- Wealth Stack Weekly

- Posts

- I Lost a Decade in the Stock Market.

I Lost a Decade in the Stock Market.

Here’s what I do differently now.

Hi ,

When I started investing in 1999, the timing couldn’t have been more perfect.

Markets were flying high. I was putting 20% of my pre-tax income into the stock market. I knew I was on the right path.

Then the dotcom bubble burst. Over the next 10 years I continued to stick it out. I nervously watched markets crash (2001 & 2008) and then watched them rebound and ultimately even out. I told myself I was keeping my eye on the long run.

My first decade of investing became known as “The Lost Decade”. The S&P 500 went nowhere from 2000 to 2010. A full decade in the market gave me back roughly what I put in.

After ten years, I was breaking even.

That experience doesn't leave you. Every time someone tells you to "stay the course" and "trust the long run" you pause and remember that feeling.

Most of us take traditional advice when we first get into markets: save for retirement, diversify, match risk with time horizon. We follow what others are doing in order to keep up. Market volatility is now accepted as the norm. Just last week the S&P and Nasdaq dropped, then they all rose again to new highs while Bitcoin went crazy.

And through all of it - nothing actually changed about the traditional market advice. The mindset is still essentially the same.

After those ten years, I started asking big questions.

What if the market volatility is costing me money?

What if liquidity isn’t a safety net?

How will I build lasting wealth if my portfolio is a mirror of market sentiment?

Those questions changed how I invest and how I think about building wealth. And they're what this issue is about.

Illiquidity as the edge.

We're going to break down:

Why the volatility in your portfolio is destroying the compounding you think you’re getting, and how you can take control.

How private credit can be the most versatile tool in a private market portfolio.

A simple Playbook to allocate into private credit and gain the illiquidity premium.

Plus, diving into BuildFlow I, our private credit fund, and my largest single investment last year. Get ready to see what "opting out of the chaos" looks like in practice.

Let's get into it.

— Walker Deibel

WSJ & USA Today Bestselling Author of Buy Then Build

Founder, Build Wealth

SHIFT YOUR STACK

The Illiquidity Premium Is Not Optional

In the first week of February, the S&P 500 dropped roughly 2% and the Nasdaq fell nearly 4%. Portfolios dropped and talking heads spread their panic across social media.

And then? A few days later, the market hit new all-time highs.

72 companies in the S&P 500 reached new 52-week highs while others hit fresh lows. On the Nasdaq, more than 100 stocks hit new highs and more than 100 hit new lows at the same time.

The economy didn't get worse on Monday and better on Thursday. The only thing that moved was sentiment. And portfolios moved with it.

This is the hidden tax of liquidity. Your capital is constantly exposed to other people's emotions. It's being repriced every second of every trading day by millions of participants who have no idea what your goals are, what your time horizon is, or what you're building toward.

Liquidity is touted as a security feature or a strategy to stay nimble. Providing the ability to buy and sell based directly on market reactions. The result is continuous repricing. Repricing can drag your wealth down, year after year, whether you realize it or not.

The alternative to these stressful cycles comes in the private markets. Private market investors are rewarded with an illiquidity premium, precisely because they opt out of the chaos. And that advantage is compounding faster than ever.

The Volatility Penalty

Most investors evaluate returns by their average.

"The S&P returned 10% over the last decade." That’s great.

But averages lie because compound returns are brutally sensitive to variance, not just the mean. It’s a misleading measuring stick, at best.

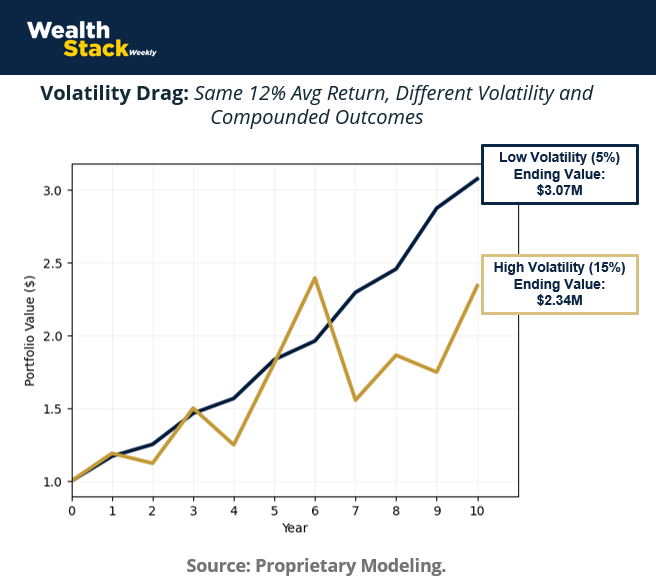

Take two portfolios. Both starting at $1 million, average 12% annual returns over 10 years.

Portfolio A (low volatility): returns stay in a tight band, 5% standard deviation.

Portfolio B (high volatility): returns swing wildly, 15% standard deviation.

(Historically, the S&P 500 fluctuates around 15% per year.)

Same average return. But at the end of 10 years, Portfolio A is worth +$730k more. The difference is volatility.

This is volatility drag. It’s the unseen wealth destroyer hiding inside every public equity portfolio. A 30% loss requires a 43% gain just to get back to even. And every time the market whipsaws — like it did last week — the drag compounds. You notice it as the years wear on.

Public markets create drag. And the more volatile the ride, the less of the "average return" you actually keep.

This is lost in a standard financial plan. An advisor presents average annualized returns. But you don't earn average annualized returns. You earn compound returns. And the difference between those two numbers is the volatility tax you're paying every single year.

Steady over Speed

When an asset is repriced in response to headlines, it means your returns are constantly subject to forces that have nothing to do with the asset's actual value. This can stem from anything including: tariff rumors, a fed comment, a viral social post. The bigger the news, the faster the repricing, the more exposed you are to the resulting market noise.

Institutional investors, like endowments, family offices, or sovereign wealth funds, have understood this for years. They know speed isn’t going to boost returns, they want slower acting assets.

Private assets don't reprice based on media spin. They're underwritten to contracts, cash flow, collateral, and operational execution. And they adjust slowly — if at all — to the sentiment-driven chaos that whipsaws public portfolios on a weekly basis.

The patience premium is real. And in a market that gets faster and more reactive every year, the premium for not participating in the noise only grows.

The Stable Alternative

Like any private asset, private credit operates differently from public markets.

Sentiment has little impact on returns. Instead, the expected return is defined in the loan agreement. The investor earns a stated spread over a base rate, supported by negotiated covenants and, ideally, collateral. The outcome is driven primarily by whether the borrower fulfills the terms of the agreement.

The return profile is based on cash flow generated by contractual obligations.

That distinction is important.

It represents the difference between returns influenced largely by market pricing and returns grounded in agreed-upon cash flow terms. For investors seeking income and clarity, that difference can truly shape how a portfolio behaves over time.

Private Credit Is the Operating Account for the Private Market Investor

If the illiquidity premium is the principle then blue chip private credit is how you get there. The best private credit fund structures out there aren’t just low volatility, they’re semi-liquid and open ended. This allows for disciplined deployments and additions without the true liquidity that breeds sentiment-driven moves.

The Low-Volatility Base Layer

Over the past 15 years, direct lending — the largest segment of private credit — has generated annualized returns around 9.5%. As of early 2025, yields were roughly 11%. Even assuming modest spread compression, Morgan Stanley projects first-lien asset yields to trough around 8.0–8.5% in 2026.

Those returns are broadly comparable to long-term public equity returns. The difference is volatility. Public markets can swing dramatically with double-digit gains followed by sharp drawdowns. Private credit has historically exhibited lower volatility, helping reduce the drag and support steadier compounding.

Private credit is intentionally built to be contractual, underwritten to cash flow, and supported by covenants and collateral. That makes it the predictable base inside a portfolio.

It’s Productive Capital

Private credit keeps capital working consistently.

Instead of your assets sitting in cash or short-term instruments earning mid-single-digit yields, capital can generate 8–11% inside a contract while investors evaluate their next move. In volatile markets, this avoids the pressure to redeploy capital into overheated assets simply to avoid idle cash.

When private equity distributions arrive, when real estate positions exit, or when growth capital is harvested, private credit functions as an interim allocation — maintaining income generation during transitions.

It functions as a disciplined holding pattern that pays you.

It Centralizes Your Private Portfolio

This is where you will shift from "investor" to "allocator."

For sophisticated investors, private credit is the connective tissue across your private portfolio. It's not just an asset class. It serves a key function in your larger portfolio architecture.

If you have the right private credit allocation (both semi-liquid and open-ended), funds can grow inside and flow through it as needed.

Your private credit allocation can be used to represent all your near liquid private market holdings.

Think of it as the effective “liquidation value” for your private portfolio.

Here’s how it works:

As you receive returns if you park them in your PC fund, the total value will rise. Unlike your outstanding of PE or real estate paper values, this is money you can use – for income, for deployment, for growth. Any distributions you receive are real and show you how much you’ve made across all deployments. This is your high watermark of your portfolio’s performance.

Private credit isn't the destination. It's the foundation that makes everything else you eventually build on top of it work better.

In a world where everyone's chasing the next hot trade, the real opportunity lives in the assets that don't move. You don't need to outrun the market. You just need to opt out of the chaos.

The illiquidity premium is non-negotiable.

Want to get a closer look at why this matters? ? Check out this week’s report, Consistency is Power.

CASE STUDY (From Our Sponsor)

BuildFlow I is Consistency in Practice

While the S&P was swinging all over last week, something very different was happening inside our diversified private credit fund, BuildFlow I.

Borrowers were actually making payments.

That's it. That's the whole update. We didn’t have any need to do emergency rebalancing or keep track of headlines.

What is BuildFlow I

BuildFlow I is our diversified private credit fund designed to be the opposite of everything that makes public market investing a second job.

We just closed our most profitable quarter at the end of last year, producing 12.3% annualized returns (12.4% for investors who elect to compound rather than take distributions).

Here's what's under the hood:

Sub-institutional loan sizes: we operate in a segment of the market too small for institutional players to bother with, which means less competition and better terms.

Real assets only: every loan is fully collateralized with conservative loan-to-value ratios, there's a meaningful cushion between what we lend and what the asset’s worth.

Second position: behind senior debt but in front of common equity. And every asset has either full takeover rights or forced sale rights. If a borrower defaults, we step into the collateral at a basis that actually improves our return profile.

Semi-liquid structure: After a 2-year lockup, there's optional quarterly liquidity thereafter.

Open-ended portfolio: the fund diversifies continuously as new loans are added. Investors can elect monthly distributions or compound internally.

Experienced team: Our operating partners have 13 years of private debt underwriting and an extensive pipeline, allowing us to cherry pick the best loan opportunities.

Why This Fund Was My Largest Investment in 2025

BuildFlow I was my largest personal investment last year. It's the opposite of flashy. It’s a better version of what I was asking the stock market to do. Low volatility, with consistent 10%+ returns.

Basically the tortoise beats the hare.

When the rest of your portfolio is volatile, you need something in it that isn't. BuildFlow I is the part of my portfolio that compounds whether headlines cooperate or not.

The recent 12.3% annualized return was impressive. These are contractual returns, not sentiment driven. It’s simple: every month, borrowers are making payments.

While we have your attention? If you are ready to have a conversation about how private credit fits into your stack, reach out to our Director of Investor Relations, Mike Brown at [email protected] or schedule time on his calendar.

THE PLAYBOOK

From Audit to Allocation

The move to private credit allocation is a fairly simple two step process. So the Playbook this week is straightforward.

Part 1: AUDIT

You’ll start with a robust and detailed audit. Pull up your portfolio. All of it — brokerage accounts, retirement accounts, everything that's invested. Then answer three questions.

1: What percentage of your portfolio reprices daily?

This is the big one. Add up everything that trades on a public exchange — stocks, ETFs, index funds, bonds, REITs, whatever has a ticker symbol. Divide by your total invested assets. That number is your sentiment exposure — the percentage of your wealth that is re-valued every second of every trading day based on the collective mood of the market.

For most high earners who've followed conventional financial planning advice, this number is somewhere between 80% and 100%.

That means nearly all of your accumulated wealth is subject to the volatility drag we described earlier. Every drawdown, every whipsaw, every week like last week — it's all grinding against your compounding.

2: How much of your capital do you actually need to be liquid?

Liquidity has a purpose: it's capital you might need to access on short notice. An emergency fund. Near-term expenses. A down payment you're planning to make in the next 12 months.

Add up what you'd realistically need access to in the next 1-2 years. Include a generous buffer. Think six months of living expenses beyond what your income covers, any large planned purchases, any near-term obligations.

Now compare that number to the total amount of capital you currently have in liquid, publicly traded assets.

The gap between those two numbers — what you need liquid and what you have liquid — is your illiquidity capacity. That's capital that's sitting in the public markets not because it needs to be there, but because that’s where everyone said to put it.

For a high earner with strong, consistent income, that gap is usually enormous. Your career is likely your near term liquidity. Your W-2 or 1099 with some emergency buffer, likely covers your living expenses. The capital beyond your immediate needs is paying the full cost of liquidity — daily repricing, emotional exposure, volatility drag — for no functional reason.

3: What is that liquidity costing you?

Remember the two-portfolio comparison from earlier?. Same average returns, different volatility. The portfolio with lower variance ended up with +$700k more after a decade on a $1M starting position.

Now run that against your own numbers. Whatever your illiquidity capacity is — the capital that doesn't need to be liquid — imagine it compounding at 11-12% with minimal variance instead of riding the public market rollercoaster. Over 10 years, the gap isn't theoretical. It's the difference between staying stuck at a level of wealth that feels like a plateau and actually breaking through it.

Part 2: ALLOCATE

You've done the audit, you know what you need liquid and what is available to put towards illiquid assets. So now you can move your selected capital into private credit.

How much? There's no universal answer, but here's a framework.

Start with your illiquidity capacity (see your answer from question 2) That's your ceiling, not your target. A reasonable first allocation to private credit is somewhere between 10-20% of your investable assets. The goal is to be a meaningful move but not to overconcentrate.

Source & Evaluate

Not all private credit is created equal. The space is approaching $2 trillion in AUM, and with that growth comes a wide range of quality. Here's what matters:

Collateral and LTV. What are the loans secured by? Real assets with verifiable value, or cash flow projections and good intentions? What's the loan-to-value ratio? The lower the LTV, the bigger the cushion between what was lent and what the asset is worth if things go sideways. You want a fund that's conservative. One where a borrower default doesn't wipe out your position but actually creates a favorable entry into the underlying collateral.

Position in the capital stack. Where does the fund sit? Senior secured is the safest — first in line if anything goes wrong. Second position can offer higher yields but requires you to understand the control rights. Do the fund managers have takeover rights? Forced sale provisions? The ability to step in and protect your capital, not just wait in line?

Sponsor quality. Who's borrowing the money? Experienced operators with track records, or first-timers? How does the fund source and vet its borrowers? A deep, established pipeline means the fund can be selective. A thin pipeline means they might be reaching for deals to deploy capital.

Lockup and liquidity terms. Understand exactly what you're committing to. How long is the lockup? What happens after it expires — is there quarterly liquidity, or are you locked until maturity? Can you take distributions along the way, or is everything compounding until exit? There's no wrong answer here, but you need to know what you're signing up for and make sure it matches your actual time horizon.

Fee structure. What's the management fee? Is there a performance fee or carried interest? How do fees compare to the gross yield? A fund generating 12% gross but charging 3% in total fees is a very different proposition than one generating 12% gross with 1.5% in fees. Ask, and do the math.

Track record through cycles. This is the one most first-time allocators skip. How did the fund (or the team behind it) perform during periods of stress? During COVID? During the 2022 rate shock? A fund that launched in 2021 and has only operated in favorable conditions hasn't been tested yet. Experience through volatility is worth more than a few quarters of strong returns in a tailwind.

That’s it. Once private credit is in place, the portfolio is positioned to capture the illiquidity premium.

WEALTH STACK REBELLION

"The big money is not in the buying and selling, but in the waiting."

— Charlie Munger

Most investors think patience means surviving the volatility.

It doesn't.

Patience is about how your capital behaves.

Every fully liquid dollar you own is subject to daily repricing —> by headlines, sentiment, political noise, and short-term positioning. That isn’t always investing. Often, it’s just exposure to opinion.

The real edge is slowness.

Capital that compounds on contract, backed by collateral, or calculated risk based on your assessment of operational execution risk.

It’s insulated from the swings of daily headlines.

The liquidity you're clinging to is a ceiling. It limits how consistently you compound capital.

Slow your capital down.

Let time do the heavy lifting.

That's the rebellion.

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.