- Wealth Stack Weekly

- Posts

- When Headlines Outrun Fundamentals

When Headlines Outrun Fundamentals

The Hyper liquidity Risk of Public Markets

Pooling Equilibrium, Bad Signals, and How Value Gets Destroyed

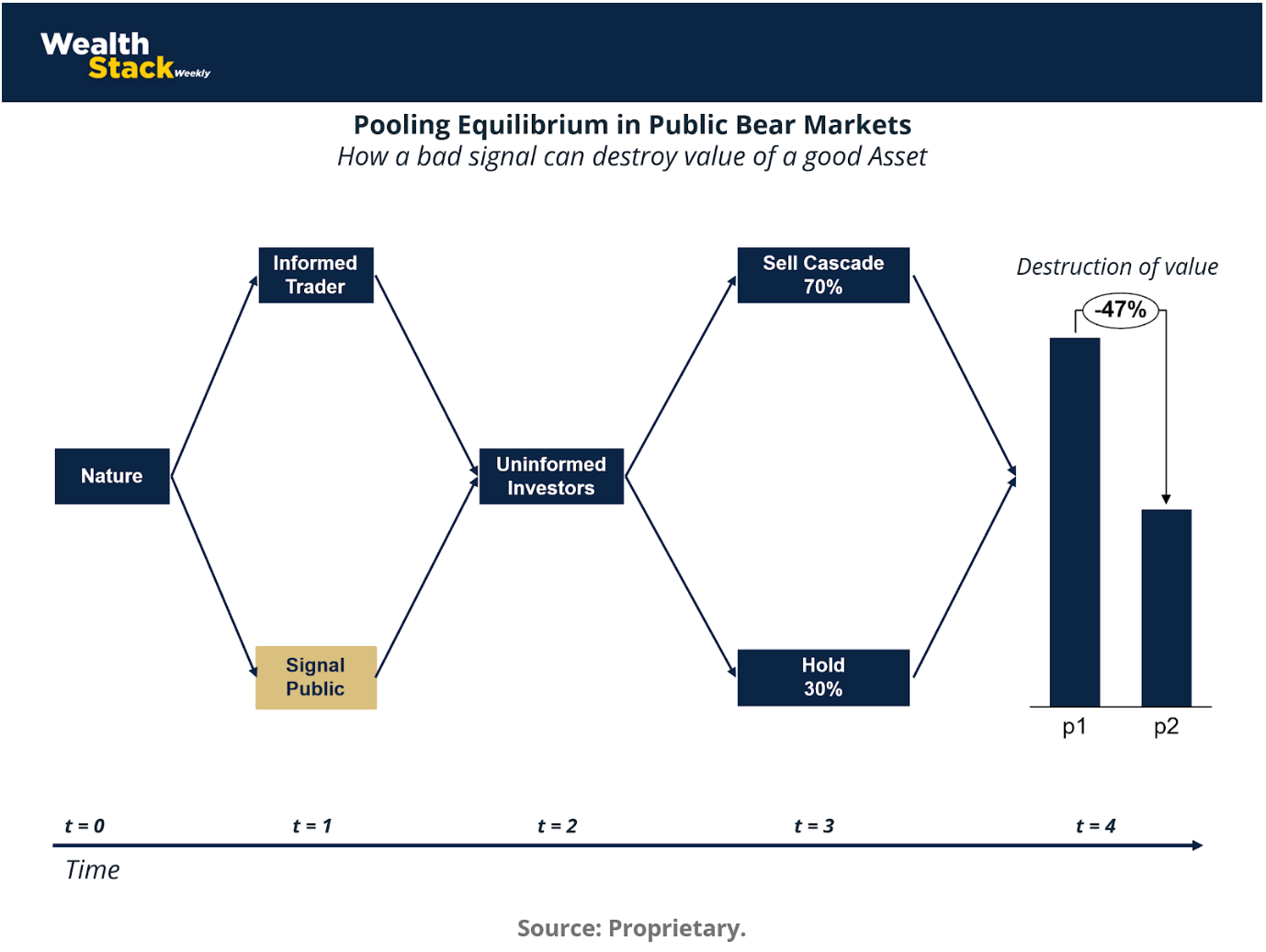

The chart illustrates a core but often misunderstood mechanism in public markets: how a bad signal can destroy the value of a fundamentally good asset through rational behavior, not irrationality. This is not chaos. It is game theory.

At time t = 0, the world begins with nature. Fundamentals exist, but they are not directly observable. Some traders are informed, others are not. The market must infer reality from signals.

At t = 1, a public signal appears. This signal may be weak, noisy, or even misleading — a headline, a comment, a rumor, a political statement. Importantly, it is public and common knowledge. Everyone knows it. Everyone knows that everyone knows it.

This is where illusion begins to matter more than truth.

Informed traders understand that the signal may not reflect fundamentals. But they also understand something more important: uninformed investors cannot distinguish between a bad signal and bad fundamentals. The signal becomes a coordination device.

At t = 2, uninformed investors observe price action and volume, not intrinsic value. They do not know whether selling reflects genuine information or strategic behavior. Rationally, they infer: “Others may know something I don’t.”

This is the essence of pooling equilibrium. Good assets and bad assets become indistinguishable because both generate the same observable behavior: selling.

At t = 3, a sell cascade emerges. Not because most investors believe fundamentals collapsed, but because selling becomes the dominant strategy. Even investors who believe the asset is undervalued face a coordination problem: holding is individually rational only if others also hold. Once enough participants sell, the equilibrium shifts.

Holding becomes irrational, even if fundamentals are strong.

At t = 4, price adjusts downward sharply. The chart shows a 47% destruction of value (example), not because cash flows changed, but because beliefs did. Price p₂ reflects not intrinsic value, but the equilibrium outcome of strategic interaction under asymmetric information.

This framework explains the following cases we will look deeper through this report:

Nvidia did not lose Argentina’s GDP worth of fundamentals in a day. It entered a pooling equilibrium after a bad signal.

Venezuela did not rebuild $100B of infrastructure overnight while Maduro got captured. Markets priced an illusion of certainty.

Credit card stocks were repriced before laws existed.

Blackstone lost value on a comment targeting a marginal sub-business.

GameStop showed the reverse: prices detached upward from fundamentals until the illusion collapsed.

The key insight is this: markets are not always pricing value; they are often pricing coordination. In liquid markets, perception becomes reality faster than fundamentals can assert themselves. A bad signal does not need to be true — it only needs to be believed to be believed.

This is why “headlines go faster than fundamentals” is not a slogan. It is a structural property of public markets under asymmetric information.

And it is why value can be destroyed — or created — long before reality has time to speak.

Case 1: Nvidia’s One-Day Loss Versus a G20 Country’s GDP

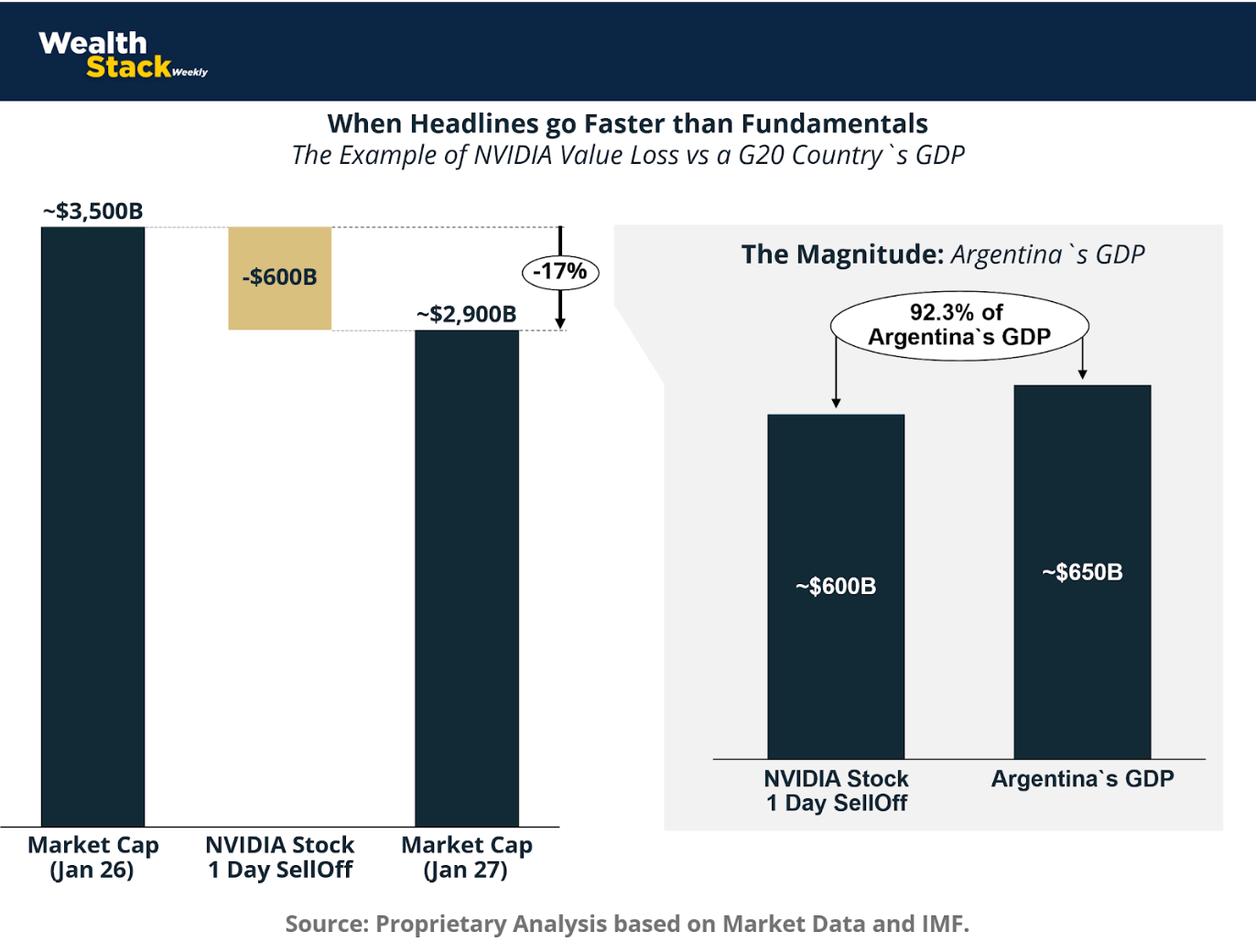

In late January 2025, Nvidia experienced one of the most dramatic single-day sell-offs in financial market history. Following headlines around DeepSeek, a Chinese AI startup claiming a cheaper and more efficient large language model, Nvidia’s stock fell roughly 17% in one session. The result: nearly USD 600 billion erased from its market capitalization in a single day.

To put that number into perspective, USD 600 billion is not an abstract figure. It is almost the entire annual GDP of Argentina, a G20 economy with roughly USD 650 billion in yearly economic output. In other words, in a matter of hours, markets repriced Nvidia by an amount comparable to what Argentina produces in goods and services over an entire year.

This comparison matters because it exposes a fundamental flaw in how headline-driven market moves are often interpreted. There is no credible financial model—discounted cash flow, competitive analysis, or otherwise—that can rationally justify discounting the present value of USD 600 billion of future earnings in one trading session based on a single announcement by a private competitor.

Fundamentals simply do not move that fast.

Nvidia’s revenues did not collapse overnight. Its order backlog did not vanish. Hyperscalers did not cancel data-center buildouts en masse. The CUDA ecosystem did not suddenly lose relevance. Semiconductor supply chains, manufacturing capacity, and customer lock-in remained exactly as they were the day before. None of the underlying drivers of Nvidia’s business changed at the speed reflected in the stock price.

What changed was sentiment, amplified by liquidity.

Highly liquid markets excel at one thing: rapidly transmitting narratives. When a dominant story is challenged—“AI requires massive compute, and Nvidia is the gatekeeper”—prices adjust immediately, often violently. Algorithms react. Momentum traders follow. Risk managers reduce exposure. ETFs mechanically rebalance. The result is not a careful reassessment of long-term cash flows, but a reflexive repricing driven by who needs to transact first.

This is why the Argentina comparison is so powerful. GDP represents real economic activity accumulated over twelve months: labor, capital, production, consumption. It is slow, tangible, and resistant to sudden change. Market capitalization, by contrast, is a liquid expression of expectations, and expectations can swing wildly on headlines alone.

When a single company “loses” an amount equivalent to a G20 country’s annual output in one day, it should immediately raise skepticism. Not because markets are irrational in the long run, but because in the short run they are often faster than facts and far faster than fundamentals.

The Nvidia–DeepSeek episode is not evidence that Nvidia’s intrinsic value collapsed by Argentina’s GDP overnight. It is evidence that liquid markets can overshoot dramatically when narratives shift, even while the underlying business remains fundamentally strong.

In the end, fundamentals move slowly. Headlines move instantly. Confusing the two is how investors come to believe that hundreds of billions of dollars of real economic value can disappear between one market open and the next.

Case 2: The Maduro Capture and the Illusion of Instant Oil Wealth

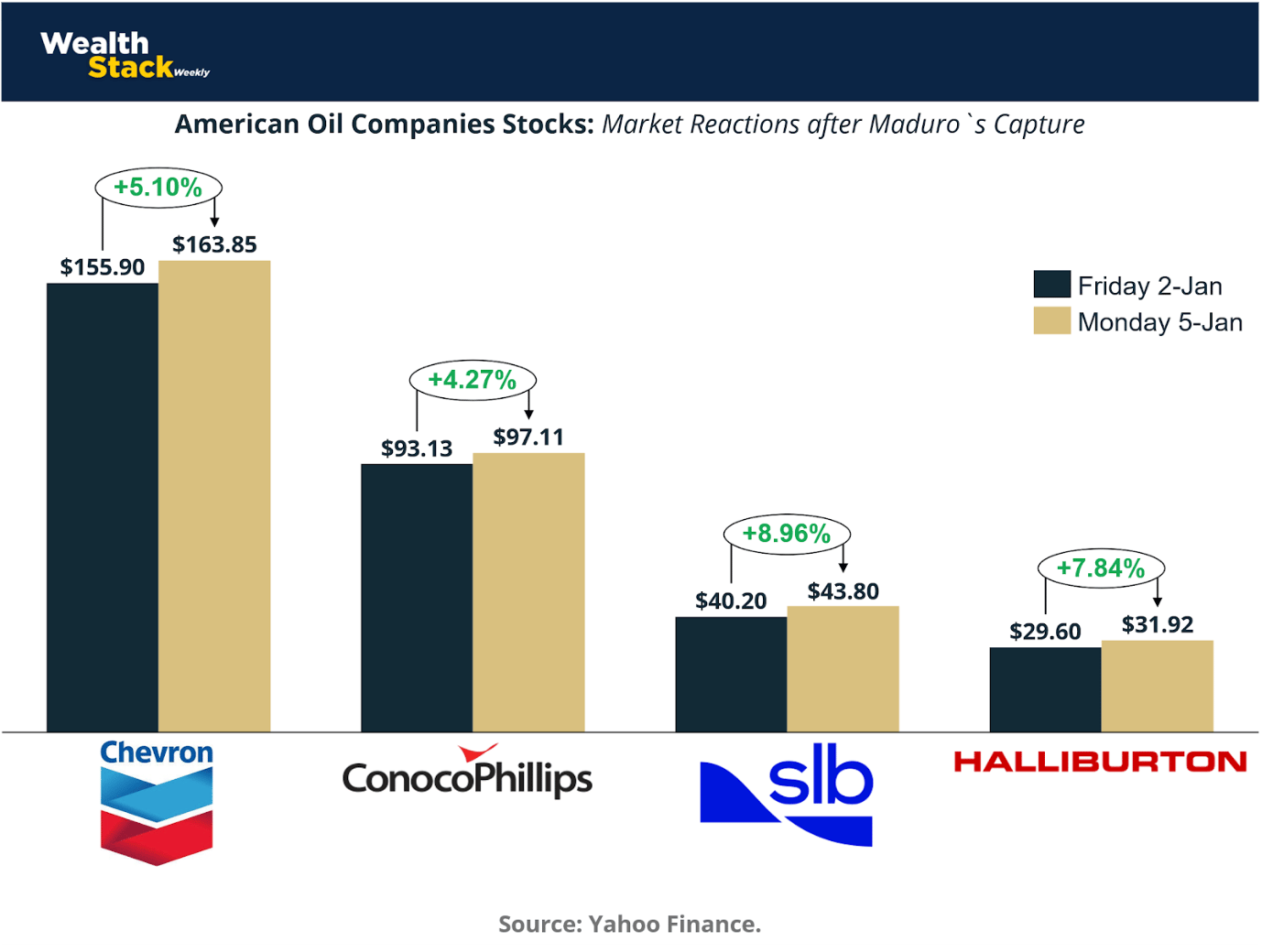

In early January, markets reacted sharply to news surrounding the capture of Nicolás Maduro on criminal charges related to drug trafficking. Within a single trading session, U.S. oil and energy stocks rallied meaningfully, as investors rushed to price in a future where Venezuela’s vast oil reserves suddenly become accessible again.

The reaction was immediate, confident, and massive. And it was almost certainly premature.

The core problem is not optimism about Venezuela’s long-term potential. Venezuela does, on paper, possess one of the largest proven oil reserves in the world. The problem is time, capital, and realism. Markets behaved as if the capture of Maduro instantly unlocked a future that would require more than USD 100 billion in infrastructure long-term investment, a stable political transition, legal clarity, and many years of execution to materialize.

None of that happened overnight.

Maduro’s capture does not, by itself, constitute a regime change. It does not automatically lift sanctions. It does not rebuild pipelines, refineries, ports, or power grids. It does not resolve governance risks, property rights, or contract enforceability. And it certainly does not transform Venezuela into a Saudi-style oil powerhouse in a single weekend.

Yet markets behaved as if all of those hurdles had already been cleared.

In effect, investors discounted an entire political transition and a full-scale oil renaissance into prices in one day. That includes assumptions about future production growth, foreign capital inflows, operational control, and decades of underinvestment being reversed almost immediately. From a fundamentals perspective, that is an extraordinary leap.

Rebuilding Venezuela’s oil infrastructure to world-class levels is not a marginal project. It is a multi-year, capital-intensive undertaking that would realistically require well over USD 100 billion just to restore and modernize basic capacity. Even under the most optimistic scenarios, production gains would come gradually, not instantly. Cash flows would lag investment by years.

Fundamentals move slowly because reality moves slowly.

What moved quickly here was sentiment, amplified by liquidity. Highly liquid equity markets are exceptionally good at reacting to narratives — especially geopolitical ones — and far less disciplined about separating possibility from probability. When a headline suggests a dramatic future upside, prices adjust immediately, even if the path to that future is uncertain, expensive, and politically fragile.

This is the same mechanism seen in other market episodes: investors do not wait for evidence of cash flows; they rush to price the story. In doing so, they often collapse years of uncertainty, execution risk, and capital requirements into a single day’s price move.

The magnitude of that disconnect is the real lesson. Markets effectively priced in hundreds of billions of dollars of future economic value — infrastructure rebuilds, production normalization, and geopolitical realignment — before any of those fundamentals actually changed. That is not careful valuation. It is narrative acceleration.

None of this means markets are “wrong” in the long run. Venezuela may eventually recover. Its oil sector may one day regain global relevance. But the timeline matters. The capital required matters. The political uncertainty matters.

When markets behave as if those constraints no longer exist, they are not forecasting fundamentals — they are trading headlines.

As with the Nvidia example, the lesson is not that fundamentals are irrelevant. It is the opposite: fundamentals are slow, heavy, and real, while markets are fast, liquid, and emotionally reactive. Confusing speed with accuracy is how investors end up believing that USD 100 billion-plus transformations can be priced in before the first dollar is even spent.

Case 3: Credit Card Stocks and the Cost of a Comment

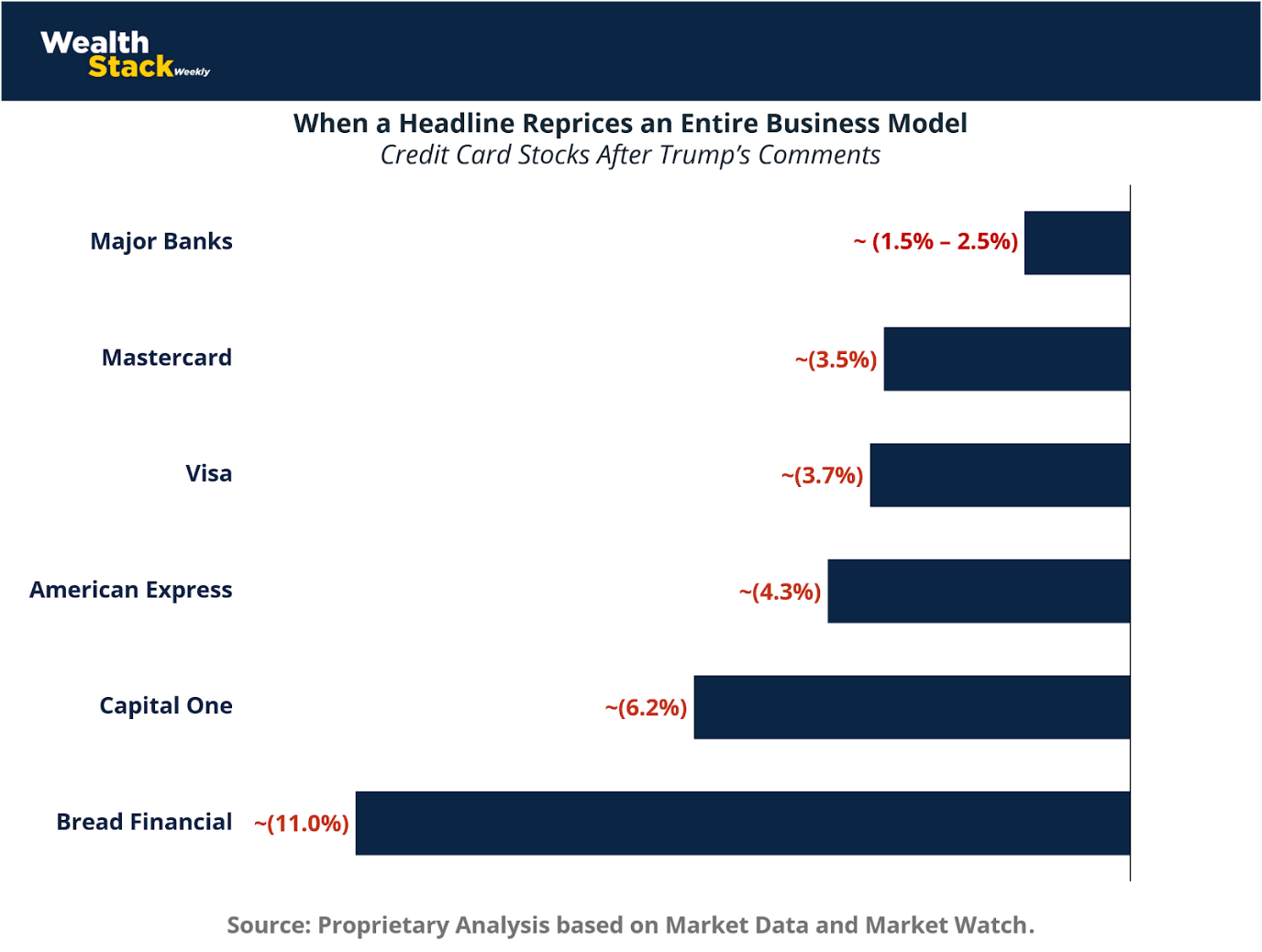

In mid-January, U.S. credit card and payment-network stocks sold off sharply after public comments by President Trump suggesting a cap on credit card interest rates. Within a single trading session, shares of major lenders and networks dropped between low single digits and double digits, with the steepest declines concentrated in companies most exposed to revolving credit balances.

The reaction was swift, uniform, and decisive. And once again, it moved far faster than fundamentals.

The market’s response implied something very specific: that a meaningful and enforceable regulatory regime had effectively arrived overnight. In price terms, investors acted as if interest rate caps were imminent, legally binding, and economically transformative for the credit card industry.

None of those conditions were actually met.

At the time of the sell-off, no legislation had been introduced, no regulatory framework had been finalized, and no enforcement mechanism existed. Implementing a nationwide cap on credit card interest rates would require Congressional approval, regulatory coordination, legal scrutiny, and extended implementation timelines. Even under an aggressive political scenario, such changes would take years to fully materialize.

Yet markets discounted the outcome immediately.

This is a recurring pattern in highly liquid equity markets. When a credible political figure introduces a policy narrative—especially one that threatens margins—prices adjust instantly. The market does not wait for legislative text, institutional constraints, or legal challenges. It prices the idea.

The magnitude of the reaction is what makes the episode instructive. Stocks across the credit ecosystem fell in a cascading fashion: payment networks, card issuers, and consumer lenders all repriced as if a permanent structural impairment to profitability had already occurred. In some cases, companies lost nearly a tenth of their market value in a single day, despite no immediate change to revenues, customer behavior, or balance sheet strength.

From a fundamentals perspective, that is an extraordinary compression of time.

Credit card economics are complex. Interest income, fee structures, consumer risk profiles, and funding costs interact dynamically. Even if rate caps were eventually enacted, the industry would respond through pricing adjustments, product redesigns, credit tightening, and cost restructuring. Margins would not simply disappear overnight. Cash flows would adjust gradually, not instantaneously.

But markets are not paid to be patient. They are paid to be fast.

Highly liquid stocks are especially vulnerable to headline acceleration. When a sector is widely held, tightly correlated, and easy to trade, narratives propagate rapidly. Algorithms amplify moves. Risk managers reduce exposure. Relative-value strategies rebalance. The result is a broad repricing that reflects urgency rather than careful valuation.

This does not mean markets are irrational. It means they are forward-looking but timing-agnostic. They discount potential futures without regard to how long those futures may take to arrive—or whether they arrive at all.

The credit card sell-off is therefore not a story about regulation. It is a story about how quickly markets convert political language into economic outcomes, often collapsing years of uncertainty into a single trading session. The chart makes this clear: billions of dollars in market value were reallocated based on words, not laws.

As with Nvidia’s AI sell-off and the Venezuela oil narrative, the lesson is consistent. Fundamentals move slowly. Headlines move instantly. When markets treat the latter as if they were the former, price action becomes less about valuation and more about velocity.

Understanding that distinction is essential—because in modern markets, speed often wins the day, even when substance has yet to catch up.

Case 4: Blackstone and the Cost of a Potential Policy

In early January, Blackstone’s stock dropped sharply after political comments suggested a potential ban on institutional investors buying single-family homes. Within hours, billions of dollars in market value were erased. No legislation was introduced. No regulation was drafted. No business model was altered. Yet the market reacted as if a core pillar of Blackstone’s future cash flows had suddenly disappeared.

That reaction makes little fundamental sense.

Blackstone is one of the most diversified alternative asset managers in the world. Its portfolio spans private equity, credit, infrastructure, real estate, insurance solutions, and global strategies across geographies and cycles. Even within real estate, single-family housing represents a sub-vertical of a sub-vertical—one strategy among many, and far from the firm’s dominant value driver.

Yet the market behaved as if a single political comment justified an immediate, material impairment to Blackstone’s long-term intrinsic value.

This is a textbook example of headline acceleration overwhelming proportional reasoning. Investors implicitly assumed that a proposal would become law, that the law would be broad and enforceable, that it would materially restrict capital deployment, and that Blackstone would be unable to adapt its strategy—all in one trading session. That is not valuation. That is narrative compression.

Even if such a ban were ever enacted, the impact would unfold slowly. It would involve legal challenges, exemptions, grandfathering, strategic reallocation of capital, and years of transition. Blackstone would respond the way it always has: by shifting capital to higher-return opportunities elsewhere in its global platform. None of that threatens the firm’s core earnings power overnight.

What actually changed that day was not fundamentals—it was perception.

Highly liquid markets are efficient at reacting, not at weighting importance. When a political headline targets a visible business line, prices move immediately, even if that business line is marginal to long-term value creation. Speed replaces scale. Urgency replaces context.

The Blackstone sell-off reinforces the broader lesson running through all these episodes: markets can reprice billions of dollars on words alone, long before reality, implementation, or economics catch up. Fundamentals endure. Headlines pass. Confusing the two is how long-term value gets temporarily mispriced in the span of a single news cycle.

Case 5: GameStop and the Extreme End of Narrative Markets

GameStop is often treated as a historical anomaly—a one-off episode of retail frenzy, memes, and market dysfunction. In reality, it is something far more important: the most extreme and honest expression of how modern markets work when narratives fully detach from fundamentals.

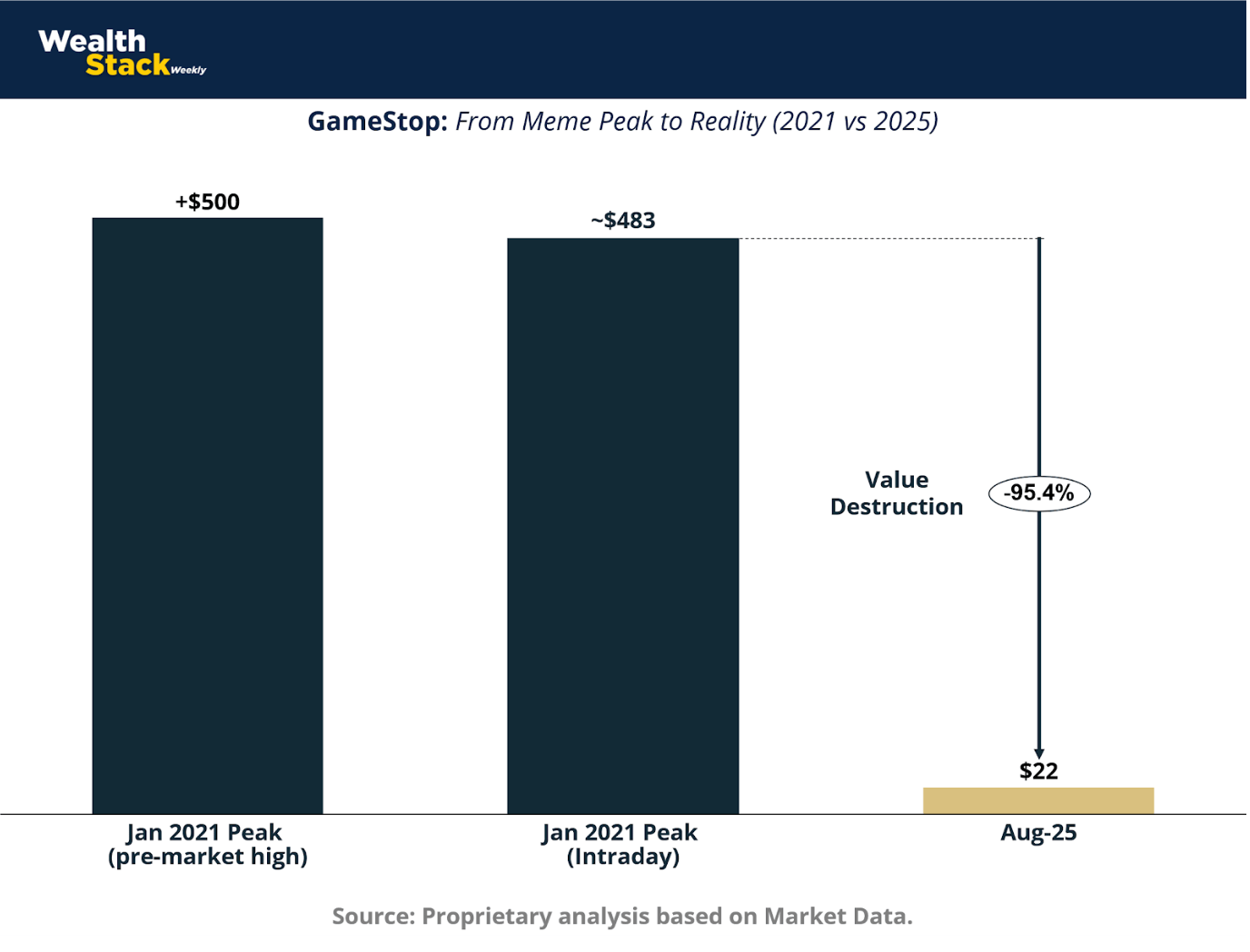

The chart makes this unmistakable.

In January 2021, GameStop’s stock surged to extraordinary levels, peaking near USD 500 in pre-market trading and around USD 483 intraday. At that moment, the market was not discounting improved cash flows, competitive repositioning, or a viable long-term turnaround. The company’s underlying business—physical video game retail—had not meaningfully changed. Revenues were stagnant, margins were under pressure, and secular decline remained intact.

What moved the stock was not fundamentals. It was belief, coordination, liquidity, and narrative momentum.

The GameStop episode demonstrated that in highly liquid markets, price can become the story itself. Short interest, options dynamics, social coordination, and media amplification created a feedback loop where valuation ceased to matter. The market did not pretend to be pricing intrinsic value—it was pricing participation.

That is precisely why GameStop belongs in the same conversation as Nvidia, Venezuela oil, credit cards, and Blackstone—but at the far end of the spectrum.

In those other cases, markets reacted violently to headlines while still claiming a fundamental justification: AI disruption, regime change, regulation, or policy risk. In GameStop, that pretense collapsed entirely. The rally openly ignored fundamentals, and the subsequent decline reflects what happens when narrative liquidity fades and reality reasserts itself.

By August 2025, the stock had fallen to roughly USD 22—representing a 95%+ destruction of value from the meme peak. That collapse was not sudden. It was slow, grinding, and fundamentally driven. As enthusiasm waned and capital rotated elsewhere, the stock drifted back toward levels more consistent with the company’s actual earnings power and strategic limitations.

This contrast is the lesson.

Markets can move up far faster than fundamentals justify, just as they can move down far faster than fundamentals deteriorate. Speed does not equal insight. Liquidity does not equal truth. In the short term, markets are voting machines fueled by narratives. In the long term, they are weighing machines grounded in cash flows.

GameStop proves that markets do not need improving fundamentals to create enormous price moves. They only need a story powerful enough to attract capital quickly. When that story fades, no amount of past price action can protect valuation.

GameStop did not break the market. It exposed it.

It showed, more clearly than any other case, that headlines, narratives, and belief can move prices far faster than reality—and reality always catches up eventually.

Conclusion: Why Illiquidity Protects Value

The Case for Alternatives in a World Where Headlines Move Faster Than Fundamentals

Across every example examined—Nvidia, Venezuela, credit cards, Blackstone, GameStop—the same structural truth emerges: public markets are designed for speed, not for truth. They process information instantly, reprice continuously, and respond reflexively to signals that are often noisy, incomplete, or outright misleading. This is not a failure of markets. It is a feature of liquidity.

But it is precisely this feature that creates a fundamental problem for long-term wealth preservation.

Public markets do not wait for fundamentals to change. They do not wait for laws to pass, infrastructure to be built, or cash flows to materialize. They reprice on headlines, narratives, and second-order expectations—often compressing years of uncertainty into hours.

As we showed through multiple case studies, this dynamic can destroy or inflate hundreds of billions of dollars in market value long before reality has time to respond.

Private markets exist on the opposite end of this spectrum. They are slower, less liquid, less transparent—and because of that, structurally insulated from narrative cascades. This difference is not philosophical. It is mathematical, behavioral, and empirically observable.

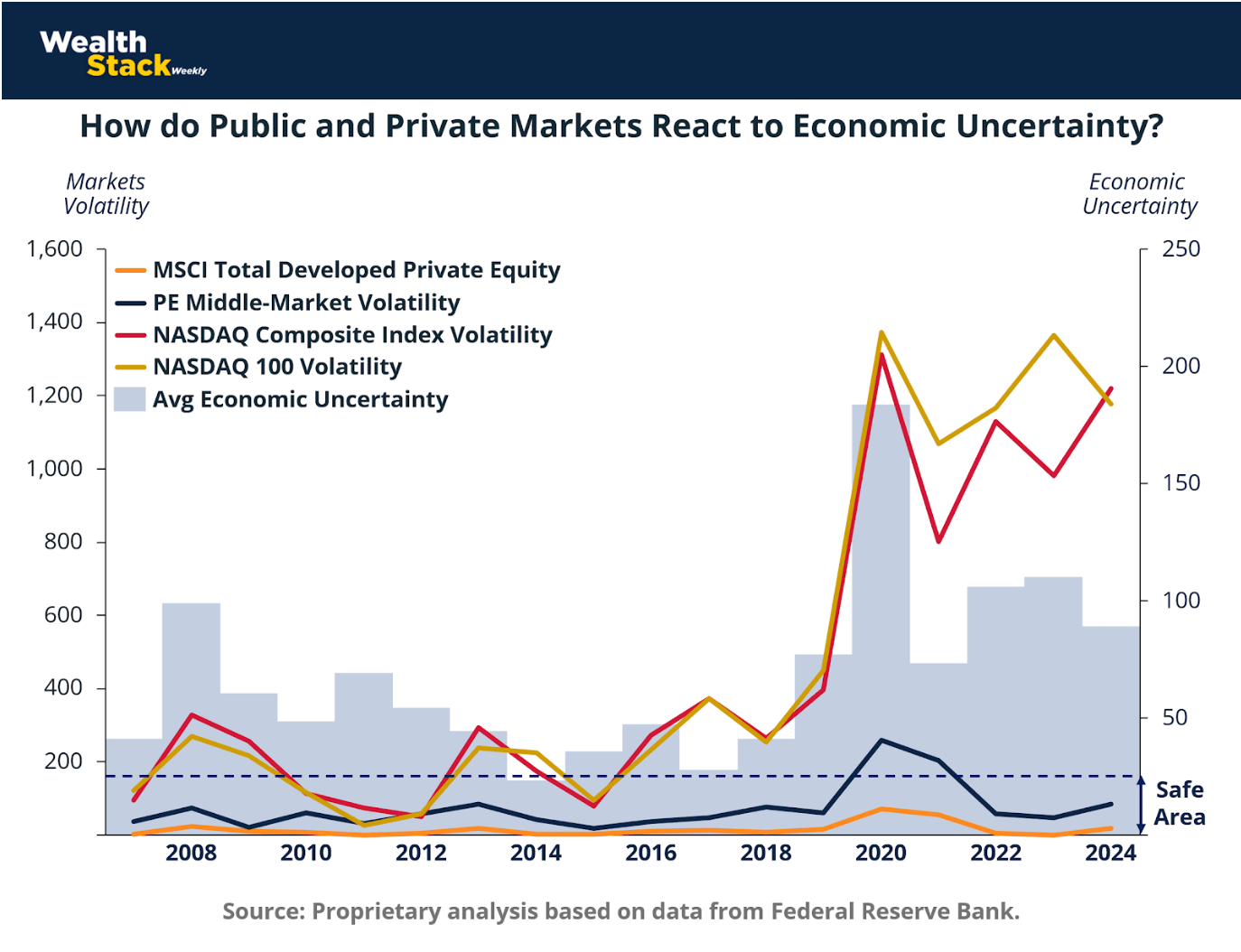

The chart above illustrates this contrast with clarity. Periods of elevated economic uncertainty—2008, 2011, 2020—coincide with sharp spikes in public market volatility, particularly in technology-heavy indices like the NASDAQ Composite and NASDAQ 100. These spikes reflect fear, policy ambiguity, forecast error, and behavioral overreaction. Volatility is not simply higher; it becomes dominant. Private equity, by contrast, barely moves.

Even during the most extreme uncertainty of the COVID-19 period, private market volatility remains muted. This is not because private assets are immune to economic stress. It is because they are not forced to reprice continuously.

Their valuations are negotiated, their strategies multi-year, and their capital locked. As a result, they are shielded from the very mechanisms—algorithmic trading, forced selling, narrative feedback loops—that drive public market instability. This insulation is not accidental. It is structural.

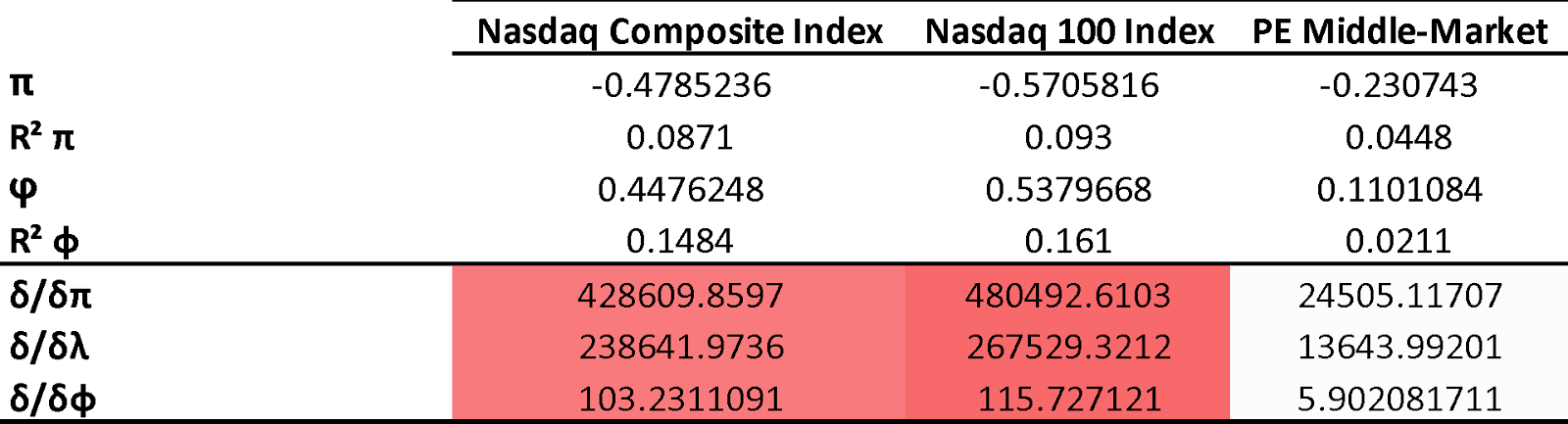

The regression evidence reinforces this point. Public equities exhibit strong negative sensitivity to interest rate changes, with the NASDAQ Composite showing a sensitivity of -0.4785 and the NASDAQ 100 even higher at -0.5706. These assets behave like long-duration instruments, violently repricing as discount rates move. Private equity middle-market transactions, on the other hand, show a far milder sensitivity of -0.2307.

In plain terms: public markets are fragile to macro signals; private markets are resilient by design.

This resilience becomes even more evident when we look beyond volatility and focus on outcomes.

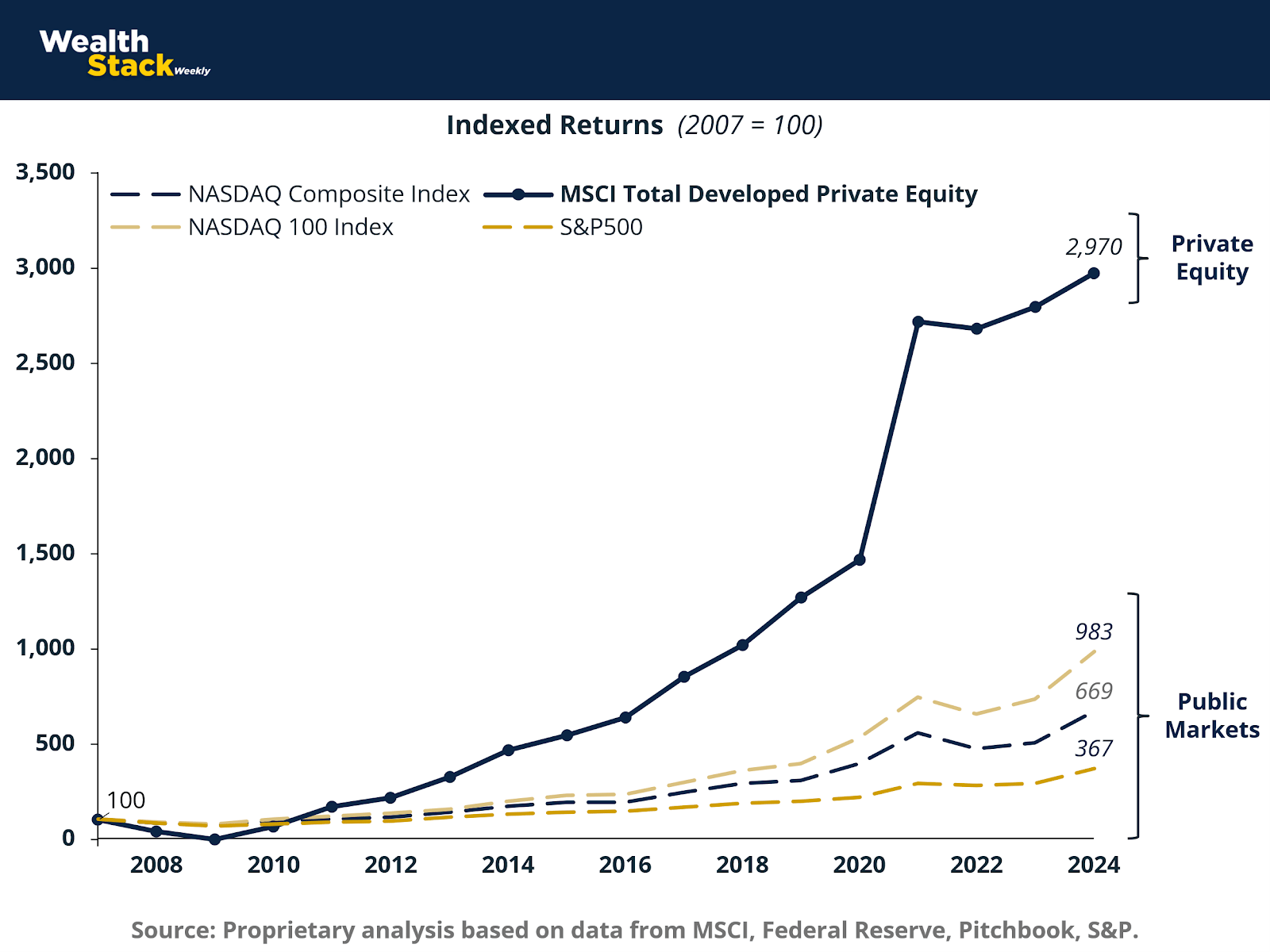

From a base of 100 in 2007, MSCI Total Developed Private Equity grew to 2,970 by 2024. Over the same period, the NASDAQ 100 reached 983, and the S&P 500 just 267. This is not a short-term anomaly. It is a long-cycle compounding effect.

Private equity delivered nearly three times the total growth of the NASDAQ 100 and more than eleven times that of the S&P 500. The CAGR numbers tell the same story: 22.1% for private equity versus 14.4% and 8.0% for public benchmarks.

This outperformance is often misunderstood. It is not merely a reward for superior manager skill. It is compensation for illiquidity, patience, and operational execution—and crucially, for being structurally removed from daily mark-to-market chaos.

Illiquidity is not a bug. It is a feature.

By locking capital for years, private markets prevent the coordination failures described earlier in this series. There is no sell cascade driven by a tweet. No pooling equilibrium where good assets are punished alongside bad ones. No need to react defensively to preserve short-term optics. Time becomes an ally rather than an enemy.

Public markets, by contrast, are dominated by what game theory would describe as coordination equilibria under asymmetric information. Investors sell not because fundamentals deteriorated, but because others might sell. Headlines become signals. Signals become self-fulfilling. Value is destroyed—or created—not because reality changed, but because beliefs synchronized.

Private markets break this loop.

They force investors to commit capital through cycles, to focus on cash flows rather than quotes, and to create value operationally rather than narratively. This is why private assets “float above” waves of uncertainty rather than being pulled under them. They are not immune to economic forces—but they are protected from panic.

The implication is not that public markets are obsolete or inefficient. They serve an essential role in price discovery, liquidity, and capital allocation. But they are poorly suited for investors whose primary objective is long-term wealth preservation and compounding, rather than short-term flexibility.

What this entire analysis demonstrates is a simple but uncomfortable truth:

Speed destroys context. Liquidity amplifies fear. And daily pricing is often the enemy of long-term value.

Alternatives and private markets do not outperform despite their constraints. They outperform because of them.

In a world where headlines travel faster than fundamentals, where markets discount futures that may never arrive, and where value can evaporate in hours without any change in reality, illiquidity is not a risk to be minimized. It is a premium to be earned.

That is the real case for alternatives. Not as a tactical allocation. Not as a diversification checkbox. But as a structural defense against the illusion-driven dynamics of modern public markets.

Sources & References

ABC News. (2026). Stocks of credit card companies slump as Wall Street overall drifts in mixed trading. https://abcnews.go.com/US/wireStory/stocks-credit-card-companies-slump-wall-street-drifts-129120491

Barron`s. (2026). JPMorgan Chase, AmEx, Capital One and More Stocks Dive. Trump’s Credit-Card Plan Sparks Panic. https://www.barrons.com/articles/chase-capital-one-bank-of-america-credit-card-stock-price-51aaf01e

CBS News. (2026). Trump says he will seek to ban institutional investors from buying single-family homes. https://www.cbsnews.com/news/trump-ban-institutional-investors-single-family-homes/

CBS News. (2025). What is DeepSeek, and why is it causing Nvidia and other stocks to slump? https://www.cbsnews.com/news/what-is-deepseek-ai-china-stock-nvidia-nvda-asml/

Market Watch. (2026). Why Visa and Mastercard are seeing their sharpest stock drops in half a year. https://www.marketwatch.com/story/why-visa-and-mastercard-are-seeing-their-sharpest-stock-drops-in-half-a-year-69fc0c5b

MEXC. (2026). Blackstone (BX) Stock Falls as Trump Proposes Ban on Institutional Home Buying. https://www.mexc.com/news/432648

Reuters. (2026). Financial stocks fall as Trump's credit card rate cap plan rattles investors. https://www.reuters.com/business/finance/us-financial-stocks-fall-after-trump-calls-credit-card-rate-cap-2026-01-12/

Reuters. (2025). DeepSeek sparks AI stock selloff; Nvidia posts record market-cap loss. https://www.reuters.com/technology/chinas-deepseek-sets-off-ai-market-rout-2025-01-27/

Wealth Stack Weekly. (2025). Volatility Destroys Wealth. https://wealthstack1.com/p/volatility-destroys-wealth-563c94aa8673b098

Wealth Stack Weekly. (2025). The Power of Illiquidity. https://wealthstack1.com/p/the-power-of-illiquidity

Yahoo Finance. (2026). Trump wants to ban Wall Street investments in single-family homes. Experts aren’t sure it would help much. https://finance.yahoo.com/news/trump-wants-to-ban-wall-street-investments-in-single-family-homes-experts-arent-sure-it-would-help-much-170203252.html?guccounter=1

Premium Perks

Since you are an Wealth Stack Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Visit our website.