markets can remain irrational longer than you can remain solvent.”

— John Maynard Keynes

In liquid markets, the greatest threat to compounding.

is being forced to respond before fundamentals have time to matter.

That’s what coordination risk really is.

When headlines synchronize behavior, prices don’t wait for evidence. They move on belief. Volatility stops being a verdict on value and becomes a timing condition. A reflection of how quickly investors are reacting to each other.

Most investors misread that moment.

They ask: What changed?

The better question is: What moved so fast?

The rebellion is recognizing that some price moves are informational — and others are structural side effects of liquidity, leverage, and coordination. When those forces dominate, selling isn’t a sign of discipline. It’s often a concession to speed.

Real wealth is built by investors who design their capital to survive those moments.

They separate time horizons so short-term coordination doesn’t force long-term decisions.

They interpret volatility as context, not truth.

And understand that patience isn’t passive, it’s structural.

The rebellion is subtle, but decisive.

You stop reacting to headlines as judgments on value and start treating them as signals about behavior.

And once you see that distinction, volatility stops feeling personal and starts becoming useful.

That’s the edge.

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into the private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.