- Wealth Stack Weekly

- Posts

- The Private Investor Playbook you need to start 2026.

The Private Investor Playbook you need to start 2026.

Get ready to build your wealth stack.

Hi ,

I’ve never been one to obsess over market timing.

Yes, I started as a stockbroker. Yes, I’ve seen both sides of the public and private markets. And yes, I still remember how it felt watching my portfolio tank in the “Lost Decade” after living on $19k a year and maxing out my 401(k).

That experience taught me something I’ve carried into every investment since.

Enduring wealth comes from how capital is positioned, not from reacting to short-term market moves.

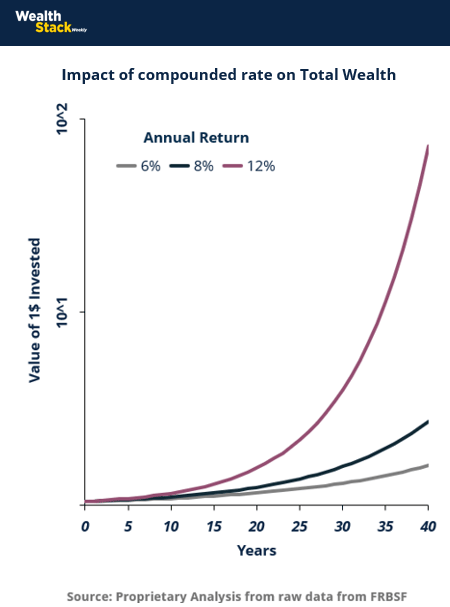

In the cycle ahead, the investors who do well will be the ones who positioned early and built with intention. They will have clear exposure, understandable drivers of return, and portfolios designed to compound through different environments.

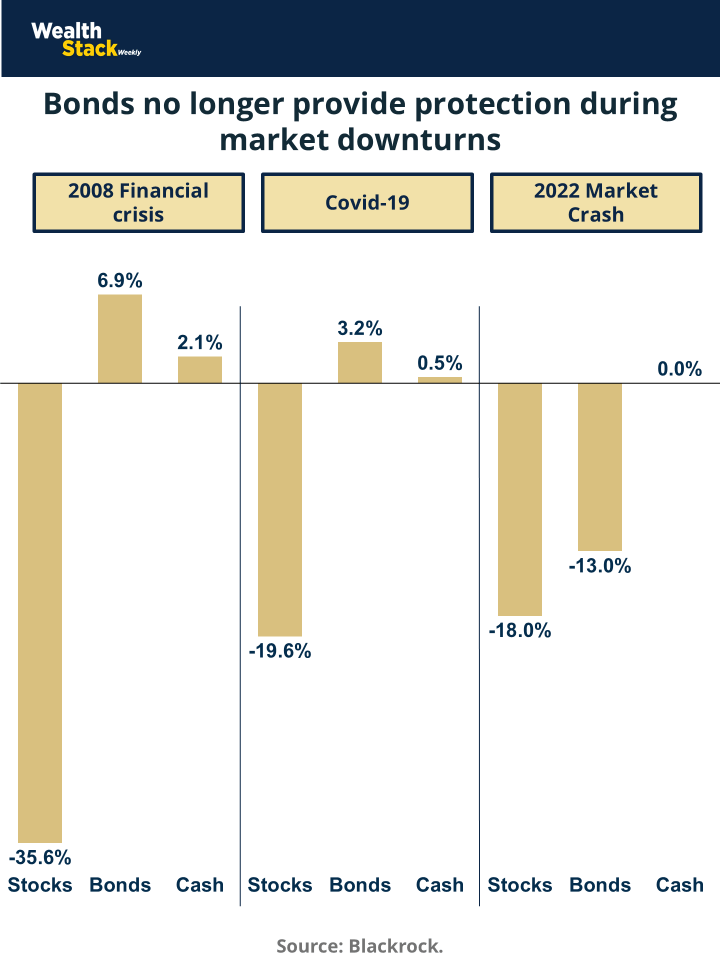

Today, the public markets are sending mixed signals. Valuations remain stretched. Volatility is embedded. The traditional 60/40 framework is being stress-tested in real time.

At the same time, investors are steadily reallocating into private strategies where outcomes are driven by structure, cash flow, and ownership.

We see that reallocation most clearly across three private engines:

Credit, as banks continue to pull back from lending

Real assets, as capital costs begin to ease

Operating businesses, as a generational ownership transition accelerates

This week’s issue is built around those signals.

Our 2026 Private Investor Playbook outlines the private investing moves we are making now to align capital with these long-term dynamics. It reflects how we are underwriting opportunities, building relationships, and allocating with a multi-year horizon.

Over the past 17 months, we’ve deployed over $35 million into these strategies alongside investors who previously held their capital at firms like Merrill, Schwab, and Vanguard.

They moved as they began to think about capital the way operators think about businesses: positioning early, underwriting risk, and compounding through an income-generating and appreciation structure, rather than speculation.

This approach favors steady accumulation, thoughtful underwriting, and portfolios designed to compound without unnecessary friction.

This is what we’re building.

As a companion to the Private Investor Playbook, we’ve also included our Portfolio Vintage Model in this issue. This interactive tool visualizes the mechanics behind the Playbook when deployed strategically over time. You can adjust assumptions and see how outcomes shift across different environments.

See you in 2026!

— Walker Deibel

WSJ & USA Today Bestselling Author of Buy Then Build

Founder, Build Wealth

THE 2026 PRIVATE INVESTOR PLAYBOOK

Position early. Think structurally. Build where the signals are clear.

1. Protect Against Public-Market Whiplash

Volatility in public markets is already building, driven by stretched valuations. You don’t need perfect timing to avoid the turbulence. You need less exposure to it.

The Move: Shift a meaningful portion of equity risk into assets tied to cash flow. Credit, real estate, and operating businesses offer stability and visibility that market-linked assets struggle to provide right now.

Why it Works: You remove noise from your portfolio and replace it with performance drivers you can understand and monitor.

2. Front-Run the Rate Environment With Real Assets

Real assets respond to lowering interest rates faster than headlines do. Pricing adjusts in anticipation, not in retrospect.

The Move: Underwrite deals now. Lean into asset-backed opportunities positioned to benefit from improving financing conditions. Favor durable income, responsible leverage, and markets with strong demand.

Why it Works: You capture the early phase of recovery, the part sophisticated investors target before broader participation returns.

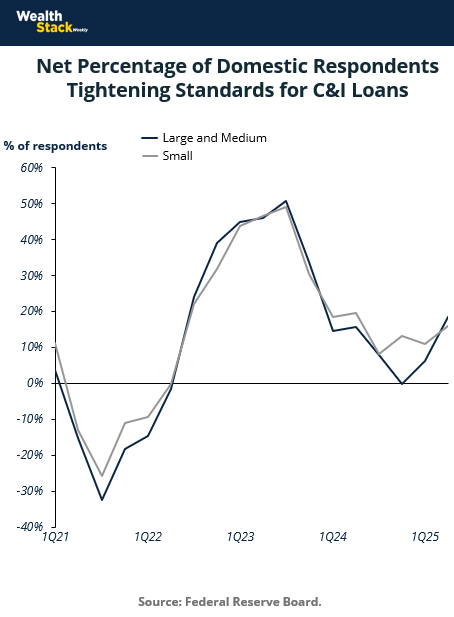

3. Anchor Yield in Private Credit While Banks Retreat

Banks continue to pull back. Private lenders are filling that void and establishing durable positions across the lending landscape.

The Move: Increase exposure to private credit funds with strong underwriting, real covenants, and floating-rate structures. Use high-quality private credit to build predictable yield and create ballast for the wider portfolio.

Why it Works: You access consistent cash flow with less volatility than public fixed income can offer in this environment.

4. Lean Into Real-World Value Creation Through Ownership

A decade-long ownership transfer is underway. Enduringly profitable companies (some with outdated processes) are entering the market in large numbers.

The Move: Allocate to operators who know how to modernize legacy businesses. If you have the skill set to acquire directly, build your ecosystem now. The first wave of high-quality businesses is already hitting the market.

Why it Works: Returns come from operational improvement and business fundamentals rather than speculative appreciation.

5. Back Independent Sponsors Who Can Win in the Thinnest Part of the Market

The sub-$10M EBITDA landscape is crowded with opportunity but sparse in qualified buyers. Trust and agility move deals faster than scale.

The Move: Build relationships with independent sponsors who have strong operator networks and proven deal judgment. They source, operate, and fund acquisitions with investor backing, bridging entrepreneurial deals and institutional capital. Explore co-investments with teams that can move quickly and create value without relying on excessive leverage.

Why it Works: You gain access to the part of the market where competition is limited and value creation is immediate.

6. Use Asymmetric Allocations Intentionally

Gold and crypto can serve as satellite allocations, complementing a private-market portfolio. Though not the main drivers of compounding, they can offer insight into investor behavior. Gold reflects a demand for stability during periods of uncertainty. Crypto reflects a search for long-term asymmetric upside.

The Move: Use these as small, satellite allocations. Gold for stability. Crypto for long-cycle optionality. Keep position sizes disciplined and deliberately aligned with your overall portfolio.

Why it Works: You reinforce the edges of your portfolio while the core engines continue to compound.

7. Build a Portfolio That Compounds Without Drama

Investors are expanding into private markets because they want structure and clarity.

For example, Build Wealth received over $35 million in commitments in the last 17 months and every single one of those investors previously held their wealth inside Merrill Lynch, Vanguard, Chase, Bank of America, or Schwab. Many moved because private strategies offered more visibility and control than they felt in public markets.

The Move: Blend the three private engines that compound. Credit for yield. Real assets for durability. Operating businesses for value creation. Use public markets to maintain liquidity rather than drive performance.

Why it Works: You create a portfolio built on productivity and control instead of daily volatility. Stability before scale.

8. Position Early, Not Perfectly

You don’t need to catch the bottom or the top. Just be present when the structural shift becomes obvious.

The Move: Reallocate in the quiet part of the cycle. Build your relationships and underwrite now. Prepare before the crowd arrives.

Why it Works: The investors who move early get the best opportunities, the best terms, and the most compoundable positions.

The next decade will reward investors who build like entrepreneurs: through clarity, intention, and steady accumulation. Private markets already reflect this reality. Public markets will catch up later.

The time to build is now.

TOOLBOX

Our Portfolio Vintage Predictor Compares Public and Private Deployments Over Time

The Private Investor Playbook outlines our view for 2026, but zooming out we see further change on the horizon. The markets (both public and private) are always in motion. Each year, as macro trends shift, new opportunities emerge to invest in.

Here at Wealth Stack Weekly, we call this investing in “Portfolio Vintages”.

Vintages, like wine? Yes, exactly.

The outcome depends on the conditions of the year and whether you wait until your collection matures. The tool below shows how disciplined investors allocate in annual vintages to de-risk any given investment and capture upside with where the world is headed.

To visualize the impact of the Portfolio Vintage approach we built The Portfolio Vintage Model. This interactive web app compares annual allocations in the stock market with what you can make with the same allocation in private markets. (Spoiler alert: private markets usually win 😉)

Try it out! You can adjust assumptions levers in real time and see the shift in outcomes. (Note: this is strictly for educational purposes. The model is not investment advice.)

Did this land in your inbox via a friend or colleague? Subscribe to get your own weekly insight into private markets.

Already a reader? Help other investors open their eyes to the private markets and forward this to someone who would value the insight. Or hit reply to tell us what you think.